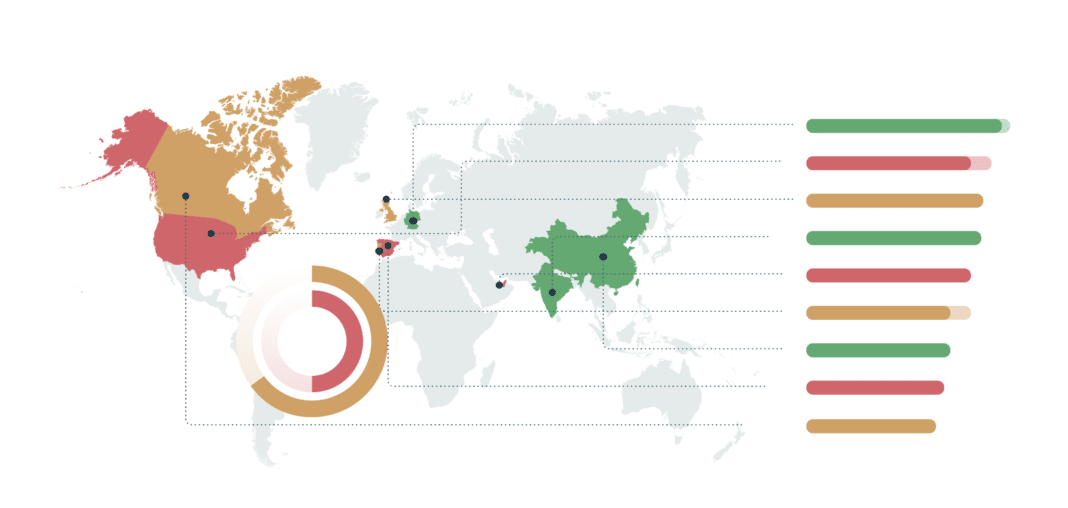

With their ability to innovate through complex market uncertainties and evolve in shifting business ecosystems, family firms represent an enduring economic foundation to most of the world’s nations. It’s estimated that family-owned businesses contribute more than half of the world’s GDP and account for over 65% of its employment. Moreover, the 500 largest family enterprises generate over $8.02 trillion in annual revenue alone, collectively enough to be the third largest national economy after the US and China.

But the contributions family businesses make can also be seen in the broad transformations they trigger, often becoming the drivers of social and environmental change with a universal impact. Family-owned companies could play a pivotal role in advancing global sustainability agendas, ESG investing strategies, and inclusionary practices that could redefine success metrics.

Figure 1: Contribution to the World’s GDP and Global Employment

Measuring Impact – A Numbers Game

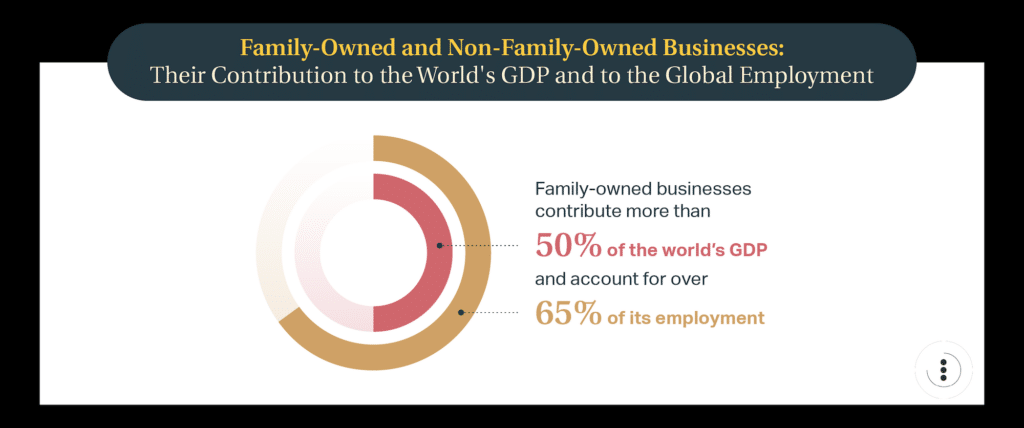

In many parts of Europe, Family-owned businesses have become synonymous with perpetual stability and prosperity regardless of the economic climate. Germany’s “Mittelstand” (mid-sized firms) are predominantly family businesses accounting for the country’s largest percentage of economic output and employ most of the nation’s workers. In South Korea, family-owned chaebol conglomerates such as Hyundai, Samsung and Daewoo have played major roles in fuelling the nation’s post-1950s growth. But Family-owned businesses in the world’s growth economies are at the forefront of their commercial development, regardless of size. In India, family firms generate 79% of the country’s GDP and represent some of its largest and smallest companies. India is home to 15 of the world’s largest 500 family enterprises.

