Photo by rawpixel.com from Pexels

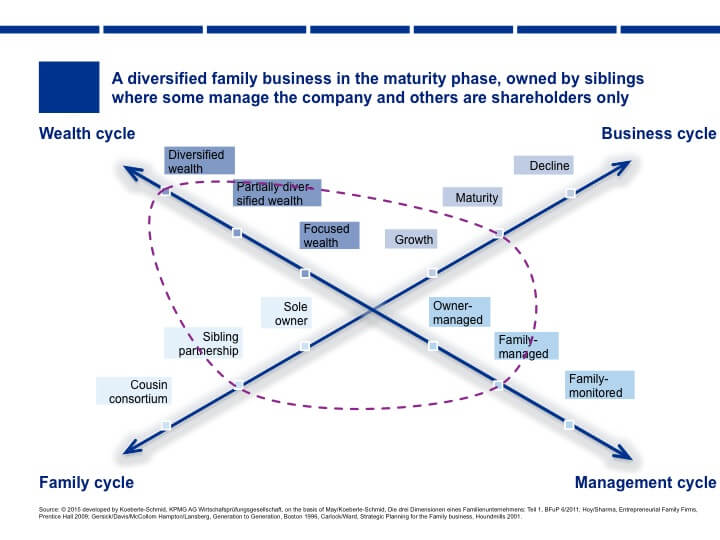

The 4 Cycle Model is a diagnosis to help find out what kind of family business you are. Developed by Dr. Alexander Koeberle-Schmid of KPMG in Germany, the 4 Cycle Model supports family businesses of different shapes and sizes to identify the unique sets of challenges that they face. Having done so, business families can then develop adequate and individually fitting solutions.

The 4 Cycle Model is comprised of the following:

1. Family Cycle

2. Wealth Cycle

3. Business Cycle

4. Management Cycle

Each cycle has three different positions. When a family takes the diagnosis, they are placed into one of these positions. For instance, the business can find out whether they are in the growth, maturity or decline phase in their Business Cycle. With this information, the family can then think about how it can innovate and develop its products and services to increase the economic value.

Lets take a look at an example of a family business that has gone through the diagnosis:

This family business has been diagnosed as a diversified family business in the maturity phase, owned by siblings where some manage the company and others are shareholders only.

What does this mean?

- In the sibling partnership, brothers and sisters should learn to deal with conflicts and should think about how to hand over the entrepreneurial spirit to the next generation. They should also start to think about the questions of how many family members can work in the business. And very important is, that the ownership structure is simplified, e. g. with the help of a holding.

- As a family managed firm, where some family owners work in the business, and others are only shareholders, conflicts of interests about money questions should be solved. All owners should also get the same information to assure transparency. The tasks of management, board, and owners should be clearly defined to assure accountability.

- When a family is invested into several business, the risk is diversified. However, this brings other challenges like whether the family has the right skill set or if it can implement professional portfolio management. The question then is: is the family business a group with a holding or is it more like a family investment office (similar to a private equity firm)?

- In a diversified firm there are always businesses that are in a growth phase and others that are in a maturity phase. Then, there are different strategic challenges at the same time. Because you need to finance growth and need to overcome innovation barriers. Possibly, you do not have enough money to finance the growth by redirecting profits, because most firms in your portfolio are in a maturity phase.

As you can see, the 4 Cycle Model is a fantastic tool to diagnose and understand your family business’s present and anticipate possible changes in the future.

Take each quiz and diagnose your family business:

1. [Quiz] How is Your Family Business Managed?

2. [Quiz] How Involved is your Family in the Business?

3. [Quiz] Where Does Your Family Stand in the Business Cycle?

4. [Quiz] Diagnose Your Family Business in the Wealth Cycle.

The information contained herein (also the challenges and possible solutions derived after the quiz) is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.