A notable shift in global economic power has taken place over the last decade, seen by many as a transition from West to East, by others as one from developed to emerging economies. Dr. Raja M. Almarzoqi, Chief Economist at Alkhabeer Capital, Saudi Arabia, analyses the real implications that may be expected from a new economic world order, the role of the G20, and the need for solid institutional frameworks in emerging economies.

Our View

The global economic power is shifting to developing nations and has major effects on the distribution of wealth and the future of power. This shift has three major impacts and they are as follows:

1. Increasing purchasing power in developing nations, which will lead to an increase in demand.

2. New investments will be introduced by wealthy nations into developing countries in a quest to identify new investment opportunities and depending on the growth rate of each country.

3. Existing economic infrastructure does not sustain the new growth, thus, there is a required partnership between the public and private sector to build and launch such infrastructure.

Background

The financial crisis that spread worldwide in 2008 proved to be the most severe economic downturn since the Great Depression of 1929, causing a major turn for the global economy. Its impact will be long-lasting and marked by a tilt in influence from West to East with an accelerated shift of power that has been noticed since early 2000.

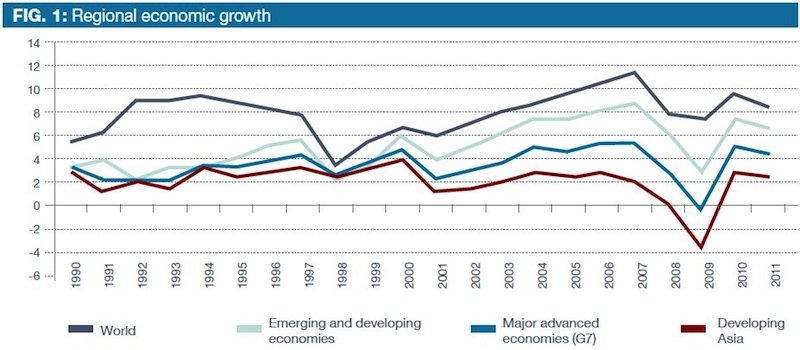

After 2001, the economic growth in emerging and developing economies (EDE) has surpassed the economic growth in major advanced economies (G-7) resulting in 4 significant implications:

1. The high growth of EDE enables them to cumulate reserves and government surpluses compared to deficits in most of the G-7 countries.

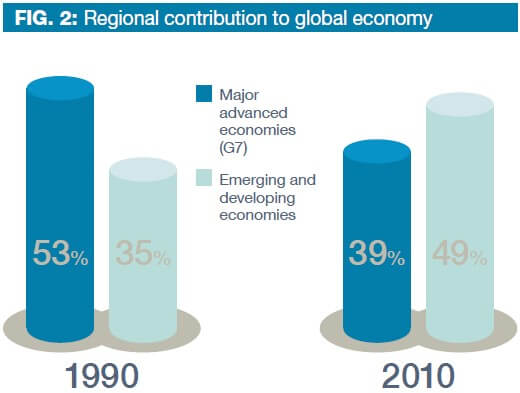

2. EDE contribution to the global economy increased from 35% in 1990 to 49% in 2010, which in turn increased the influence of EDE on the growth of the global economy.

3. EDE started attracting capital and FDI, whereby high economic growth gave rise to opportunities for higher rates of return with respect to investment opportunities.

4. The shift in economic growth has promoted the importance of EDE in the decision making process of global issues signaling the need for EDE to support G-7 in the management of the global economy and the resolution of financial crisis.

Thus, the financial crisis in 2008 was the cornerstone from which the G-7 recognised the need to address global reform issues (Figure 1 and Figure 2).

The Group of 7 (G-7) was not capable of resolving the global crises alone and needed the cooperation of emerging markets. In the last decade, the global economy has been hit by many economic and financial crises that lead the G-7 to realise that its influence over the global economy had started declining while the influence of developing countries started to increase.

Prior to the launch of the Group of 20 (G-20), there have been several initiatives to form similar formations with the objective to involve non-G-7 countries in the resolution of global aspects of the financial crisis. Two subsequent meetings comprising a larger group of participants (G-33) held in March and April 1999 discussed reforms of the global economy and the international financial system. Such regular dialogue with a constant set of partners was institutionalised by the creation of the Financial Stability Forum (FSF) and the G-20:

1. The Financial Stability Forum brought together representatives from G-7 countries and from existing international institutions concerned with international financial regulation.

2. The formation of the Group of 20 brought together finance ministers and central bank governors from the G-7 nations, and from twelve non-G-7 emerging market countries. The objective was to tackle the financial and economic crisis that spread across the globe in 2008. Thus, the G-20 members were called upon to further strengthen international cooperation. The meeting was at the level of the heads of states. It has since become the global forum to discuss global economic issues.

The Way Forward

The evolution of the G-20 into a forum addressing complex global issues will help promote balanced growth and sustainable development only if G-20 developing countries actively participate. Further research is needed on the interplay between global and local issues, as well as the future roles of developing countries.

Experts are needed with specialised knowledge to assist global leaders in understanding local issues, and supporting local leaders in perceiving the broader picture. Without such studies being supported by government bodies, think tanks, and research institutions in developing countries, the only beneficiaries will be advanced economies. This will occur at the expense of developing countries, and will not support sustainability in the global economy. Therefore, the G-20 reflects a significant step in the global political economy. Whether such development produces a balanced benefit for both, developed and developing economies will depend on whether its members will rely more on research-backed material, and clear objectives.

Such a shift will have a positive impact and will be recognised by business communities. As the balance of benefits of a global economy improve, EDE economies will expand and businesses will have the opportunity to play in a fair-game global environment.

UNCTAD surveyed a sample of 240 company executives from the largest non-financial TNCs about the effect of the crisis on their international investment strategies during the next three years. The main finding here is that “Developed countries in Europe and North America may be severely affected by the downsizing of TNCs´ investment plans and by their increasing preferences for emerging economies. However, they still enjoy major advantages in terms of market size and business environment, thus remaining among the top priority countries for investors. And the “decrease-then-rebound” pattern in TNCs´ investment plans for 2009-2011 seems similar across all regions. However, companies from emerging economies appear to be slightly more optimistic than those from developed countries, especially the European countries.” (World Investment Prospects Survey 2009 – 2011). FDI data shows that while FDI to developed economies declined by 29% in 2008, it increased in developing economies by 12%. In 2009, the decline of FDI to developed economies reached 44%, while FDI to developing countries has declined by 24%. This implies there is a shift in investors risk preference after the financial crisis of 2008. If the developing countries focus their attention on improving their institutional framework and infrastructure then this shift toward developing countries could be lasting.

The shift in global economies’ power and the change of the size of the economy of countries will affect the distribution of wealth among nations. Currency values will be affected, whereby the currency of growing economies will appreciate and the currencies of economies decreasing in size will depreciated. Businesses will have to reconsider the way they allocate their wealth, concluding in the need to diversify their investments towards the growing regions.

Tharawat Magazine, Issue 11, 2011