When a family-enterprise seeks to diversify its risk and grow its activities, many different paths may lead to a successful outcome. Typically, mergers and acquisitions and strategic alliances come to mind as well as using the family’s own wealth as an injection to further strategic goals. However, an option that is rarely considered or openly discussed is that of promoting entrepreneurship within the family as a tool to diversify risk and increase the family wealth. Prof. David L. Deeds the Schulze Chair of Entrepreneurship in the Opus College of Business at the University of St. Thomas, USA, discusses the benefits for family wealth and the next family generation when shifting from a family-enterprise to becoming an enterprising-family.

The family-enterprise is the backbone of the world’s economy and is critically important to the economic growth and development of every nation. There is mounting evidence that the family- enterprise on average outperforms publicly owned firms. The centrality of the family in the enterprise provides several competitive advantages including a long-term perspective on investments and performance, stability in leadership and values, and strong organisational culture and norms. These are part of what has been broadly termed the advantage of “familiness” a term tagged by Habbershon, Williams & MacMillan in 2003. However, family-enterprises and their owners face distinctive challenges and two in particular are well established: The first is the need for the owners of family-enterprises to diversify their wealth. The second is the need to incorporate, train and put to best use the most important family asset – the next generations. Shifting the mindset from being the owners of a family-enterprise to being an enterprising-family can provide a solution to each of these challenges.

Family-enterprise owners are limited in their ability to diversify the wealth of the family because the bulk of the wealth is retained within the business. This concentration of wealth within a single firm leaves the family with excessive firm-specific risk and, often, the family’s wealth under- diversified. The traditional road is to use the markets to achieve financial diversification of this risk. This requires the family to extract wealth from the business to invest elsewhere in stocks, bonds, hedge funds, real estate, and others. However, taking substantial amounts of cash out of the family-enterprise often leaves it weakened and unable to grow and invest in potentially profitable opportunities. This can lead to the erosion of the competitive position. In fact, unless judiciously applied, the extraction of wealth from the family-enterprise in order to lower the risk to the family’s wealth may in fact have the reversed effect and increase the danger of failure. While managing the family’s investments may provide the training necessary to become a financier, it does not provide the managerial, operational and entrepreneurial training and challenge that prepares the next generation to build on the family’s previous success.

Another potential solution to the issue of under- diversification is acquisitions. Acquisitions can leverage the wealth and competitive advantage of the family-enterprise by buying another firm that expands markets, products and/or market power. When acquisitions go well they provide profitable growth opportunities and increased margins via synergies between the family-enterprise and the acquired firm. Acquisitions also diversify the risk to the family’s wealth by decreasing the business’ dependence on a few products or markets. However, acquisitions are extremely challenging and historically have had a low rate of success. Furthermore, the costs of an acquisition are usually underestimated. The integration of the two organisations is almost always much more difficult and longer than expected. The possible negative impact of the acquisition on the operations of the core family-enterprise is rarely considered nor properly estimated. A successful acquisition once completed and fully integrated can be beneficial to the family’s wealth in the long-run, but in the short-term can create considerable added risk. Hence, unsuccessful acquisitions pose a substantial threat to the health of the family’s business and wealth. They can provide the managerial training and challenges that prepare the next generation to lead, but, given the size of investment and the high risk of failure, this is not a task for novices or the ill-prepared. Acquisitions are difficult and require substantial managerial skill, experience and expertise and do not necessarily teach the next generation how to be entrepreneurial and innovative.

The preceding solutions to the challenge of diversifying family-enterprise owners’ wealth are well established and widely employed with varying degrees of success. However, there is another alternative, which is under-utilised and when properly employed leads to lower risk, the creation of substantial new wealth, and provides the perfect opportunity to train, evaluate and incorporate the next generations in to the family business: Family supported entrepreneurship. It requires the family to shift from a family-enterprise mindset to an enterprising-family mindset whereby the family continues to nurture the core family-enterprise while at the same time returning to its entrepreneurial roots. Every family-enterprise begins with an entrepreneurial act – the founding of the business by the first generation.

Over time as the family tends to focus on growing the business, improving operations, and creating a strong and stable business structure whereby the family shifts from an enterprising-family mindset to having a family-enterprise mindset. The solution to both the diversification problem and the challenge of making the greatest use of the next generation is to once again become an enterprising-family.

