LATEST

Entrepreneurship Surges as New Business Owners Embrace the Future

The Global Entrepreneurship Monitor (GEM) recently released its Global Entrepreneurship 2023/24 Global Report: 25 Years and Growing, which reveals the findings of...

GROW

The Top 5 Behaviours Next-Generation Leaders Need to Adopt for Success

The largest wealth transfer in human history is happening now, with over $74T USD being transferred from older to younger, next-generation, rising...

FEATURED

Latest Articles

Entrepreneurship Surges as New Business Owners Embrace the Future

The Global Entrepreneurship Monitor (GEM) recently released its Global Entrepreneurship 2023/24 Global Report: 25 Years and Growing, which reveals the findings of...

Sold! 8 Family Business Buy Outs

Even the most successful multigenerational family firms are often sold by their founding families. The reasons families make the difficult decision to...

The Social Impact of Family Businesses

Family businesses have a long history of caring for communities and springing into action when there is a threat to the well-being...

The (Complicated) Multigenerational History of The Scrooge Group

This article is fictional

by Sophia Scrooge, 8th-generation family CEO and chair

Like most family businesses...

Economic Concerns Overshadow Growth Opportunities for Australia’s Family Businesses

There are more than 1.4 million family firms operating in Australia, representing 70% of the country’s businesses, and employing 50% of the...

The 10 Largest Family Businesses in Buenos Aires

Argentina is Latin America’s third largest economy, with a GDP of around $632 billion. A resource-rich nation, Argentina controls the world’s second-largest...

The Top 5 Behaviours Next-Generation Leaders Need to Adopt for Success

The largest wealth transfer in human history is happening now, with over $74T USD being transferred from older to younger, next-generation, rising...

Toronto’s 10 Largest Family Businesses

Family enterprises are a driving force in Canada’s economy, accounting for two-thirds of private-sector companies and contributing over $500 billion to the...

Economic Impact of Family Businesses – A Compilation of Facts

With their ability to innovate through complex market uncertainties and evolve in shifting business ecosystems, family firms represent an enduring economic foundation...

Tales of Turmoil: 10 Family Business Scandals

What's in a name? A whole lot if you're a family business. An essential part of building a multigenerational legacy is to...

When Family Business Becomes Policy

The role family businesses play in advancing national economies is hard to overemphasise. Two-thirds of companies globally are family-owned, generating 60 per...

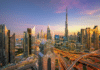

The 10 Largest Family Businesses in Tokyo

Japan is home to around 37,550 enterprises that have operated for over a century. The country’s largest stock exchange, the Tokyo Stock...

The Successor’s Voice

The Successor’s Voice is a book for those family members who follow in the footsteps of their predecessors. While there exists a...

![[Podcast] A 16th Generation Family Legacy podcast-a-16th-generation-family-legacy](https://www.tharawat-magazine.com/wp-content/uploads/2017/05/Scone-696x385.jpg)