The story of a family business is unique. Its peculiarities will depend on the mentality of the family, circumstances, the economy at large, and other factors within or outside of human control. There are, however, typical patterns to be recognised in family business evolution. The way they evolve typically demonstrates certain stages, challenges, and applied strategies. If family businesses fail or succeed depends on many different factors. Dr. Hischam El Agamy, Executive Director of Tharawat Family Business Forum and Founder of Tharawat magazine, discusses the family business life cycle, the factors that are in and out of control, and how in the end, family unity is of the essence and at the base of family business success.

The riddle of family business continuity

Statistics suggest that most family businesses do not make it past the 3rd generation. This in spite of the many competitive advantages family businesses can harbour, such as the leverage on the family name, the possibly great trust between family business members, and the long-term orientation because of the need to provide for future family generations. Why then, is the failure rate so high? Indeed, the most frequently identified factor that leads to the demise of family businesses is succession. Passing the business from one generation to another requires a great organisational and often emotional effort from the family business, and many face apparently insurmountable obstacles at this stage of transition. Yet, succession is not the only reason for failure or conflict; many other factors of family business management define its survival probability and continuity.

Interestingly, once a family business has made it past that fearful stage, at which most of its kind fails, it seems to have a great potential to carry on for a very long time. Family business success stories stretch over decades or even centuries and have become part of history. A group of historical family businesses are part of the Henokians; an association instated for old family and bicentenary companies. There is also a UK-based association for small- and medium-sized businesses; the Tercentenarians, that consists of ten family owned businesses, all of them more than 300 years old. One of their members is C Hoar & CO, founded in 1672, and may well be the oldest family-owned bank in Europe.

So really, family business continuity seems to pose a bit of a riddle. Some seem to know the answer to it and continue to run their companies successfully often without even changing their core business activities. Arie de Geus, in the Harvard Business Review, 1997, made it his objective to solve this riddle. The main conclusion the scholar came to was that the family businesses that make it through many decades and even centuries, are the ones that have the most personality: ‘They know who they are, understand how they fit into the world, value new ideas and new people and husband their money in a way that allows them to govern’. In essence, this brings back the family business success to the strength of the family unity; the strength of the alliance of family members standing behind the business brand. This however, is quite an abstract concept and does not give much to go on as to how a business should actually be managed to ensure its lasting success.

The challenges surrounding succession were mentioned to explain the high failure rate of family businesses. However, we also know of families where succession did not cause any difficulties and that still they did not make it past the 3rd generation. The high family business mortality therefore cannot only be explained by family conflicts, but may have to do with the way the business is managed and adapts to micro- and macro-economic factors. Indeed, de Geus (1997) made the observation that long-living family companies are very good at the ‘management for change’. With economic landscapes changing at a fast pace, it makes sense to state that the speed of adaptation to new circumstances will largely determine a business’ chances of survival. In order to be in time for such adaptations, it seems that it is even more important to identify the ‘needs for change’ at the right time.

It is therefore of particular interest to have a look at the various phases a family business typically goes through and where the needs for change arise and change management becomes crucial.

Family Business Life Cycle

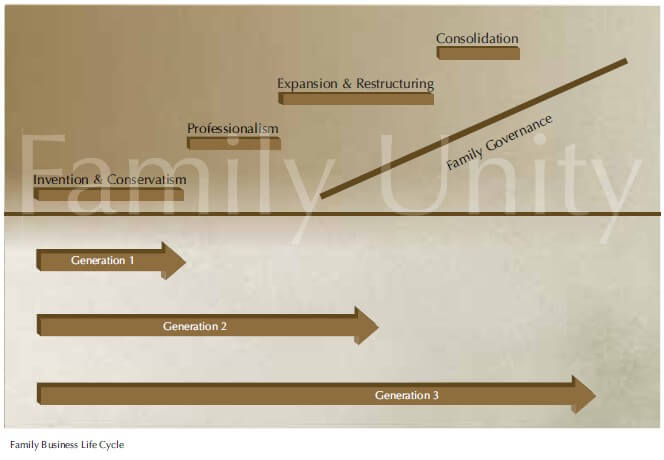

Typically, a family business will go through several stages of business evolution. The sequence of these stages can well be called the professional life cycle of the family business (see ‘Family Business Life Cycle’).

The establishment of a new family business begins with the founder’s dreams. From that point in time the way the business develops is a direct result of the combination between the founder’s vision and his attitude towards risk-taking.

