Just before the turn of the 18th century, it was a commonly held belief in the West that all swans were white, simply because no one had ever seen anything different. However, that changed in 1697 when Dutch explorer Willem de Vlamingh unexpectedly discovered black swans in Australia, thereby rewriting Western zoology.

As a result of the discovery, the term “black swan” became a metaphor to describe something once thought impossible. Finance professor and former Wall Street trader Nassim Nicholas Taleb popularized the black swan concept when he applied it to financial events in his 2001 book, Fooled by Randomness. He went on to extend the term’s breadth to occurrences beyond the world of finance, and today, many are applying it to COVID-19.

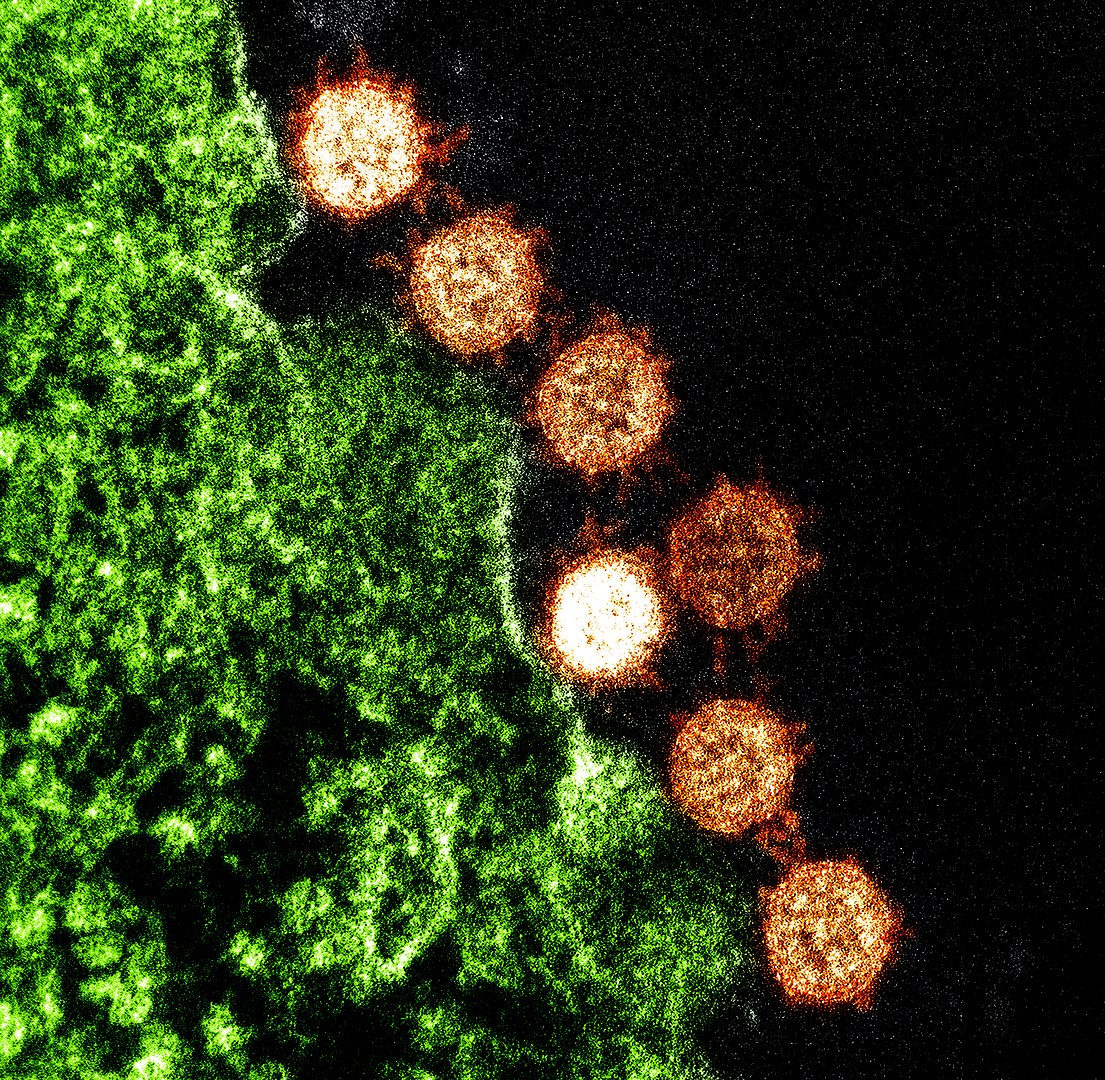

The highly infectious virus appeared in China at the end of 2019 and was first reported to the World Health Organization on 31 December. Labelled a pandemic on 11 March 2020, COVID-19’s virulence is predicted to leave no country unaffected, with deep societal and business impacts on a global scale.

Billions of people are under lockdown or are being forced to comply with the new norm of social distancing. Supply chains have been disrupted if not completely severed. Conferences and events have been cancelled worldwide, and international travel has all but ceased. The International Air Transport Association (IATA) estimates that the aviation sector will suffer losses of $113 billion in 2020, and 2020 economic growth forecasts for the global economy have been slashed from 2.9 per cent to 2.4 per cent. Moreover, London School of Economics recently conducted a poll of economists and found that 51 per cent believe the world is headed for a major recession.

