The dynamism of the global economy has created bountiful opportunities for Middle Eastern (ME) family firms. Eager to enter new growth fields, learn new skills, build new capabilities, and keep their members involved, many ME family firms have joined other companies in forming alliances, established joint ventures, and increased their exports. Despite the huge investments many of these companies have made, some have found it difficult to sustain their global presence. This leads us to ask: What can family firms do to improve the odds of succeeding in internationalising their operations? In this article Dr. Shaker A. Zahra, University of Minnesota, USA, Sondos K. Abdel Gawad, ESADE, Spain, and Dr. Rania Labaki, University of Bordeaux 4 and INSEEC Business Schools, France, address this important question.

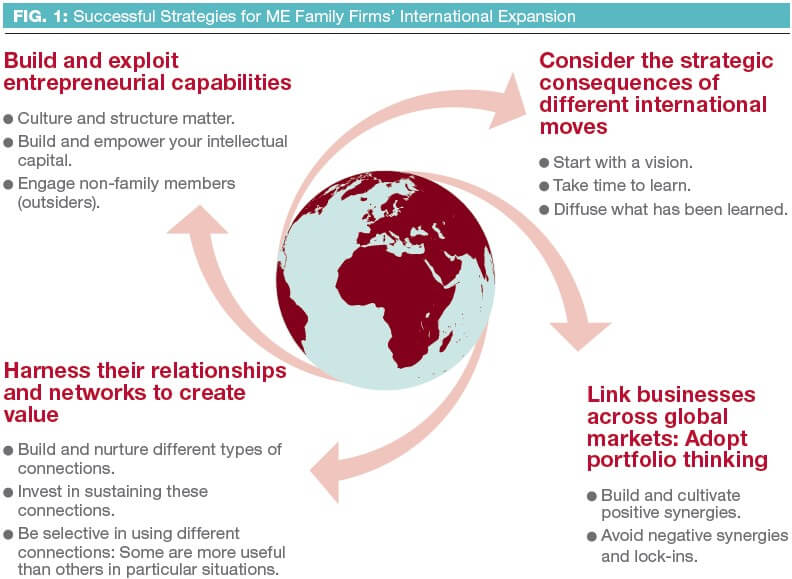

ME family firms can capitalise on their assets, both tangible (e.g., financial resources) and intangibles (culture, values, etc.) as they expand beyond their national borders. In Figure 1, we highlight several actions that can improve the odds of successful international expansion.

Consider the Strategic Consequences of Different International Moves

With many companies building their international operations and pursuing foreign markets, pressures mount on ME family firm owners and leaders to do the same. However, as we suggest in Figure 1, this could be a fatal mistake. The decision to internationalise these firms’ operations should be guided foremost by their vision

Start with a vision.

Family firms usually pursue financial and non-financial goals that interest their members and keep them engaged. This often creates tensions in these companies’ missions. This expansion does not cause the loss of control on the part of the owner family, thus reducing a major source of friction within the company and owner family. Indeed, success in international markets can significantly improve the domestic market position and reputation of the family firm. This has led many ME family firms to join a number of acquisitions and joint ventures within the MENA region and developed countries. They have also pursued their internationalisation in other world regions and/or industries by exploiting their connections with immigrant/expatriate family members and branches. Some of these transactions allow these firms to hedge against business risks in a volatile global economy.Success requires clarity about the strategic reasons that drive family firms to internationalise their operations. What do the company and owner family aspire to achieve? What does the family firm have to offer in international markets? What is the effect of internationalisation on the company’s operations, values and hybrid identity? These are simple but important questions that management should address before pursuing international opportunities. Without considering the strategic implications of these transactions for building a global presence and developing new capabilities and sustaining the business over generations, family firm may fall prey to international moves that dilute their value and stretch them too thinly. Gaining advantage from international activities requires understanding the unique organisational, financial and technological challenges that must be addressed.

As we indicate in Figure 1, having a clear and well articulated mission can allow ME family firms to make wise decisions about potential international partners. Family firms have a disposition to deal with other family firms, especially those that have similar goals, values and investment horizons. Strategic clarity about what the company wants to achieve can help in assessing potential partners and their capabilities as well as their credibility. These evaluations require going beyond numbers and figures to probe intangibles such as the quality of management, strength of the organisation, the motivation and skill of its intellectual capital, and the compatibility of its values with those of the organisation. When conducting these analyses, numbers alone do not tell the whole story.

