What’s in a name? A whole lot if you’re a family business. An essential part of building a multigenerational legacy is to safeguard its reputation. But where complex relational dynamics, conflict, and personal pressures intersect with professional operations and wealth management, the potential for scandals is high and can cause serious reputational and economic damage to families and their firms.

Some families emerge from scandalous events relatively unscathed, or even stronger for the experience. Others seem to perpetuate a cycle of newsworthy misconduct that often overshadows their business achievements. And some never fully recover from their transgressions, relegated to history as cautionary tales.

Here are 10 business families who found themselves involved in scandals:

Barclay Family

Press Holdings

England

Twin brothers David and Frederick Barclay’s portfolio of businesses, real estate and hotels was worth billions and included the Daily Telegraph newspaper. The reclusive brothers spent decades battling over control of their assets, which eventually led to allegations of bugging and commercial espionage. David Barclay’s heirs — Alistair, Aidan, Howard, and Aidan’s son, Andrew Barclay — admitted to secretly recording their uncle Fredrick’s conversations at the family’s London Ritz Hotel in 2020. Fredrick’s nephews, who today oversee the family’s business interests, apologised for their covert actions, which ultimately saw them unburden their uncle of the hotel and sell it to a different buyer.

David Barclay died in 2021, and his brother Fredrick dropped the suit he had filed in the High Court against his nephews shortly after, publicly stating his intention to put the dispute behind them and keep the family unified.

Porsche Family

Volkswagen

Germany

Labelled the “Diesel Dupe,” the scandal involving Volkswagen’s rigging of vehicle emissions began in the US but soon spread to the UK, Italy, France, Canada, South Korea and Germany. In 2015, America’s Environmental Protection Agency determined Volkswagen diesel cars could detect when they were being tested, prompting the software in the vehicles to report lower emissions results.

In response, the world’s largest carmaker admitted they were cheating. Despite their marketing claims, Volkswagen engines were emitting up to 40 times the allowable amount of nitrogen oxide pollutants in the United States. The Volkswagen Group’s CEO resigned as the company recalled millions of cars worldwide and reported its first quarterly loss in 15 years.

