Survey Summary by Sam Bruehl, Omar Romman and Hilla Talati

As COVID-19 spreads around the world, many of us have had to adapt to a new social and economic reality. We, at Banyan Global family business advisors, launched a survey at the onset of the crisis in order to understand the effects of the crisis on family businesses, and to glean advice for managing and owning a family business during this time. As we settle into a “new normal” we also want to share our thoughts on what essential elements of governance families and owners should ensure they have in place to successfully navigate the uncertain times ahead.

Survey Highlights

In our exclusive survey with nearly 200 participants from around the globe, we have found that most family owners have been quick to rise to the challenge of the pandemic – with a number of owners opting to get more closely involved in the business. Many have also found this time to be a test of both family relationships, and the values that they stand for. As we continue to navigate through the crisis, it will be important for owners to: ensure that their governance systems are serving them well; “reset” relationships with their executive management team; and involve the next generation in a meaningful way so that they can learn from this experience.

Our Respondents: A Global and Diverse Set of Family Businesses

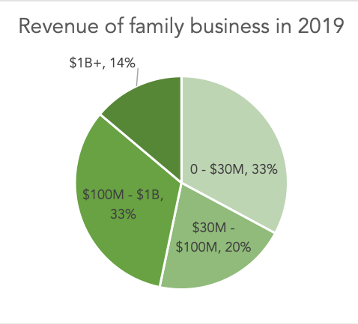

Our 190 survey participants span geographies, industries and generations (see Figure 1). They hail from over 20 countries across six continents. Over half of the responses are from family businesses in the United States, with the next highest number of participants from Brazil and India. They represent over 25 industries, with the greatest number of respondents coming from manufacturing, construction, real estate, oil and gas, food and beverage manufacturing and professional services. Approximately half the respondents are from family businesses that earn revenues of $100 million USD or less and the other half are from larger businesses with annual revenues of $100 million to $1 billion plus USD. They also span generations, with about a quarter being 1st generation or founder-led, and the rest coming from the 2nd, 3rd, 4th generation and beyond.

Figure 1: Profile of Respondents

Business Impact: Few Family Businesses Have Been Immune

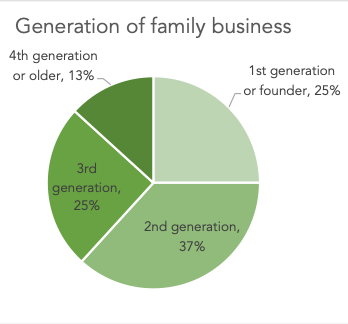

Not surprisingly, very few family businesses in our sample have been immune to COVID-19. When we asked “How would you describe the business impact of COVID-19 so far”, 44% of respondents say they have suffered significantly, with another 5% in danger of failing. Another 40% have experienced minor negative impact (see Figure 2).

Many respondents comment that they are “considering the year as lost” and recognise that business “will not return to anything resembling the way they were before”. For conglomerates spanning a range of industries, the results have been more of a “mixed bag”, with some business units “feeling the pain, while others are doing well”. The family businesses that have had the least negative impact are those that operate in industries that have been relatively immune to, or in fact have been beneficiaries of, the crisis.

Figure 2: Business Impact of COVID-19

Family businesses report using a broad range of tools to mitigate the impact of the crisis and manage for cash, which include: delaying significant capex (61%); reducing their employee cost (through reducing salary or benefits (38%), furloughing employees (30%), and/or laying off employees (28%)); and reducing dividends (33%). Many have also looked to shore up their balance sheets through additional borrowing (31%).

For some, the crisis is seen as an opportunity, with 15% of respondents planning to make acquisitions during this time – this includes businesses that have been positively and negatively impacted by the crisis, with owners recognising that there will be winners and losers coming out of the crisis.

Navigating the Crisis as Owners: Key Insights

As family owners navigate the crisis, a few insights emerge from our survey.

This is the Time for Active and Decisive Ownership

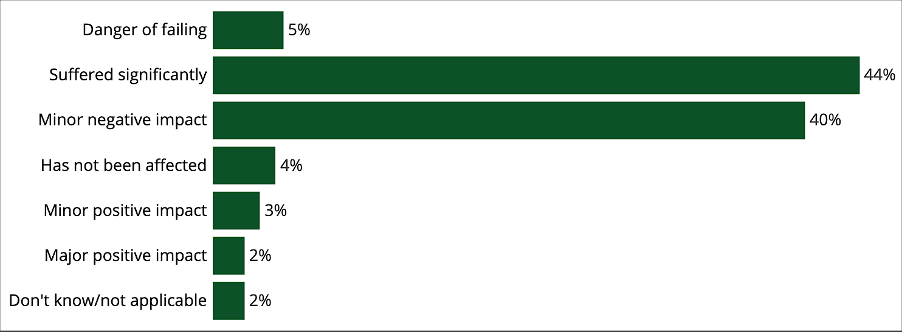

For many owners, this is the most significant crisis they have faced in their lifetimes. They recognise the need to be actively engaged in order to take decisions with speed and ensure that the business remains true to its values. From our survey, 20% of respondents state that they are significantly more involved as a result of the crisis, with another 27% being somewhat more involved (see Figure 3). It is worth noting that in the case where respondents report no change in the role of the owners, this is often because owners were heavily involved already.

