An Interview with Maurizio Sella, President of the Sella Banking Group, Italy

Maurizio Sella is the President of Sella Banking Group, a family business 126 years in the making. Sella is also part of a family legacy which counts thirteen generations of entrepreneurs. The Sella family started its entrepreneurial activities in the 16th century, when the family’s ancestors distinguished themselves as entrepreneurs in the textile field. Three centuries later, Maurizio Sella’s family built further on the Sella legacy by being among the first textile manufacturers to use the world’s first mechanical machines. On the heels of Italy’s industrialisation at the beginning of the 19th century, Pietro Sella introduced Belgian textile machinery in a Northern Italian factory in 1817.

A few years later Pietro Sella’s brother, Giovanni Battista, introduced the same innovation in a separate factory. These industrial maneuvers forged the family business ahead for decades, leading to the introduction of mechanical looms in the 1870s along the river Cervo, in a Biella-based plant., known as Lanificio Maurizio Sella. Maurizio Sella moved his business to this mill in 1835, which today serves as the Data Processing Centre of the entire Sella Group and i’is also the Sella Foundation’s headquarter.

With modernity, the Sella family contributed to the birth of the Italian company Idroelettrica Maurizio Sella and the Filatura Follegno (Lana Gatto) whilst also founding the Sella & Mosca winery in Sardinia. In 1886, Gaudenzio Sella, with the financial support of a Sella family interested in investing in new business without abandoning the textile sector, decided to found the Banca Gaudenzio Sella & C along with six brothers and cousins. The common threads of these ventures have unmistakably been the family’s passion for its work, a strong sense of responsibility to the local community and the active training of successive generations.

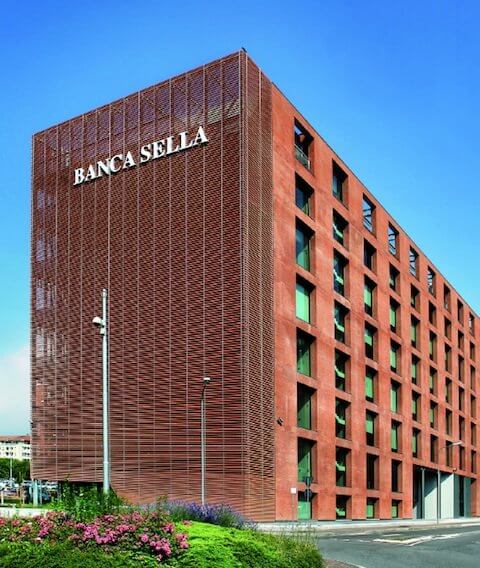

With Maurizio Sella at the helm as General Manager of the Sella Banking, the company has grown into 335 branches in line with its reputation as a stalwart Italian financial organisation. The banking group is comprised of 22 companies which operate internationally and offer a wide range of banking and financial services.

In 1997, Maurizio Sella was one of the founders of the Associazione Italiana delle Aziende Familiari – AidAF (Italian Association of Family Businesses). He was and remains convinced that it was necessary to emphasise and reinforce the unique role of entrepreneurial families. He has been President of the Association since 2007. In this interview with Tharwat magazine, Maurizio Sella shares his expert opinion on and passion for Italian family businesses.

[ms-protect-content id=”4069,4129″]

What fascinates you most about family businesses?

I believe that the most important aspect is the natural vocation that drives the family entrepreneurs to work and act in order to make the company prosper, gain credit, and reputation inspire customer confidence and expand facilities. This is the spring board for progress and is perhaps even more powerful than the impetus of gain.

Moreover, I find the ability to transmit the entrepreneur’s spirit from generation to generation fascinating; it is based on the family sharing values and on the knowledge that the faith in the company comes first. I also believe that the family’s entrepreneurship is an art. There is not a recipe to success, we can all learn from the experiences of other family businesses, but we can apply what we learnt by adapting it to our own reality. Every family business is unique.