Figure 2: National GDP Contribution and Workforce Participation of Family-Owned Businesses for a Global Cross-Section of Nations

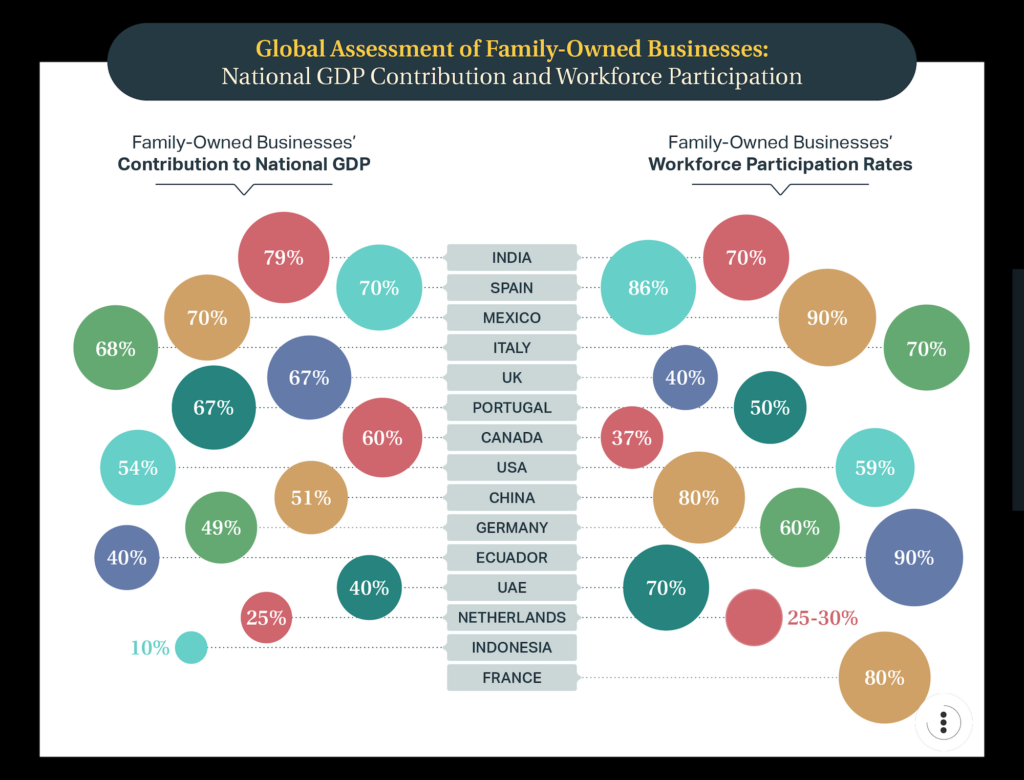

Prevalence in the Private sector

Europe maintains the largest share of family firms of any region. There are 17 million family-run businesses in Europe, accounting for 60% of all businesses. Europe’s family businesses represent 25% of the region’s top 100 companies and generate 100 million private sector jobs.

Figure 3: The Percentage of Family-Owned Businesses in the Private Sector from a Global Cross-Section of Nations

Ascending the Public Sector

Publicly listed family or founder-run businesses encourage growth and transformation on national and international levels by leveraging the equity and sentiment of global investors. Asia-Pacific (excluding Japan) contains the largest share of these public entities globally, at 49%. Europe maintains 25% of the world’s publicly traded family firms, followed by North America (14%), Latin America (6%), EMEA (4%), and Japan (2%).