Survey respondents cite the need for a more “command and control” management style during this crisis, resulting in the increased levels of involvement. For some, the increase in free time resulting from lockdowns has enabled greater involvement.

Figure 3: Impact of the Crisis on the Involvement of Owners

In our experience as well, working with family businesses through the pandemic, we have seen family owners get more involved in order to ensure that critical decisions – around layoffs and restructuring, health and safety, cash management and balance sheet protection – are made in a way that is consistent with the family and business values, and with the long-term health of the business in mind. Family owners have played an important role in setting the financial and non-financial guardrails that are required to inform decision making during this time.

The nature of this involvement has varied, based on the context. Some family board members are chairing Crisis Committees to navigate crisis decision-making. Some are engaging with professional management teams directly on a weekly and sometimes even daily basis in order to keep abreast of day-to-day changes and guide decision-making.

We have also seen a number of situations in which founders who had previously relinquished the CEO role have stepped back in, in order to steer the business themselves.

In some cases, these changes in the role of the owners have been welcomed by management teams, who recognise the need for close partnership and alignment during this time. In other cases, especially where founders have stepped back into executive roles, this has led to strained relationships with management and potentially also other family stakeholders (particularly when the communication around this change has not been managed well).

We have found that having clear governance and decision-making systems, and alignment across the owner group on the values and what is important, have been critical factors in enabling swift decision making during this time. Where these have not been in place, we have seen tension build and conflict arise.

Investing in Family Relationships is Even More Important

The pandemic has introduced many new stresses for family owners: their businesses may be in crisis; they need to take many weighty decisions in a compressed period of time; and their regular patterns of communicating and interacting with each other have been disrupted as a result of widespread lockdowns (in some cases resulting in greater distance, and in other cases, too much proximity, with other family owners).

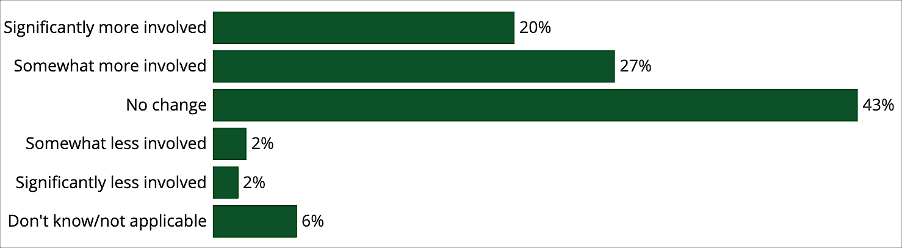

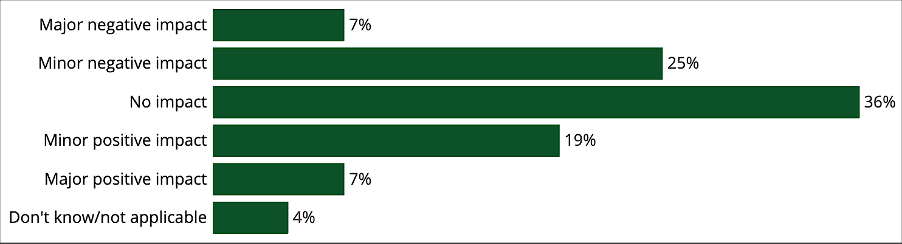

In this context, it is not surprising that 32% of respondents report that the crisis has had a major or minor negative impact on relationships amongst the family owners (see Figure 4). Some talk about the stresses of being forced to communicate remotely: “we are a very face-to-face family and video calls are not a fair replacement”.

Others highlight how the crisis has shone a light on fundamental differences in opinions across family owners: “we have disagreement on how serious the pandemic is and how we should handle cash at this point.” This is exacerbated for businesses that have been impacted the most by the crisis – where the business has suffered significantly or is in danger of failing, close to 50% of respondents report a deterioration in relationships. However, the stresses of this time have impacted relationships where the business has been relatively protected as well.