What are the key characteristics of Italian family businesses?

In Italy, like in most other European countries, family businesses make up around 85 percent of the total number of companies. These family firms provide about 70 percent of national employment. Unlike other countries, in Italy there is a higher percentage of family members directly involved in the management of the company, this is especially the case in SMEs. Another specific feature is that CEOs or presidents stay in charge for a long time, bearing in mind that Italy has the second highest longevity rate country in the world.

Italian family businesses of medium and large size have less debt than other types of companies and are, therefore, less dependent on foreign capital. Moreover, in the last five years the relationship between debt and equity capital has significantly decreased, from 7.1 in 2007 to 5.6 in 2011 (computed as the ratio between total assets and equity). The data released by the Observatory, created by AIdAF, UniCredit and Bocconi University, which lists all family businesses with sales of over 50 million euros, reveal that this value is the lowest since 2001 and is about two points lower than that of the average non-family companies. The explanation of this fact is that in family businesses the growth of equity has been consistently higher than the growth of sales. We believe that this is a clear indicator of the caution and prudence that drive family businesses and also of their strong interest towards the strengthening of capital solidity. In fact, they prefer to consistently allocate part of their resources from the sales to future growth.

What is the role of family businesses in the Italian economy?

The role of family businesses in the Italian economy is particularly important. The data of AUB Observatory shows that family businesses have been able to withstand the crisis in a better way because, in most cases, they did not hesitate to use their own resources in order to support the business and extend their vision beyond the acute phase of the crisis. Family businesses started recovering sooner than other types of businesses in the fall of 2009. Both in 2010 and 2011, they grew more than any other type of business. In the same period they had the highest operating profit than other companies, with the only exception being companies under public scrutiny. Moreover, the number of people employed by family businesses grew significantly from 2006 to 2010. Therefore, its impact on the total number of employees of companies with share capital grew.

What industries are Italian family businesses strongest in?

Italy is the country with the second largest manufacturing sector in Europe after Germany. Italian family businesses excel in many sectors such as mechanical engineering, building materials, food and of course in fashion and design.

What are the greatest challenges that Italian family businesses face in today’s economic landscape?

Until a few years ago, the Italian famiy businesses paid special attention to the relationship between family and business, which should never be neglected. Today, they also need to focus on the management of the companies. Although statistics tell us that the businesses conducted by members of the family has a better performance than those driven by external managers, it is equally clear that family businesses also need skills that can be found in non-family managers. Therefore, it is important to understand which are the factors that lead to failure, in order to cancel them out.

The second challenge is that the family businesses have to being able to understand in advance the signals of a potential crisis in their companies and addressing them in time, without falling into the illusion that things will fix themselves on their own. Waiting will only make them to lose precious time. They must have the courage to act quickly even if they have to make difficult choices.

What are sustainable growth strategies for Italian family businesses?

The two main objectives of future development are increasing the size of the company and expanding into international markets. Italian family businesses are smaller than those of other European countries. This situation puts them at a disadvantage in terms of the ability to invest in research for innovation. In recent years, smaller companies have learnt to build business networks that help them to achieve a critical mass enabling them to face the challenges of the market. In order to obtain a bigger size, if applicable, they must be able to open their capital to shareholders other than the family, such as investment funds or private equity companies.

International development is closely linked to the size of the businesses. In order to open new branches, create alliances, bring their products to other countries of the world, the businesses must have a certain size, an external management structure that is integrated with the managers of the family, which creates a solid and successful team, and an adequate organisation. Many Italian family businesses are at this developmental stage.

What does the future hold for Italian family businesses?

If the Italian family businesses are able to develop a “conscious business” oriented to the merit, to the balance and to the respect of the areas of action and responsibility of the family related to the company, they will be able to reveal the real potential residing in their long-term vision and in their local roots. They will then be able to play a significant role in the economic recovery of our country.

Tharawat Magazine, Issue 18, 2013

[/ms-protect-content]