There are approximately 10,000 family offices in the world today, ten times as many as existed in 2008. Unsurprisingly, their influence has grown in conjunction with this marked proliferation. According to research reported in Forbes, by the end of 2018, family offices held wealth totalling more than $4 trillion. Viewed through a slightly different lens, this equates to family offices managing 44 per cent of the $9.1 trillion held by the world’s billionaires.

Read Tharawat Magazine’s Family Offices Collection

However, it’s not just that family offices are growing at almost exponential numbers; they are also changing, and technology has become the catalyst for their rapid transformation. The way they operate today is, in some cases, completely different from just a few years ago.

Family offices are not just benefitting from the latest technology, they are also heavily invested in it. Family wealth managers are now the fastest-growing body of investors in emerging technologies; over the past five years, they put approximately $5 billion into early-stage technology companies.

To get a clearer picture of what the future of the family office might look like, here are three ways technology is transforming the space currently.

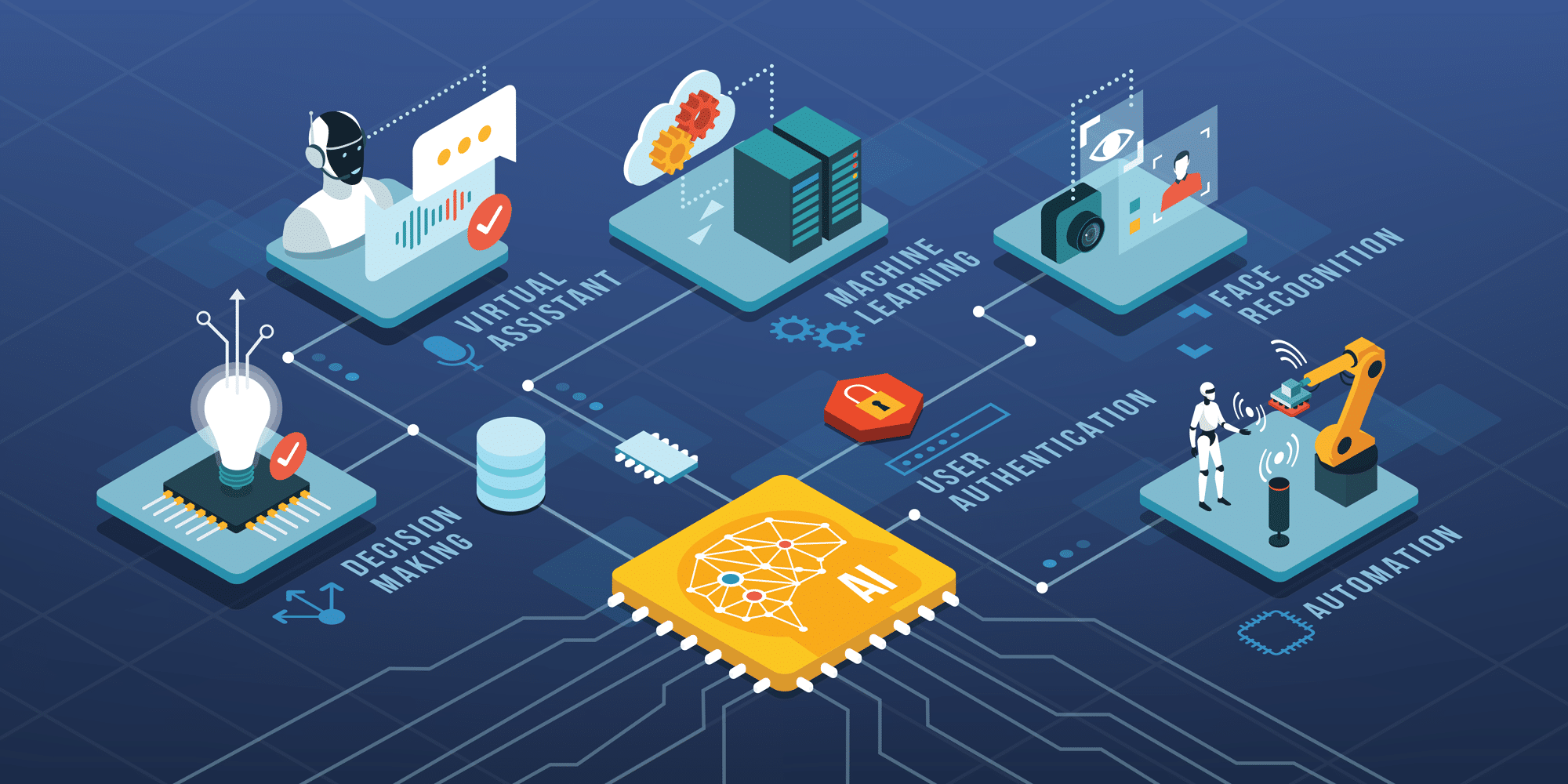

1. Artificial Intelligence

Family offices are now embracing what they call ‘fam-tech’, a collection of various technologies that can assist them in their day-to-day operations. Perhaps no other fam-tech has had a greater influence on this rapid tech revolution within family offices than AI.

According to the Global Family Office Report 2019, 87 per cent of all family offices agreed that AI will be the next biggest disruptive force in global business. Family offices tend to view AI as a way to revolutionise the way they do business. More than a third (37 per cent) of family office executives surveyed for the report believe that AI-driven virtual family offices will replace traditional structures by 2025.

While the idea of investing millions in the latest fintech or start-up may seem thrilling, the realities of dotting the i’s and crossing the t’s are almost certainly anything but. Until now, tasks such as evaluating debtor and creditor positions, balance sheets and profit-and-loss statements have been done manually. To do a thorough job, the entire process could take a few months.

AI, however, can pour through data on the web to collect the necessary information and raise any red flags, reducing this vetting process from months to less than an hour. It’s not hard to see the competitive advantage this kind of technology can create for a forward-thinking family office.

In fact, the use of AI in family offices is becoming so prevalent that the day may soon come when it will no longer be seen as forward-thinking but simply expected. Family offices that rely exclusively on traditional tools might soon find themselves at a distinct competitive disadvantage.