At the same time, 26% of family owners have found that the crisis has in fact had a major or minor positive impact on relationships. They talk about seeing “greater family unity, with more concern for each other”; “having productive and heartfelt exchanges on how COVID-19 has impacted [us]”; spending more quality time together; “putting differences aside” in order to focus on the crisis; and seeing the younger generations “stepping up to the grind of a crisis”. For some family owners, the crisis has been an opportunity to build a sense of purpose and reconfirm that they want to be in business together.

Figure 4: Impact of the Crisis on Relationships Amongst the Family Owners

What has resulted in these divergent outcomes? In our experience, the families that have come out the strongest are those that have been proactive about learning how to work together and communicate with each other about complex and difficult issues. One family owner pointed out that because he and his siblings had invested in creating a structure and process for working with each other and making decisions before this crisis, they were in a much better position to guide their businesses through this difficult time together. They were also aligned around a core set of values and beliefs (in this case, their stance towards indebtedness), which facilitated their decision-making process.

Some families have also used this as an opportunity to deepen the engagement of the next generation in the business, strengthening both their affinity to the business and their bond with the rest of the family.

One third-generation cousins’ group shared that this crisis has enhanced their appreciation for their family business. At the start of the pandemic, the parents decided to use this situation as an opportunity for the next generation to learn how their parents work together and make decisions. The next generation (ages 16-30) participated in bi-weekly conference calls in which they received a business update and had a chance to ask questions. This experience has increased the next generation’s sense of how important their family business is to the economic well-being of their country. It also provided a unique window into how their parents make big decisions together during a crisis.

The families that have experienced a negative impact on their relationships during this crisis either have not addressed underlying sources of tension, or have not established effective structures and processes for keeping the family informed about the health of the business.

One next-generation family member shared that a lack of transparency between the family members leading the business and the broader family ownership group had caused tensions among family members. This family member noted that a forum for the family owners to be informed about the business and to have a voice in setting the direction, would help improve the situation.

The Crisis has been a Stress Test for the Family’s Values and Purpose

The crisis has presented family owners with an opportunity to “walk the walk” when it comes to values. Many have stepped up to live their values during this time, taking care of their employees, customers and their broader communities. As one respondent put it, “this is the time to really live your values and prove the exceptional nature of family businesses.” Family owners also recognise that “the impact of [their] actions today will echo for years to come”, impacting future generations.

In our experience, having clarity on values has made it easier for family owners to take difficult decisions during this time, by helping them evaluate difficult choices and establish the red lines and “non-negotiables”.

One family business in the US decided to send each employee a $1,000 bonus at the beginning of the crisis and committed not to lay off any employees. While this reduced their distributions for the year, it reinforced their commitment at a time when employees were worried about losing their jobs. In their own words, the owners told us that, “There was immediate, unanimous and enthusiastic support from the ownership group when we first discussed it.”

Looking Ahead

For many family owners, the first chapter of the crisis has come to a close and they now have breathing room to plan for the coming months. In light of the findings from the survey, we would leave family owners with three sets of questions to grapple with:

Has Your Ownership and Governance Model Served you Well?

As we have seen, many owners have really “leaned in” during this time. For some families, the governance they had established prior to the crisis has enabled the right people to come together and take decisions in a timely way.

For others, some of these structures have been cast aside as key leaders have scrambled to take decisions and act. It would be useful for family owners to reflect on whether their governance structures have remained relevant in the current environment, and if not what changes need to be made to ensure that they are fit-for-purpose for the coming months – so that they can serve the dual purpose of ensuring the prosperity of the business while keeping the family united.

Have You Maintained Productive Working Relationships with Your Executive Management Team?

As family owners have become more involved, the relationship between owners and executive leadership has in some cases changed. While many non-family executives have appreciated a close partnership with family owners to take decisions during this time, there are others who have rankled against the loss of autonomy.

For family owners, this is a good time to re-establish roles and responsibilities vis-à-vis management. The crisis has also shed light on areas where the owners and the executives running the business may not be fully aligned on values and decision-making criteria. This is a good time for family owners to reflect on whether they have the right leadership to take the business through the next phase of the crisis.

Have You Been Able to Use this Crisis as a Learning Opportunity for the Next Generation?

Lastly, while some next-generation members have had the opportunity to step up and get engaged in crisis management of the business, in other cases younger family members have been left on the sidelines as the “grown-ups” have taken key decisions. We would urge family owners to think about how they can engage the next generation to build their affinity for the business and learn from the crisis and its aftermath.

As this crisis unfolds, there will be other challenges that family businesses will need to address. Doing so with an ownership group that is aligned on a core set of values and principles will allow family businesses to survive, and even thrive, as they meet new challenges.