The role family businesses play in advancing national economies is hard to overemphasise. Two-thirds of companies globally are family-owned, generating 60 per cent of employment and 70 per cent of the world’s gross domestic product. The 500 largest family enterprises generate $8.02 trillion in revenue. And yet, these contributions are not always well understood or even recognised by governments and regulators.

However, several countries have introduced policies or targeted initiatives to support the activities of family enterprises and raise awareness of their impact and the unique challenges they face. In 2022, the United States, with its world-leading economy by GDP, joined the growing list of nations hoping to address the issues confronting family-owned businesses.

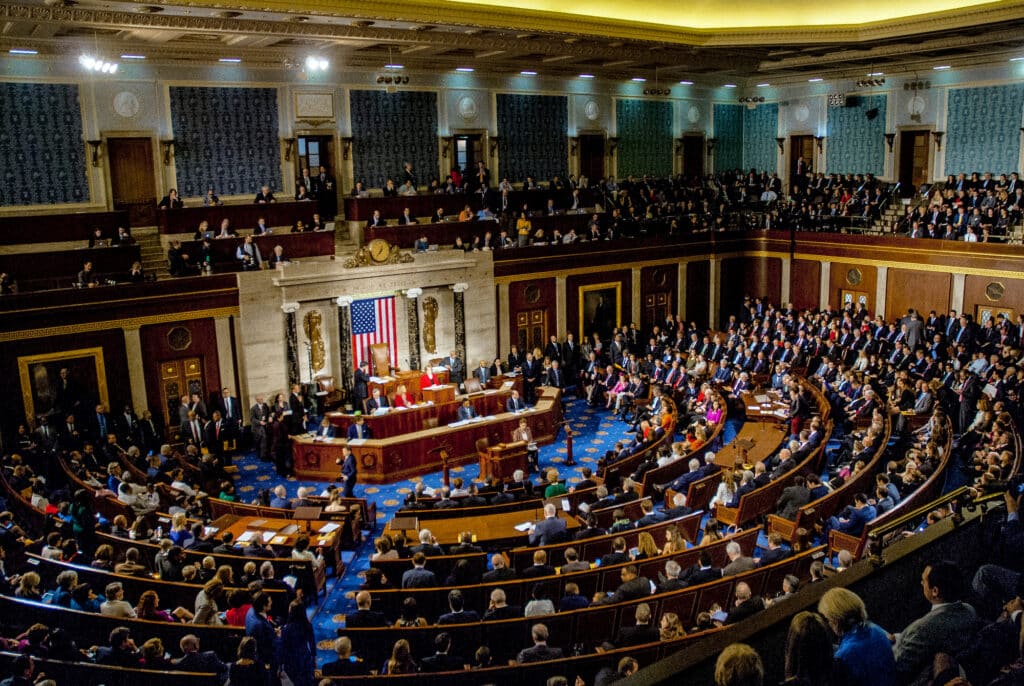

The New Congressional Family Business Caucus

In December 2022, a bipartisan group of US congressional representatives launched the country’s first-ever congressional caucus advocating for family businesses and their role as economic drivers, job creators, and supporters of communities. The Family Business Caucus aims to connect members of the US Congress with the country’s family businesses, both in the nation’s capital and in their home states.

The new initiative’s other goals include educating Members of Congress about family enterprises’ contributions to the American economy and local communities. The caucus seeks to build awareness within Congress about issues such as workforce challenges and tax policy that impact family businesses. Supporting a less burdensome regulatory landscape that promotes entrepreneurship is another pillar of the Congressional Family Business Caucus’ mission.

The creation of the caucus was driven by a desire to help members of Congress understand the power of America’s 32.4 million family businesses that represent the largest block of private employers in the nation, with over 83 million workers contributing $7.7 trillion to the country’s economy annually.

More Regions Legislating to Support Family Business

Early in 2023, Canada and Poland introduced new regulations intended to improve the succession process for family firms in their respective countries.

Canada’s new federal proposal would alter the tax rules that govern the intergenerational transfer of small businesses or farms, effective Jan 1, 2024. The changes to Canada’s tax law will make it less cost prohibitive for parents to pass ownership of their business to their children or other family members. It’s estimated the initiative could affect tens of thousands of family businesses nationwide.

Similarly, Poland’s new family business rules, signed into law in January 2023, strive to ensure smoother, less costly successions between family members upon retirement or death. Modelled in part after German and Austrian legislation, Poland’s revised law establishes a legal framework that allows family members to profit from a company and its assets without direct involvement in the business, an improvement over the old mandate requiring direct involvement, which sometimes led to conflicts between family members and a protracted process to divide the assets. The UK’s Institute for Family Business estimates that 57 per cent of Poland’s family firms are planning a succession within the next five years.

A Strategy to Grow Family Enterprises in the UAE

Following the launch of several initiatives and regulations by policymakers intended to bolster the activities of family businesses, the UAE implemented its new Family Companies Law at the start of 2023, designed to help family firms overcome obstacles encountered during succession planning.

In 2022, the country established a new programme and family businesses centre intending to support the continuity of family enterprises, enhancing their role in the private sector, and attracting more businesses to the UAE. Two of the new Thabat Venture Builder programme’s primary goals are the transformation of 200 family business projects into major companies by 2030 and doubling the contribution family firms make to the UAE’s economy by 2032.

Additional support for family firms comes from the Dubai Centre for Family Business, launched by the Dubai Chamber of Commerce. The centre offers family business-oriented educational programmes and resources to support successful generational transitions.

The estimate partially drives the UAE’s recent strategy to support family businesses that only 20 per cent of wealth managed by family businesses reaches the third generation in the Middle East, despite family firms contributing 80 per cent to the region’s GDP and employing 40 per cent of its workforce.

Hong Kong Expands Incentives for Family Offices

With its standing as an international financial services and banking centre, home to over 70 of the world’s largest 100 banks, Hong Kong has long been a popular destination for family offices. In 2023, the city took steps it hopes will attract at least 200 more top family offices by 2025, establishing Hong Kong as the leading family office destination in Asia.

The government’s InvestHK department has created a dedicated team to help family offices transition to the city. The team has assisted 14 overseas family offices in setting up their operations in Hong Kong, and another 50 have been scheduled. The government will also provide funding for the new Hong Kong Academy for Wealth Legacy, a service offered under the Financial Services Development Council that will provide talent development services to industry practitioners and next-generation wealth owners.

Hong Kong’s family office expansion strategy includes a move by the Securities and Futures Commission (SFC) to revise its licensing requirements, making it easier for families to take advantage of Hong Kong’s investment benefits. The government also hopes the new legal measure will attract private wealth management firms to Hong Kong for the opportunities offered by its flourishing wealth management industry.

An Investment in the Future

The introduction of government policies aimed at promoting the growth and sustainability of family firms appears to be a logical step in light of their predominance in global economies. However, the real impact of the examples above is yet to be measured. Still, if recent trends are any indication, an increasing number of governments are expected to adopt similar approaches and establish frameworks in support of multigenerational business owners and their positive impact on economic growth.