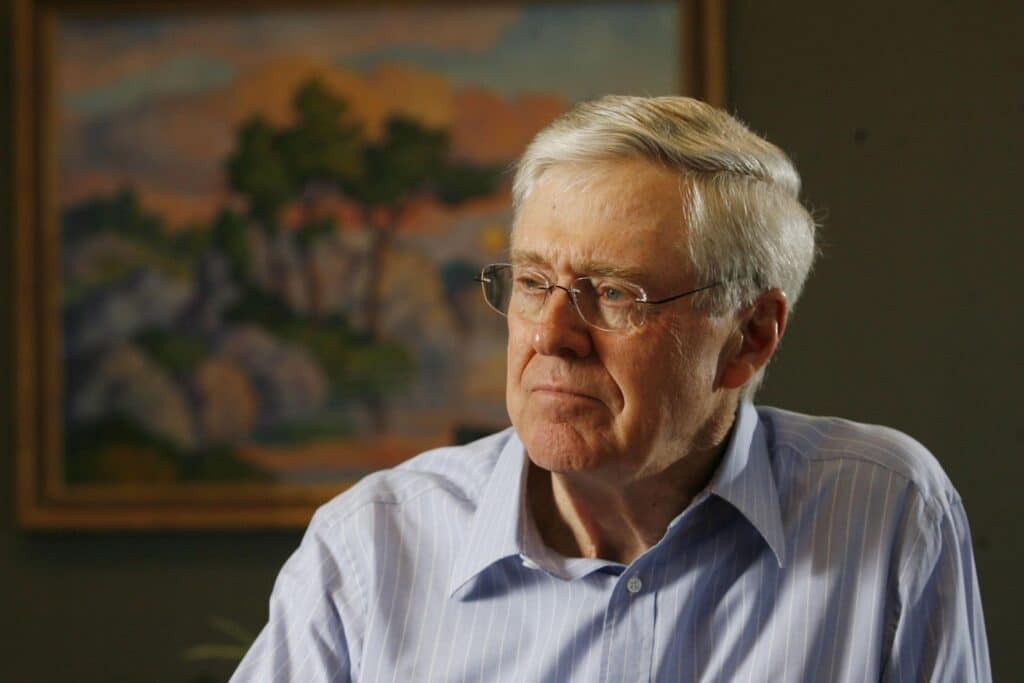

Koch Family

Koch Industries

USA

Founded by Fred Koch in 1940, son Bill Koch unsuccessfully attempted to take control of his family’s company Koch Industries in 1980. Bill was fired from the family-owned company, and three years later, he and his brother Frederick Koch sold their shares to brothers Charles and David for more than $700 million. Over the next 18 years, the Koch family endured repeated litigations as Bill and Frederick attempted to remedy what they felt was an unfair financial buyout. They eventually settled with their brothers in 2001.

Koch Industries is one of America’s largest private companies and engages in diverse activities. These include manufacturing, agriculture, packaging, refining, logistics, and investments. Charles Koch heads his family’s firm, which generates more than $125 billion in annual revenue.

Tanzi Family

Parmalat

Italy

Founded in 1961 by Calisto Tanzi, the family-run dairy business is one of Italy’s largest food companies and a multinational conglomerate with 214 subsidiaries across 48 countries. When the company’s financial performance slid in 1990, its leadership initiated a scheme to disguise Parmalat’s fiscal shortfalls through fraud and conspiracy. For the next 13 years, the company’s executives inflated the reported revenue figures, from creating fake transactions and double billing to hiding Parmalat’s debt from investors. It wasn’t until 2002 that financial analysts began to suspect that Parmalat’s balance sheet wasn’t adding up.

In response to the many allegations of financial impropriety, the company attempted to conceal its fraudulent behaviour with even more fraudulent activities until Parmalat was declared bankrupt and collapsed in December 2003. For his role in what was considered Europe’s biggest corporate bankruptcy scandal, Calisto Tanzi was sentenced to 18 years in prison.

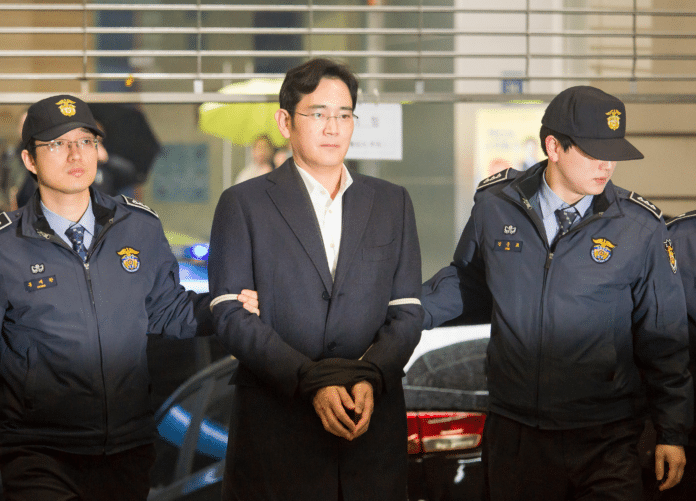

Lee Family

Samsung

South Korea

In 2017, Jay Y. Lee, heir to his family’s Samsung Group, was arrested for using bribes to support a merger that would help him cement his control of the South Korean multinational conglomerate. Prosecutors indicted 17 others, including Lee, and South Korean President Park Geun-hye was impeached for her role in the scandal. Following Lee’s conviction, and while going through an appeal process to lower the 5-year sentence handed to him for bribery, embezzlement and hiding assets abroad, Jay Y. Lee made a public apology and stated his children would not inherit management positions in the firm. Lee was ultimately pardoned for his illegal activities in 2022 and quickly returned to his position as Samsung’s executive chairman.