On average, family or founder-run public businesses generate nearly 4% of the annual revenue generated by the world’s listed companies. However, their performance in many specific regions can be significantly higher. Publicly traded family firms in Japan account for around 30% of the revenue generated by all of the nation’s listed companies.

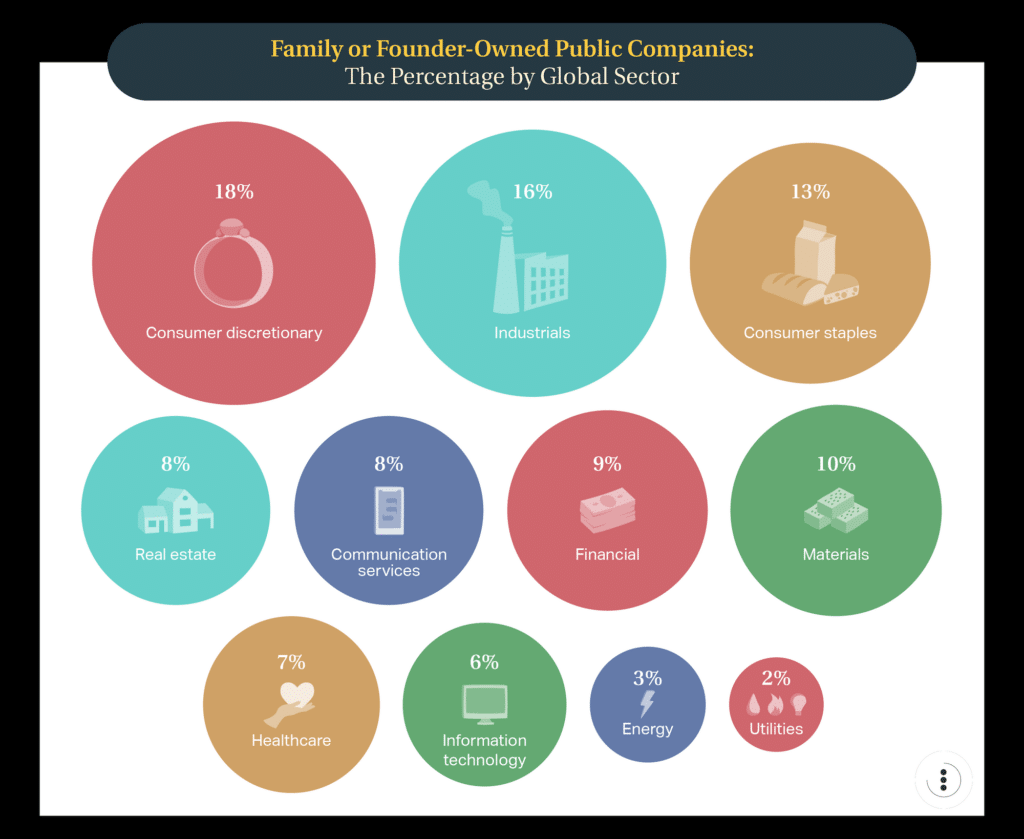

Figure 4: Percentage of Family or Founder-Owned Public Companies by Global Sector

Transforming the future through ESG

Consumer focus on environmental, social, and governance issues has risen significantly, elevating the impact of businesses that advance these causes. Over 3 out of 4 consumers base their purchase preferences on ESG issues, while Millennials and Gen-Zs place sustainability and social issues among their top concerns. Data suggests that family-owned companies are performing better in ESG on the global stage and are showing consistent improvements. European family businesses lead other regions as environmental and social drivers, but family-owned firms in Asia are closing the gap.

The financial impact of family-owned businesses on global and national economies is considerable. Still, their contribution through ESG initiatives and investments will likely further cement their influence in the future. Family businesses continue to be time-honoured brokers of global prosperity and agents of positive social change.

Sources for figures:

Institute for Family Business

The Economic Times

Family Enterprise USA

BCG Henderson Institute

Market Overview – Italy

Campden FB

Understanding Family Business in China

Family Enterprise Canada

Family Business Week

BDI

AIDAF

Campden FB

Tilburg University

Plant Canada

EGADE Business School

Universidad Espiritu Santo

The National

Gulf Today

Oxford Economics

Forbes

Seegman

China Merchants Holdings International

Business Insider

Roadmap Portgual