This year, family businesses had to absorb rampant inflation and logistics bottlenecks in addition to the ‘new normal’ of non-traditional work environments, heightened environmental awareness and legislation, and the unstoppable wave of digitisation.

Regardless, some leaders harnessed their creativity to make strategic decisions that will serve their organisations long into the future.

Here are 7 family businesses that changed strategies in 2022

Walmart

2022 saw the globe’s biggest retailer1 extend its expansion strategy to an entirely virtual world. Leveraging the immersive gaming platform Roblox, Walmart premiered two new experiences inside the Metaverse this year. Walmart Land and Walmart’s University of Play feature a toy dropping blimp, musical performances from popular artists, games, and a store that showcases verch (virtual merchandise) that reflects offerings the retailer sells online and at its brick-and-mortar locations.

Moving to the Metaverse is a first for the prominent family business that, beyond its e-commerce skewed website, had arguably only dipped its toes into cyberspace through social media shopping live streams on Twitter, TikTok, and YouTube. Still, Walmart considers its new strategy a test of where and how it can secure traction in a shifting retail landscape. Walmart’s new online experiences are specifically tailored for Gen Z shoppers whose engagement will be key for the company’s future success.

SK Group

South Korean family-controlled conglomerate SK Group announced it would invest USD 22 billion into the United States chips and clean energy sectors. The move was at least partly to take advantage of favourable new US legislation to increase the country’s domestic semiconductor production. SK’s commitment will potentially see its US workforce grow fivefold by 2025.2

SK’s major American foray marks a strategic shift for the Seoul-based behemoth that has traditionally eyed Chinese markets for its expansion plans. With the investment, SK has significantly accelerated its renewable energy strategy. The company has also hinted at hedging its bets against a sputtering post-COVID Chinese economy and a possible East-West trade war.

ArcelorMittal

ArcelorMittal acquired a majority stake in one of the world’s largest state-of-the-art iron plants. Located in Texas, the world-class Hot Briquetted Iron (HBI) plant has a two million annual tonnes production capacity while using advanced blasting systems that result in lower coke consumption and a reduced carbon footprint. However, ArcelorMittal intends to leverage the plant’s technology and nearby coastal conditions to produce renewable green hydrogen for its steel-producing operation.

The USD 1 billion plant purchase3 reinforces the family-led, Luxembourg-headquartered company’s strategy to decarbonise the global steel industry. ArcelorMittal began implementing its “smart carbon” climate action initiative in 2020 and has transformed several plants across its European and North American steel-producing network. The company’s plans for its new Texas facility represent a significant leap for one of the world’s largest steel producers.

Reliance Industries

Family-controlled Reliance Industries announced its intentions to invest $75 billion4 in renewable infrastructure projects that included generation plants, solar panels, and hydrogen-producing electrolysers. Mukesh Ambani, Chairman of the energy and technology conglomerate, outlined the company’s plans to establish 20 GW of solar energy generation capacity, partially aimed at producing green hydrogen. Once proven at scale, Reliance intends to double its green hydrogen manufacturing ecosystem investment. The company plans to produce 100 per cent clean hydrogen by 2025.5

Reliance Industries is currently one of the world leaders in producing cost-effective, greenhouse gas emitting grey hydrogen6. The transition to green hydrogen marks a significant strategic pivot for the Mumbai-based family firm. A large pillar of Reliance’s aggressive pursuit of green hydrogen will involve bringing the production cost down from its current $3.6–5.8/kg to under $2 per kg. In addition, Reliance intends to manufacture targeted power-generation electronics and software systems to help meet its ambitious goals.

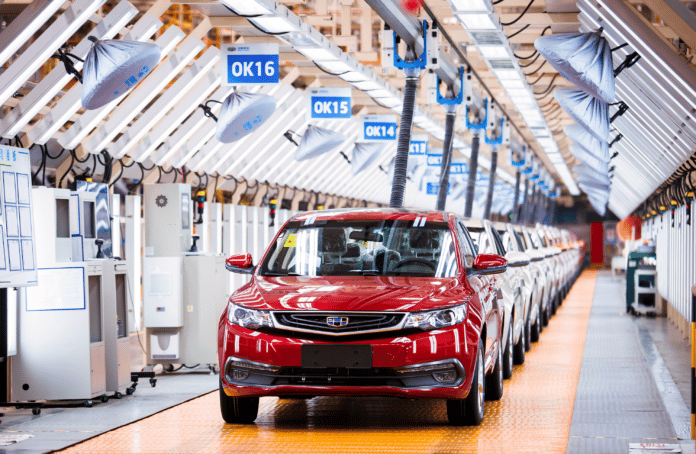

Zhejiang Geely Holding Group

China’s largest privately-owned automotive technology group officially entered the mainstream European market through a strategic cooperation agreement with Hungary’s Grand Automotive Europe. Geely’s Zeekr Geometry C electric compact crossover will be the company’s first European import when it becomes available in Hungary, the Czech Republic, and Slovakia in 2023. The Zeekr brand is Geely’s premium electric car segment, designed to compete with Tesla and other high-end EV offerings.

Geely Holding Group’s European move is a crucial step for the company that began its globalisation strategy in 2007 with a commitment to producing the world’s best eco-friendly cars.7 Since then, the group has bought stakes in several European automakers, eventually becoming the first Chinese multinational automotive group when it acquired Volvo Cars in 2020. Even with Geely’s 15-year-long global expansion initiative, the company currently sells 99 per cent of its vehicles in its home region of mainland China.8 Geely Holding Group’s foray into Europe with its EV exports could potentially reshape the world’s electric vehicle marketplace.

Porsche

Volkswagen AG’s sport-performance brand initiated the largest IPO in Europe’s history by market capitalisation. Despite the year’s turbulent market climate, Porshe’s stock became the most traded by volume during its September 29 public introduction and secured a value of over $72 billion.9

The historic move comes just as the profit and loss transfer agreement between Porsche and Volkswagen nears its expiration at the end of 2022.10 The IPO is seen as an entrepreneurial opportunity for Porsche, giving it greater freedom to create value for itself and its parent company. A new arm’s length industrial cooperation agreement between Porsche and Volkswagen will give the luxury sports car maker greater strategic autonomy. In addition, Volkswagen intends to leverage the capital from the IPO to finance its future electric vehicle plans.

Patagonia

Yvon Chouinard announced he would donate the outdoor apparel business he had built since 1973 to the cause of saving the planet. One of the world’s most successful sportswear brands, Patagonia generates more than $1 billion in annual sales.11 In the exceptional move, Chouinard’s family gave 2 per cent of all stock and its decision-making authority to a trust that will ensure the company’s values and goals are maintained. The remaining 98 per cent of Patagonia’s stock will go to a non-profit called the Holdfast Collective, which will use all of the company’s profits to protect the planet and its biodiversity.12

Championing the environment and other social interests has played a significant role in the company’s overall strategy since its inception, donating 1 per cent of its annual sales to promoters of sustainable practices. Moreover, Chouinard had been outspoken about other companies he felt engaged in “greenwashing” to capitalise on the swelling interest in sustainability among consumers. Patagonia’s new ownership arrangement ensures the planet’s needs are foremost addressed without putting the values of its founder at risk.