The extent of the disruption caused may ultimately be unprecedented, but it is not the first time a black swan event wreaked havoc on the world and threatened its economies. Despite the damage incurred by these past unforeseen – and non-market-related – events, some companies found ways to mitigate the worst of the impact and emerge even stronger on the other side.

Nissan

An earthquake with a magnitude of 9.0, followed by a tsunami, struck Japan on 11 March 2011. The Fukushima Daiichi Nuclear Power Plant was severely damaged and started to leak radiation into the Pacific Ocean. Later, this contamination would be detected in the nation’s vegetables and dairy products, as well as Tokyo’s drinking water. The devastating natural disaster was responsible for an estimated 19,000 deaths and cost upwards of $200 billion, making it the most expensive natural disaster in history to date.

The consequent disruption to supply chains, specifically those of semiconductor equipment and materials, had a global impact, as Japan produces 20 per cent of the world’s semiconductor products. Additionally, manufacturing in aviation, automotive and other key areas was temporarily suspended. International travel was significantly affected as Japan accounts for nearly 7 per cent of the premium global travel market.

When their supply chains were cut off, the Japanese “Big Three” automakers – Toyota, Honda and Nissan – were forced to halt a large portion of their production, both domestically and internationally. However, Nissan seemed to recover quicker and more effectively than Toyota and Honda. Many credit this to a series of actions taken by Nissan’s leadership, including the development of a crisis management plan almost immediately after feeling the effects of the earthquake at the Yokohama headquarters[8]. Teams were swiftly sent to the company’s outlets to determine which products would be most affected by the disaster. In an unusual display of transparency in Japan’s corporate culture, Nissan CEO Carlos Ghosn appeared on television within a week to present the company’s timeline for reopening. Nissan would also gain an edge over its competitors with its use of common and standardised parts that allowed plants and suppliers to get up and running quicker.

Industry analysts have noted other important factors that aided Nissan, such as the company’s corporate structure, which included many foreign executives who had previous regional and global experience in crisis management, unlike the strictly Japanese-only composition of Toyota’s and Honda’s senior boards. Nissan itself credits working together in a cross-functional capacity for helping to overcome the challenges it faced in the wake of the disaster. Through strategic choices made before and during the crisis, the company not only resumed production months before its rivals but also succeeded in gaining market share at their expense.

SF Express

The SARS pandemic of 2003 saw 8,098 people infected in over two-dozen countries, with a total of 774 deaths. The deadly virus had a devastating effect on Asian travel and, ultimately, took a severe economic toll on the region and the world. The sectors hardest hit were retail, entertainment and hospitality. International and key domestic businesses were affected. The global economic loss as a result of SARS is estimated to be $40 billion. In particular, Hong Kong saw a drop of 2.6 per cent in GDP.

In 2003, delivery and logistics company SF Holdings was a much smaller business than it is now, competing in a space that was becoming crowded. When the entire commercial airline industry was in disarray during the SARS outbreak, SF Express CEO Wei Wang refused to let the crisis interrupt his company’s service. Managing to secure a licence to run charter flights, SF Express became one of the only delivery companies to continue service during the pandemic. The move is credited for establishing SF Express as the most reliable delivery service in China. With the then-fledgeling e-commerce business getting a boost from SARS-related home shopping, SF Express leveraged its growing reputation to secure partnerships with the region’s larger online retail sites, such as Alibaba. Today, SF Holdings’ network covers 200 countries, with more than 15,000 vehicles, including a fleet of 35 aircraft. Currently, it is China’s largest delivery service.

Cantor Fitzgerald

After the tragic events of 11 September 2001, the world plunged into a recession. Oil prices fell nearly $28 a barrel from August 2001 to December 2001, and the American airline industry lost $55 billion. In total, the attack cost the US economy an estimated $5.93 trillion.

Financial services firm Cantor Fitzgerald occupied five floors in the North Tower of the World Trade Center. Not a single employee in the 55-year-old investment bank and brokerage’s offices at the time of the attack survived – in all, 658 people were killed, almost two-thirds of the company’s workforce. CEO Howard W. Lutnick, who lost his brother in the attack, made a commitment to keep the company going, while also giving families of the victims 25 per cent of the firm’s profits for five years and 10 years of health insurance. The final cost came to $180 million.

Lutnick and the company’s remaining employees returned to work with a new sense of purpose and were back on trading desks just a week after the attack. Every new employee hired was made aware of whose memory and family they would be honouring as the company steadily rebuilt. Today, Cantor Fitzgerald has 12,000 employees and trading desks in all of the world’s major financial centres in more than 30 international locations. It is globally recognised not only for the strength of its services and products but also for the grit that helped to rebuild a company that few thought could continue. Cantor Fitzgerald is also remembered as an example of how conviction and human spirit are essential ingredients in every crisis management plan.