As financial markets gradually regain confidence after the recent financial crisis, talk of IPOs is once again gaining currency in business circles. This is true in Asia and Europe, and certainly the Middle East. Often viewed as a clear statement of success in the business world, going public can prove to be much more of a mixed blessing to an owning family, and can turn out to be a bitter pill indeed. Dr. Denise Kenyon-Rouvinez, Head of International Family Business & Philanthropy at RBS Coutts Bank Ltd in Switzerland, discusses the pros and cons of family businesses going public.

In recent years, some families who have taken their business public in Saudi Arabia, UAE and other countries of the Gulf have been disappointed with the result, often wishing they had never made the move despite the financial benefits it brought them and their businesses. IPOs bring a mixture of positives and negatives to families in business. Being aware of both and managing expectations can help families to have a successful experience when taking their businesses public.

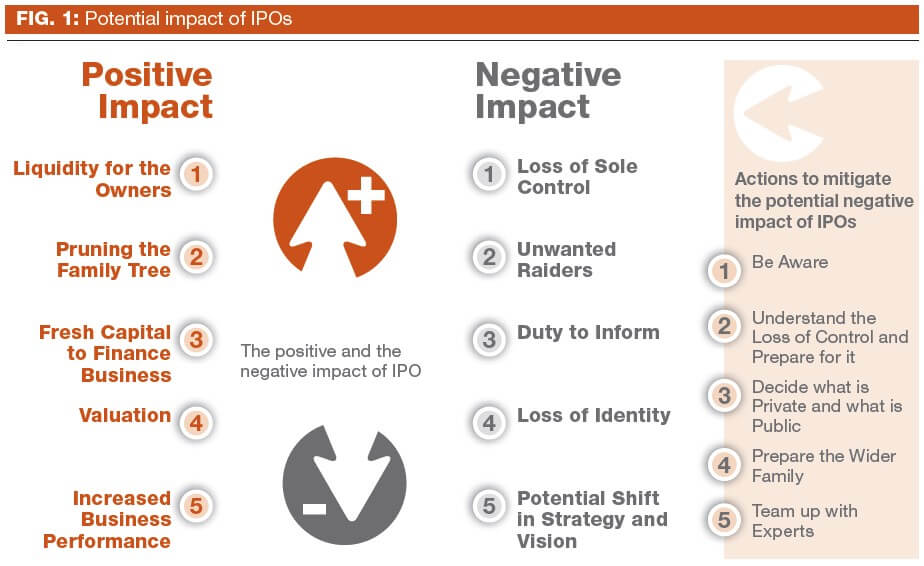

Before addressing the potential problems it is appropriate to review the positives, as they can be considerable, both for the family and the business.

Positive impact

1. Liquidity for the owners

The cash brought by IPOs can result in a significant financial windfall to the owners, enabling some to buy a house, others to have seed money for a new business venture or simply providing financial independence from the family for some of its members. In many cases this can relieve numerous family tensions, not least because family members know they can always exit via a sale of their shares, or even acquire more shares, at any time through the stock exchange.

2. Pruning the family tree

In large family settings, when family shareholders become too numerous to handle or where family harmony is at stake, the new inflow of money can serve to buy out some family shareholders or a family branch, thus simplifying the ownership structure and speeding up decision-making . While this “pruning” may be perceived as a failure by some, it usually proves to be healthy for the business and for the family in the long run if handled sensitively.

3. Fresh capital to finance business growth

Providing additional capital to the business for growth, development or consolidation reasons is often a significant factor in the decision to go public, and this can certainly be the case for a family business. It can provide a tremendous opportunity for growth, new developments, and for the long-term sustainability of the business.

4. Valuation

One benefit of being quoted on a stock exchange is that it provides a clear and uncontestable market value for the shares, thus avoiding many family feuds on pricing when buying out a shareholder – the continuing owners wanting a lower price and the departing members a higher one.

5. Increased business performance

Around the world, studies on the performance of family businesses have for the most part clearly shown that listed family businesses are high performers, and usually better long-run performers than listed non-family businesses. A study conducted in France over ten years concluded that listed family businesses demonstrated performance superior to that of other listed businesses in every single year of the ten-year period. An earlier study in the UK demonstrated that listed family businesses over perform private family businesses. More generally, trends indicate that opening up the capital – whether to the public or to private investors – boosts the performance of the business.

Being under public scrutiny tends to concentrate the minds of those at the helm. Discipline is more likely to be achieved if people know they are being observed by external forces such as analysts and non-family shareholders, business boards open to external wisdom and talented non-family managers can make it up to the top of the organisation.

Financial advisers and intermediaries are likely to push the advantages of going public, such as those introduced above. However, they may be less forthcoming about the costs of stock exchange listing, either because they are less aware of them or because their job is to encourage IPOs to happen, or both. They are knowledgeable about the financial and pure business advantages that a listing can bring, but are often less aware of the family and personal side of the coin. The rest of this article explores the more negative issues.