Take time to learn.

Internationalisation takes time and dedication of resources. Fortunately, many family firms are long-term oriented in making their decisions as they focus on the viability of the business for future generations. Yet, managing “attention” is a strategic imperative when it comes to internationalisation. As international expansion ensues, managers become busy–focusing on the feedback from markets and customers. This causes some family firm managers to overlook the opportunity to learn from their international experiences. Managers need to reflect on and analyse their decisions as they engage in social (what drives customers and competitors to behave the way they do) and technological (how they build their capabilities as they create products and systems) learning. Managers need also to learn how to organise their operations, sequence the various activities they undertake, and build linkages among these activities. Learning is a key source of new knowledge that fuels the family firm’s growth. Analysis of succe?sful and unsuccessful transactions could be a great source of learning that serves as a foundation for success. Diffuse what has been learned.

Learning (i.e., gaining new knowledge) is not sufficient for success in international markets, however. As indicated in Figure 1, managers need to create the systems and processes that capture and diffuse their learning throughout the organisation. Diffusing best practices learned is essential in order to benefit from internationalisation. Lessons learned from successes and failures are also important. “Intelligent failures”, those episodes where a company learns from its misfortunes, also provide important occasions to learn and then capture and diffuse that learning. Failure is commonplace in the internationalisation process especially for those ME family firms that do not have a lot of experience in international markets. Managers know they need to understand the reasons of how to reduce the odds of future failures and how to weave lessons learned into thinking throughout the organisation. Intelligent learning occurs when members of the firm; i.e., the owner family and employees, learn from disappointments and successes and apply what they have learned when they make decisions. In family firms, organisational memory is traditionally perpetuated over generations. This is distinct feature that these companies should exploit in their organisational learning about internationalisation.Diffusion of what has been learned is essential to create value. However, managers are often reluctant to share what they have learned with employees believing that this is the prerogative of management. Family owned businesses are especially unwilling to share what they have learned with employees that are not members of the owning family. This isolates the employees while depriving the company of their talents and insights. In contrast, sharing provides an important means for clarifying issues, developing causal explanations of what happened, and crafting strategies for effective change.

Link and Build Synergies: Adopt Portfolio Thinking

Like many other companies, family firms typically follow a sequence of activities to build their international operations. They often start as exporters: licensing their technologies and products, building distribution channels and finally locating their operations overseas. They frequently join alliances and establish joint ventures to gain access to markets and technology, and improve their learning. In undertaking these activities, it is easy to fall victim to the simple logic that managing each of these activities is crucial. While some transactions can make or break the firm, as indicated in Figure 1, it is imperative to think of linking these transactions and cultivating synergy among them. This synergy is the premium to be gained from connecting and coordinating the firm’s international operations. This glue could be in the form of a coherent strategic direction that is approved by the business and the family (Where are we going?), operational efficiencies, as well as the complementarities that create financial and non-financial (family members’ happiness and well being) value.

Managing the international business portfolio, however, is not only about money and financing. For family firms, it is often about creating a new set of opportunities, developing capabilities that could be used in different business fields, and introducing business models that have the potential to change the fabric of the industry and its competition. This places a heavy burden on family firm owners and managers who need to have the foresight to see the future before it is born, the creativity to mold resources into capabilities, and cleverly target capabilities in pursuit of particular opportunities.

It is also important for family firms to avoid negative synergies and lock-ins that can destroy value, as stated in Figure 1. Negative synergies become evident when two or more activities work counter to each other, depressing the value of the overall international operations. For example, a family firm might seek to maximise the flexibility of different units by giving them autonomy in making key decisions about their respective markets. Extreme autonomy handicaps agile decision making and responsiveness, thereby reducing a company’s gains from internationalisation. “Lock-ins” usually occur when one strategic move keeps the firm from pursuing other options. For example, having an exclusive foreign distribution contract with a well known company might be worth it, but it can also limit the company’s ability to make other choices as the market changes. Some ME family firms are likely to encounter this situation because of their limited experience, few connections, nepotism, and absence of alternatives.