At this stage it is important to see how the founder’s dream and vision is naturally influenced by the traditional values of his environment and the Zeitgeist. As his dream slowly becomes reality, the founder may become increasingly protective of the outcome of his efforts and will want to prevent the enterprise from taking any excessive risks. This phase of ‘Invention & Conservatism’ seems a natural result for a business leader, who battled his way through the sometime tedious start-up phase and now wants to preserve the gained ground.

At a later stage, the family slowly takes in the next generation that has its own visions and often a strong desire to introduce more strategic thinking and a more professional organisation. Usually, the new generation has the benefit of contemporary education and modern technological knowledge, which it uses to push this stage of ‘Professionalisation’ of the family business. Introducing this more professional approach into the business may happen under the founder’s leadership or may only happen after the transfer of leadership to the second generation. The stage of professionalisation is a decisive one as it creates the platform for business expansion. Best case scenario here is that the business owners recognise and professionalise the strength of their core businesses and start looking ahead for new opportunities.

The next stage is one of ‘Expansion & Restructuring’ and requires a lot of effort from management towards innovation and towards taking a certain amount of risk. It is a stage of re-inventing and re-working strategy. In many ways it is a new starting point where the family business goes back to the founder’s initial vision and adapts it to the current challenges. The expansion phase is often linked to the family business’ need for restructuring. This stage mostly coincides with the increase of family members involved in the business (including in-laws and cousins) and requires more formal family and corporate governance rules. This stage is without a doubt the most critical in the family business life cycle. It symbolises a turning point: the family members and business may continue or fragment and disappear.

Should the family business indeed survive the ‘Expansion & Restructuring’ phase, it enters the next stage, which can be called ‘Consolidation’. This phase reminds strongly of the time of the founder’s conservatism in the early days of the business. Consolidation is marked by need to focus on the systematic branding of products and services, by the consolidation of distribution channels and the further expansion into new domestic and international markets. It is a sort of renaissance for the business.

Is this cycle applicable to all family businesses? Does it necessarily take several generations to go through this cycle? What happens if a family business goes from a foundation phase directly to Expansion phase? What kind of influence does the family culture and traditions (core values) have on the cycle?

These and many more questions surround the family business life cycle model and the answers will vary from case to case.

Overall, it can however be stated that in family businesses the best business model is useless without family unity supporting the different stages. Surviving the different stages, will depend not only on a professional business approach but will ultimately always be a combination of professionalism and the strength of the family cohesion and solidarity backing it up. It also requires a sense of realism; the family needs to be aware of even the weakest signal indicating family conflicts and of the first signs of potential erosion in the business.

Application to Arab Family Businesses

One of the chief aspects influencing the family business cycle is the cultural and traditional context. For Arab family businesses the model might need to take into account several additional external and internal factors.

Firstly, family structures n the Arab world are a factor to consider . Families live in an environment that is more communal and they are often numerous. This makes issues such as stakeholder structures and wealth allocation a major issue for family business continuity and family unity. It becomes relevant in the ‘Expansion & Restructuring’ phase, where families often face changes in organisational structures and need to work on the mindset of the family, which might be a challenge, depending on the number of active and passive stakeholders .

Secondly, there is a controversy between the fact that Arab culture is prone towards entrepreneurship but at the same time knows a rather conservative approach to business. This conservative thinking in some cases goes against innovation and entrepreneurship. Yet, successful Arab family businesses excel and progress along the cycle as they have developed a sense of realism in how far conservative thinking should be applied and dosed according to the circumstances and context.

Thirdly, there is the influence of the community on Arab family business. Preserving the reputation often impacts their way of communicating and the decisions they make. The founder’s values often develop a “contract of trust” with the clientele. The family brand establishment therefore happens primarily in the early ‘Invention & Conservatism’ phase. Nowadays, consumers have gone back to being thrifty. They are prone towards returning to old-fashioned thinking after an era of excessive spending. If a certain amount of traditionalism can be maintained throughout the family business life cycle then Arab family businesses retain a competitive advantage in today’s market. Trust and expansion at an affordable risk should be the strategic goal. Most importantly, the goodwill should be jeopardised at no stage of the family business cycle .

There are many more particularities that would customise and shape the family business life cycle for Arab family businesses. Overall, however, running a family business can be a challenge at any of the stages of the cycle. Ultimately, successful family businesses are those that throughout each and every stage maintain strong family unity and mind set strategic priorities.