2. Blockchain

To date, blockchain technology has been closely associated with providing the necessary framework for cryptocurrencies such as Bitcoin. However, its potential for application is far wider; family offices are discovering that blockchain can be used to tokenise various assets to make their management more efficient, more accessible and more secure.

A Deloitte 2019 survey showed that 53 per cent of 1,386 global senior executives identified blockchain technology as a critical priority for their organisation. Less than a quarter, however, had begun using it.

Much like AI, blockchain can be used effectively to speed up the due diligence process. Where blockchain can really prove its value to family offices lies in its ability to provide superior risk management capabilities, providing unimpeachably secure records and serving as a watchdog for the family office in several different ways.

For example, using blockchain to create smart contracts and other automated procedures greatly reduces the risk of data loss or human tampering. It can also be extremely effective in mitigating compliance risk. By using smart contracts, it can raise the alarm on any potential compliance violation in a proposed deal before it is even signed.

3. RPA and the Cloud

AI and blockchain may be the two most appealing technologies to family offices at the moment, but others, used in smaller ways, can still have a huge impact. Robotic processing automation (RPA) allows the automation of repetitive tasks that previously consumed a large number of human work hours. Data entry is perhaps the best example of where RPA can assist family offices – completing the family office tax return each year, for example. RPA can fill in much of the form, thereby automatically freeing up countless administrative hours.

Any family office that still stores data on physical servers might want to undergo a complete migration to the cloud sooner rather than later. Not only is cloud storage less expensive to maintain but it is also markedly safer in the face of potential cyberattacks. On-premise servers are potentially a disaster waiting to happen.

Read Tharawat Magazine’s Family Offices Collection

Only Human, Afterall

Ultimately, family offices that have benefitted the most from the latest fam-tech are those that have combined this new technology with good governance. Even the most advanced technology is, of course, still only as effective as the family office that uses it.

For the most part, implementing or at least guiding leaders towards these technologies will be the employ of next-generation family members. And for them, sharpening their family office’s edge with the three-sided whetstone of AI, blockchain and RPA will require a deep understanding of historical success factors as well as a fluency in futurism. However, those that have a solid foundation will find the added advantage of new technology will be well worth the investment — and then some.