Image source: Pixabay via Pexels

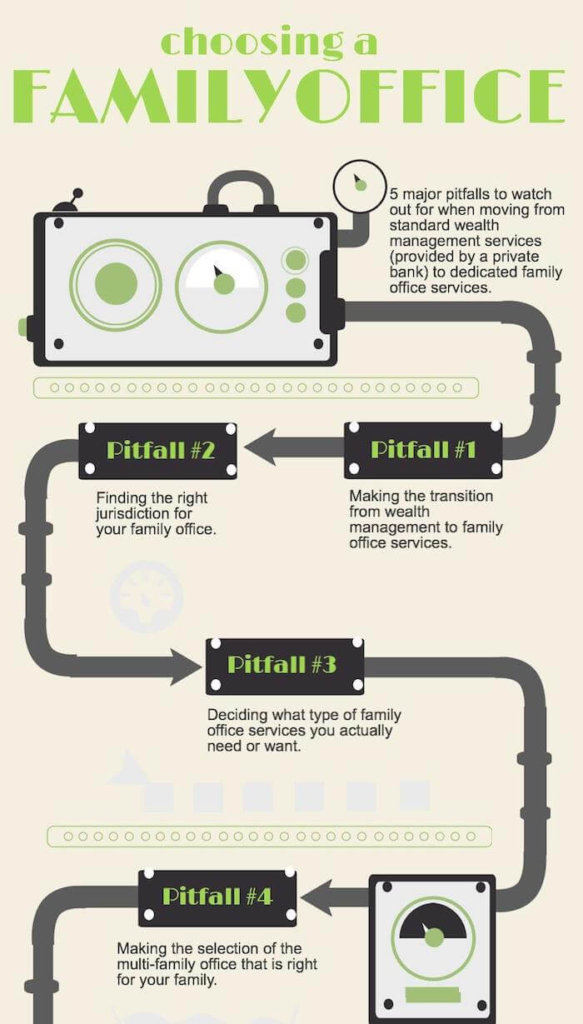

Once the family has decided what kind of services it needs from a family office, as discussed in the third part of this series of articles, the family needs to select the multi-family office (“MFO”) provider it wants to work with. As MFOs are surprisingly varied, this is definitely not an easy part of the process.

Which provider provides what?

Currently, there is a growing number of providers offering MFO services. While a large number of providers is generally considered a good thing in a free-market economy (as this normally generates a variety of benefits, such as decreasing prices and a more competitive choice for consumers), the same does not automatically apply to the MFO industry.

The main reason is that the MFO industry is not at all transparent. There is no industry standard for what range of services an MFO should offer and most MFOs tend to operate discreetly without giving an insight into their actual activities or their real offerings.

Moreover, the use of the term “family office” is, in most jurisdictions, neither regulated nor supervised and even if it is, it is only done lightly. MFOs also originate from very diverse backgrounds, which means they tend to offer completely different ranges of services. As a result, every family office has a different service offering that can only be experienced from the inside. Or, as it is also sometimes put, “if you’ve seen one family office, you’ve really only seen one family office”.

Most MFOs only provide a small core of services in-house, strongly connected to the background of the founder(s) and coordinate a small number of other services on your behalf. Almost no family offices provide a very wide range of services. Some MFOs are, for example, very focussed on wealth management; others primarily deal with wealth planning structures and tax/legal issues. Finding out what an MFO really can offer you can be a burdensome task, not to mention judging the quality of that offering.

It is also quite unknown to the public that most MFOs only work with clients out of a single or limited number of jurisdictions. Such a family office will not accept a client out of a jurisdiction it does not cover because it will not be able to provide an optimal service. The same applies to the level of wealth a prospective client should have to be accepted as a client. Some MFOs accept clients regardless of their actual level of wealth; others only serve clients as of a minimum asset level. This difference is also often reflected in the quality of the service provided. Pricing can also play a role in this. The client needs to find the Mercedes or Volkswagen that he is looking for.

Another issue, besides finding a provider for the services you seek, is to check that the chosen office is actually able to provide those services in the way you would want them to. For example, if a provider states that it can provide investment services and can also support you with philanthropy, this does not automatically mean that it is able to support you with impact investments, which is a combination of both.

Finally, families should also be aware when using MFO services that it is not guaranteed that they will always be advised objectively or that their assets are exposed to less investment risk. Because this depends very much on how the MFO is providing its services and how the MFO is actually set up. In this regard too most family offices have a different approach.

In the last part of this series, we will discuss how necessary or unnecessary it is to have a cultural and/or personal affinity with the (staff of the) family office.

Jan van Bueren & Thomas Ming are Co-Founders of FOSS Family Office Services Switzerland & Senior Wealth Planners in Zurich at Union Bancaire Privée, UBP SA.

For more information go to: www.switzerland-family-office.com