Negative impact

1. Loss of sole control

The loss of absolute control over their company is usually the biggest shock for most families. In Oman the law currently requires at least 40% of a company to be offered in an IPO. The Capital Market Authority and the Ministry of Commerce are in the process of amending the legislation to reduce this requirement to 25% for family-owned companies. (Source: Times of Oman, November 1, 2010). While this may encourage more families to list shares, in reality what is important is not the percentage made public but the very fact that some – even a very small proportion – of the shares are publicly held. This very fact means that the family is not alone in the driving seat and that unknown outsiders have a say. This is an unavoidable fact. Not all families fully realise that this will happen, and not all families can cope with this.

2. Unwanted raiders

In early November 2010, the family controlling Hermès, the French luxury goods company, woke up one day to find that LVMH, a key competitor, had acquired 17% of the shares in their family company. The family was quick to react and publicly asked Mr Arnault to back off from what they saw as an unfriendly move (Source: Reuters, November 3, 2010). The fact is that once public, a family does not have much say over who acquires their shares and who does not.

3. Duty to inform : increased requirement for transparency and information

More visibility and more bureaucracy (the result of regulatory compliance) are direct results of any IPO. Families need to be ready for this. Quarterly and annual reports need to be published, which may result in hiring new staff and the changing of the IT system to be able to assemble the necessary information for the reports. The increase in cost is one thing, but what troubles most families more than the cost after an IPO is the loss of privacy and the fact that any financial analyst can have a say on how the business is run and on its performance.

4. Loss of identity

Family businesses that excel do so largely because of the strong values that tie the business to the family owners and to the long-term strategic focus families have for their businesses – what matters to most business families is not so much how much return they will generate in the next three years, but how successful their business will be in twenty years when the next generation is at the helm. Financial markets are regulated and motivated mainly by shorter-term visions, annual profits and dividends. The shorter-term goals of the new owners will most probably not wholly match the longer-term goals of the family owners, and this may force families to review the strategic course of their businesses. The discrepancy between short-term and long-term goals can result in frictions unless expectations are managed carefully right from the outset. These tensions often come as an unpleasant surprise, certainly for families who went public as a way of resolving a family feud. They can find that they have merely swapped one set of conflicts for another.

5. Potential shift in strategy and vision

Levi Strauss, a 6th generation family business from the USA, went through a painful experience some years ago. In 1971 the family sold shares to the public. The family business went from a highly focused strategy –one main product – to a diversified offer of varied apparel, one-product strategies being considered too risky by financial markets. The diversification strategy proved unsuccessful and the family decided to buy back all the shares to regain control in 1985, buying back the shares at a price of $50 per share (Source: The New York Times). $50 per share was a high price, but a price the family was ready to pay to regain control and freedom to set strategy, as what was at stake was extremely important to them. They vowed never to go public again. In 1986 the company dropped its diversified apparel operations (Source: Hoover’s).

Levi Strauss is not alone in this category. In Western Europe and North America a significant number of family businesses which went public in the 1990s returned to private ownership in the late 1990s and early 2000s, the controlling families often buying back the shares at a very high price. In the Gulf, families generally did not go as far as to take their businesses private again, but disappointment and frustration are voiced by many.

Despite the possible negative impacts, families should still consider going public as a potentially valuable financial tool. However, to maximise the positive impacts they need to anticipate the negative ones and prepare for them. Before an IPO, families need to weigh up the benefits and the costs of going public, and only go for the IPO if the analysis is positive. In addition, families should not shy away from their responsibilities; they must understand that they can and should be pro-active in the preparation of an IPO. They are usually very energetic in preparing the business for its stock market debut, but much more rarely do they prepare their family members for the realities of life after an IPO. Often this is through lack of awareness of the likely issues. Here are some key things families can and should do:

Actions to mitigate the potential negative impact of IPOs

1. Be aware

Most importantly, families should ensure that all family members are aware of the positive and the negative consequences of going public. Experience shows that awareness alone can significantly reduce the frustrations and other problems that a family can face after an IPO.

2. Understand the loss of control and prepare for it

No matter how small or large the percentage of capital opened up for public ownership, it will result in families having to share control. The implications of this need to be properly understood and accepted by the whole family.

3. Decide what is private and what is public

A good strategy to minimise some of the negative aspects of going public can be is to take only part of the business public, keeping the rest private. This is easier where there are a number of businesses, but even where there is only one business there may be appropriate splits – for instance, the product/service side of the business could be listed, while the real-estate side of it remains private.

4. Prepare the wider family

Organise meetings and gatherings where shareholders and family members can discuss the pluses and minuses of going public and where they can express their opinions and frustrations. The more family members are involved in and “own” the final decision, the more they will accept it and support it.

5. Team up with experts

Some family business experts are well aware of what it means for a family to sell its business or to go public. Seek them out and invite them to speak at a family meeting. Their knowledge and insights might be of significant help in preparation of the family for an IPO of its business.

An IPO can bring many advantages to a family business, but it can also bring many frustrations and conflicting interests and strategies. The more a family prepares for the emotional impact of an IPO, the more its members will be able to understand and thus be prepared for any downsides with objectivity, and thus the more they will be in a position to decide whether an IPO is right for them and their business. If they can achieve that they will maximise their chances of enjoying to the full the benefits that can result from going public.

Tharawat Magazine, Issue 9, 2011