Hancock and Wright Families

Hancock Prospecting and Wright Prospecting

Australia

The high-profile decade-long civil case made it to Western Australia’s Supreme Court in the summer of 2023. The family of late mining magnate Peter Wright filed a claim against leading Australian mining and agricultural business Hancock Prospecting, which was founded in 1955 by Wright’s former business partner, Lang Hancock. The Wright family, owners of Wright Prospecting, were denied shares and royalties from the iron ore-rich Hope Downs tenements, which were jointly held in the partnership between the two family-owned businesses. Seeking decades of back royalties and part ownership of the tenements re-acquired from the government by Hancock Prospecting in 1989; the Wright family could receive a settlement worth several billion dollars if their legal actions are successful.

Gina Rinehart succeeded her father as Hancock Prospecting’s executive chair after he died in 1992 and continues to lead the business that generates around $18 billion annually.

Redstone Family

National Amusements

USA

Sumner Redstone built the drive-in theatre business he inherited from his father into a media empire. The Redstone family’s National Amusements would eventually become the parent company of Viacom and CBS, solidifying Sumner Redstone as a force in Hollywood. In the early 2000s, Redstone’s daughter, Shari Redstone, questioned her father’s judgement on matters ranging from his investments in the video game company Midway to executive compensation and critical personnel choices.

The father-daughter clash prompted Sumner to publicly question his daughter’s ability to succeed him while also attempting to buy her out of the business in 2006. That same year, Shari Redstone’s brother, Brent, sued their father and tried to break up National Amusements over what he deemed was favouritism toward his sister. Brent Redstone later settled his claim, but Shari Redstone remained largely estranged from her father until 2015, when the two joined forces to contest a challenge made by Viacom’s board over Sumner’s mental competency.

Shari Redstone took control of National Amusements after her father died in 2020 and serves as its president in addition to chairing the board of its subsidiary, Paramount Global.

Raju Family

Satyam Computer Services

India

In 2009, co-founder of Satyam Computer Services, Ramalinga Raju, admitted to carrying out what would be considered India’s most prominent corporate fraud at the time. Established in 1987 by Raju with his brother and brother-in-law, Satyam Computer Services quickly became an Indian success story. The company was listed on the Bombay Stock Exchange in 1991, then the Nasdaq in 1999. It generated over $1 billion in 2006, and $2 billion by 2008. What began as a small gap in the company’s actual operating profit versus what was reflected in its books grew over the years, forcing Raju to significantly inflate Satyam’s reported earnings to cover the deficit. When the scandal broke, nearly 94% of the company’s recorded revenue was fabricated.

Ramalinga Raju and nine others involved in inflating the company’s revenue were sentenced to jail in 2015. Satyam Computer Services was eventually absorbed by IT firm Tech Mahindra in 2013.

Goetz Family

Tony Goetz NV

Belgium

In 2020, brothers Alain and Sylvain Goetz, heirs of refining and precious metals group Tony Goetz NV, as well as the family’s many other business interests, were found guilty by an Antwerp court of engaging in fraudulent trading transactions that amounted to running their own black-market for gold. The brothers ran an illegal system, which involved purchasing gold from anonymous customers in ways that circumvented cash transaction limits between 2010 and 2011. It was also alleged that some of the gold purchased by the company had been stolen. Tony Goetz NV made around $10 million from the scheme.

Alain and Sylvain Goetz received suspended sentences for participating in the company’s illicit activities, but Tony Goetz NV was ordered to pay back over $3 million to the authorities. Tony Goetz NV rebranded as Industrial Refining Company shortly after the incident.

Bettencourt Family

L’Oréal

France

In 2007, Françoise Bettencourt Meyers, heiress to the L’Oréal cosmetics empire and granddaughter of its founder, Eugène Schueller, filed a criminal suit against a man she felt was taking advantage of her 84-year-old mother, Liliane Bettencourt. Meyers claimed that for 25 years, she had watched her mother lavish novelist and photographer François-Marie Banier with expensive gifts totalling over $1 billion. Moreover, Meyers claimed Banier was attempting to break apart the Bettencourt family, going so far as asking Liliane Bettencourt to adopt him.

The scandal, known as the Bettencourt Affair, enthralled many in France for nearly a decade. It eventually ended when Banier was convicted and sentenced to three years in prison. The family rift between Françoise Bettencourt Meyers and her mother remained until Liliane Bettencourt died in 2017.