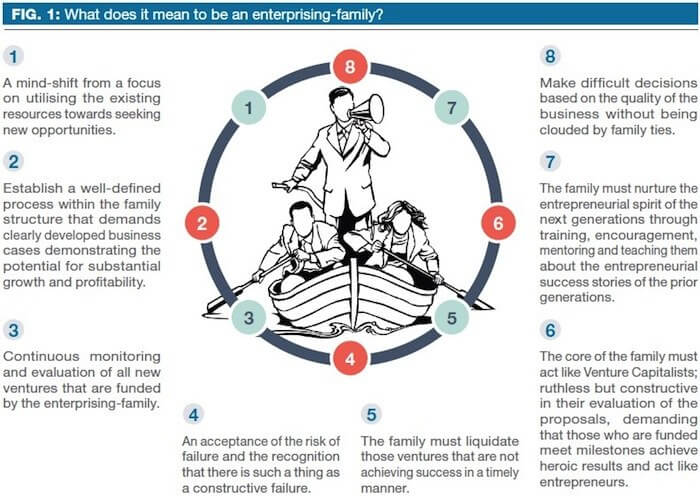

What does it mean to be an enterprising-family?

Being an enterprising-family does not mean pursuing wild risks or simply indulging the next generations’ business visions without questioning. The following core requirements need to be fulfilled for this concept to be a success (See Figure 1):

1. A mind-shift from a focus on utilising the existing resources towards seeking new opportunities.

2. The family needs to establish a well-defined process within the family structure that demands clearly developed business cases demonstrating the potential for substantial growth and profitability. This process needs to provide much more than just a yes or no, rather it must provide a detailed evaluation of the proposed business, suggestions for refinement of the plan. If the answer is no, then a reasoned explanation of why and an encouragement to keep looking for new opportunities needs to be provided.

3. Continuous monitoring and evaluation of all new ventures that are funded by the enterprising-family.

4. An acceptance of the risk of failure and the recognition that there is such a thing as a constructive failure.

5. The family must liquidate those ventures that are not achieving success in a timely manner.

6. The core of the family must act like Venture Capitalists; ruthless but constructive in their evaluation of the proposals, demanding that those who are funded meet milestones achieve heroic results and act like entrepreneurs.

7. The family must nurture the entrepreneurial spirit of the next generations through training, encouragement, mentoring and teaching them about the entrepreneurial success stories of the prior generations.

8. The family has to make difficult decisions based on the quality of the business without being clouded by family ties. This is why it is advisable that the family embed the process and the value of entrepreneurship within their business and culture.

To become an enterprising–family also requires the next generations to rise to the challenge and seek out opportunities for growth and profit. They need to create well-developed plans, business cases and presentations for their ideas, that would impress a Silicon Valley Venture Capitalist. The proper research must be done prior to initiating the venture. The next generation must not to depend on the indulgence of their parents and grandparents, but must raise their work and effort to meet the standards of the venture capital market. This will push them to become entrepreneurs – to seek and exploit opportunities through creativity, vision, and lots and lots of hard work. Being an entrepreneur is the hardest job in the modern economy. It demands that you do more with less. It accepts no excuses and demands superior execution.

At this point you may be thinking “Doesn’t becoming an enterprising-family create the same risks for family firms as expanding through acquisitions?” The answer is no if well executed. Entrepreneurs and Venture Capitalists use real options reasoning to minimise risk. If the entrepreneur estimates that he needs $5 million for his venture, no investor will provide him that exact sum. Rather, they would provide him a mere $50,000 and tell him to go accomplish something and come back. An entrepreneur minimises initial investments because they are the highest risk and most expensive capital. They are forced by the markets to continually prove themselves by achieving outcomes – patenting, proto-typing the product, getting the initial customer, and creating a profitable and scalable business model in order to gain the resources they need. Commitments of resources are staged and additional commitment requires that outcomes be achieved and milestones be met. The enterprising-family needs to follow the lead of Venture Capitalists in Silicon Valley and around the world and apply options reasoning to their entrepreneurial investments.

What is the outcome of the transition from a successful family-enterprise to a successful enterprising-family? First, diversification of business risk as the family’s wealth is spread across markets and products and continues to seek out new opportunities for profitable growth. Second, and most importantly, it leads to the development of the next generation of leaders of the family-enterprises. The next generation trained to act entrepreneurially, think creatively, build an organisation and execute a plan is what every enterprising-family needs to build on their success. So, if the owners of a successful family-owned company can execute this process and truly become an enterprising–family they can address two key problems simultaneously: risk diversification and preparing the next generation to lead and lay the groundwork for a future of profitable growth.

Tharawat Magazine, Issue 12, 2011