Managing the portfolio of a family firm’s international operations requires attention to the internal processes, management, and governance systems already in place. As these operations grow there is a need for new structures, systems and processes that ensure synchronisation, the timely gathering and dissemination of information as well as agile decision making. This makes investments in information technologies and systems along with having effective governance structures worthwhile. Equally important, having different members of the owner family involved in particular areas is essential to develop their talent and ensure that they understand how internationalizing is progressing.

Build and Exploit Entrepreneurial Capabilities

Family firms with a strong entrepreneurial orientation are well positioned to uncover lucrative opportunities and pursuing them in innovative ways that others cannot imitate. To turn this orientation into a reality, these companies build entrepreneurial capabilities that allow them to collectively sense and select opportunities in the light of their unique internal resources, cultures, histories and other idiosyncrasies. By developing a set of entrepreneurial capabilities, family firms can develop their own rules, instead of following the recipe that other companies use, as stated in Figure 1.

Building and sustaining this entrepreneurial capability requires the infusion of variety and diversity into these companies. To ensure success, the owner family has to be careful in exercising its power and control. This could prove to be a major challenge for many ME family firms, where authority is usually centralised in the hands of the founder and a selected few family members. These companies need also to build their intellectual capital by hiring people with different outlooks and skills, recruiting skilled managers and employees worldwide, training them in creativity techniques, allowing them to express their views with openness, and encouraging them to look well beyond the company’s comfort zone. As the presence of outsiders (non-family members) increases, ME family firms need to re-examine their compensation systems and existing organisational structures. They need also to empower these employees, thus giving them some discretion in locating and pursuing lucrative business opportunities.

ME family firms need two key ingredients to benefit from the diverse and varied skills of the firm when internationalizing. The first is to develop an ability to create an organisational culture and system that fosters learning. Frequently, companies spend more time and energy tracking their competitors and customers in an effort to learn. However, they do not spend as much time or devote as much effort to encourage “collective learning”, where employees and managers share their experiences and reflect on the strategic value of those lessons learned. Learning is rarely automatic and usually requires careful thought and analysis in order to successfully expand internationally. The second requirement is having an environment where people genuinely participate. Intelligent and capable employees thrive on putting their ideas to the rigorous tests of the marketplace. Companies, therefore, need to give these employees (especially non-family members) a forum where they can influence the decisions being made.

Harness Relationships and Networks to Create Value

To sustain their entrepreneurial capability, ME family firms need to take advantage of the relationships they develop in international markets, as noted in Figure 1. Family firms thrive on building enduring relationships with bankers, suppliers, customers, local communities, universities and research institutions, charitable organisations, other companies, and government bodies, which can be critical in giving the company important clues about pending technological, market or policy changes. These relationships offer important signals of changing competitive conditions. They also help in assembling the resources required for internationalisation, analysing opportunities, and appraising progress. Family firm managers and owners devote considerable time and energy to networking, which is important for gaining access to and nurturing these relationships. Company and site visits, attendance of important conferences and trade association meetings, and speaking to local business people and research universities are important ways of connecting and building beneficial relationships. Information technology (e.g., video and teleconferencing) can also keep family business owners and managers well informed. Still, there is no substitute for personal contact.

Competition in international markets is no longer between a company and another company–it is between a network and another network. A family firm cannot rely solely on its own skills and resources; they need to leverage the skills, connections and resources of other companies in their networks. ME family firms, therefore, need not “go it alone”; instead they collaborate and win in international markets. Further, these firms need to be selective in using their connections; different connections are valuable in different situations and for different reasons. Appreciating and capitalising on these differences is crucial for success. Family firm managers need also to understand the unique challenges and capabilities of their partners.

In conclusion, for many Middle Eastern family firms, internationalisation is an important but risky approach to learning, acquiring resources, building capabilities, and creating value. As we have stated in Figure 1, these companies improve the odds of success in today’s dynamic markets by: considering the strategic consequences of different international moves; linking businesses across global markets and gaining synergies by adopting portfolio thinking; building and exploiting entrepreneurial capabilities; and harnessing their relationships and networks to create value for their owners and shareholders. By appreciating and creatively exploiting their unique missions, values and cultures, Middle Eastern family firms can build a strong international market presence.

Dr. Shaker A. Zahra, University of Minnesota, USA

Sondos K. Abdel Gawad, ESADE, Spain

Dr. Rania Labaki, University of Bordeaux 4 and INSEEC Business Schools, France

Tharawat Magazine, Issue 11, 2011