From its modest beginning in the 1940’s and 50’s as a small automobile assembling plant that produced commercial vehicles for the Indian market, TATA Motors, a member of the famous “Tata Group” family business, has evolved into a global brand with international footprints in all segments of car manufacturing. Today, TATA Motors is India’s leading automobile company and one of the largest in the world with a turnover of $42 billion.

It is common knowledge that many family businesses do not last past the third generation due to several factors that affects the business both from within and without. However, this supposition is currently being challenged by Tata Sons, the family with the largest share holding in TATA Motors, as it has witnessed the third generation of leadership being instituted. Not only that, the family business is also well poised to continue for many generations to come.

What then are the factors responsible for the success of this family owned business? Why has it survived despite various challenges that have confronted it over the years?

TATA Motors was founded in 1945 under the name Tata Engineering and Locomotive Co. (TELCO) – the name TATA Motors was later adopted in 2003. The company’s breakthrough into the commercial automobile industry however came in 1954 when it entered into a 15-year-partnership with Daimler Benz for the production of Mercedes-Benz trucks in India.

This was a strategic move because it came at a time when the economy was still reeling under the effects of the depression that occurred in the wake of World War II; as such, the company had the first mover advantage in the Indian automobile industry. JRD Tata, who was chairman at that time, took advantage of the downturn by investing into heavy commercial vehicles that would be in great demand as the economy began to recover. This opportunistic strategy would later be adopted by Ratan Tata, JRD Tata’s successor, who leveraged it to bring about substantial turnaround in the company’s fortunes after two major crises – the Asian financial crisis of 1999 and the global economic crisis of 2008.

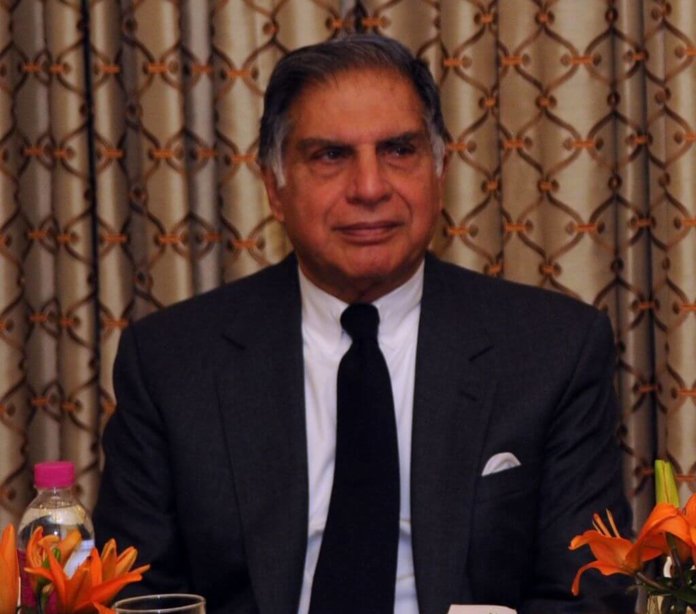

The success story of TATA Motors therefore cannot be separated from Ratan Tata, who served as chairman for 21 years (from 1991 to 2012). Ratan Tata was an unlikely choice to replace JRD Tata as group chairman, and many didn’t have confidence in his ability to steer the group’s affairs. However, the years that followed have proved otherwise as TATA Motors has experienced substantial transformation through his leadership.

In 1991, the year Ratan Tata assumed office as chairman, the Indian automobile industry underwent significant liberalization. The government introduced a de-licensing policy which meant that local players in the automobile sector could significantly expand their production and could now venture into new product segments. However, it also meant that large multinational automobile companies could enter the local market.

While most of the Indian business community was excited about the new policy, Ratan greeted it with caution. As such, he moved strategically by first improving the internal efficiency of the company which paved the way for its internationalization.

TATA’s internationalization strategy has always been to first secure dominance in the local market, venture into neighbouring emerging markets, before expanding its international footprint in developed nations through acquisitions. Despite stiff competition from established multinationals, the company has maintained its leading role in the commercial vehicle segment (both at home and in emerging markets) through its “frugal innovation” policy that ensures the production of low cost fuel-efficient cars. It has also evolved to become a truly global brand, through the huge success of new models released by its subsidiaries in developed nations such as Jaguar Land Rover of the UK and Daewoo of South Korea.

The acquisition of these two brands marked a major turning point for the company. It began during the Asian financial crisis of 1999 that struck the Indian economy severely and brought huge losses to TATA. Ratan initially implemented a policy that entailed substantial cost cutting. But soon he began to see the importance of internationalizing TATA’s operations in order to develop economies of scale that would hedge the company against downturns in the local market. This pushed TATA to acquire the Daewoo brand in 2004, a commercial vehicle company in South Korea that commanded 22% of the Korean market. Through this investment, TATA also gained entrance into China and Europe thanks to the brand’s established logistical network and manufacturing knowhow.

The second breakthrough came in 2008 when TATA acquired British brands Jaguar and Land Rover for $2.3 billion. The purchase gave TATA a foot into the international luxury car market and allowed for a number of technological transfers that it would incorporate into its other brands.

As TATA grew, Ratan’s innovative management style highlighted the company’s growth. He often organized an annual competition in which he awarded the “best-failed project” of the year. This management style was also crucial to the success of the Jaguar Land Rover and Daewoo subsidiaries. Unlike the previous management, Ratan allowed JLR and Daewoo employees to make major decisions while maintaining a simple board supervisory role. This approach paid off as it fostered innovation within the company because it took less time to get new products approved by the top management.

Today, TATA is under management of Cyrus Mistry, the second chairman in company history that is not a family member. And though the company no longer has a Tata at the helm, the family’s ownership and business philosophy remains. As it faces an increasingly difficult operating environment in the coming years, all eyes will be on the Indian powerhouse to see how it can innovate its way to success once again.