Photo by Miguel Á. Padriñán from Pexels

Mustafa Hussain, a solicitor with Taylor Wessing’s wealth group, UK, and author of “The Family Business Passport”, discusses the role and responsibilities of directors in Middle Eastern family businesses.

Blood is thicker than water”. These words constitute perhaps one of the greatest universal truths. The proverb is particularly true of the Middle East, where the family acts as the core component of society. The model of a family business allows the members to use these strong family ties as a source of loyalty, commitment and drive to further the business. It is not surprising then that family businesses represent some of the most successful enterprises in the region (and in the global market). Why have a corporate governance policy?

Effective organisation is vital to the sustainability and profitability of a family business and so owners should always be mindful of ensuring their corporate governance systems are both comprehensive and robust. Blood ties may act as a distinctive strength for family businesses but they also bring their weaknesses. There can be sensitivities regarding executive succession, the role of family members in the business, and the use or abuse of business assets to name but a few. Without a planned regulatory framework, such sensitivities can become real vulnerabilities for the business.

Owners can demonstrate their commitment to high standards of corporate governance using, for example, a corporate governance policy to provide for the intention, objectives and details of how a company, its shareholders and its executives will follow best practice. The policy can provide for how a family business can operate without interference from the owners but with strategic control. This helps owners set the tone on how the business should be run.

Closing the gap between owners and directors

If blood ties are one of the driving forces of a family business and the basis of its ownership, then strategically it is (or should be) the board of directors that pilots the operating controls. A corporate governance policy can be supplemented by delegation of authority and committee terms of reference statements. Those help to bridge the gap between the owner’s expectations and the detailed instructions by which directors can operate the business as a board but within the boundaries set by the owners.

Once that connection between ownership and operations has been documented, the directors of the company have the comfort and mandate to know how they should execute their task. They will know that they have to operate ethically, strategically and with a focus on performance, value creation and accountability. In order to avoid any doubt or frustration from the owners, the board will also know that they will be expected to produce a timely flow of high quality information for owners and have effective decision-making processes in place.

The role of directors

The role of the directors is to use their skills, experience, knowledge, and independence in order to challenge, formulate strategy, and drive the performance of a family business. There should be a supportive relationship of mutual respect and open communication between the family and non-family members of a board and between the executive and non-executive directors. Executive directors carry out strategic functions in the company but also hold employee positions (such as a CEO). Non-executive directors are not company employees nor executive officer holders. They are independent and asked to join the board because of their expertise. When a person (such as a family patriarch) is not an appointed board member but exercises influence on some or all of the board and those other board members act in conformity with his directions, then that person can be deemed a “shadow director”. There is no material distinction between the duties owed by the different types of directors but a particular difficulty with shadow directors is that they can result in a person being liable for responsibilities without the formality of an appointment (See Figure 1 below).

Favoritism

The temptation in a family owned company will always be to fill the board with those members of the family or friends who are trusted by the patriarch or favoured by him. There is also a susceptibility to using board appointments for political point scoring; for example, in businesses co-owned by siblings, the owners will often seek to control the board using appointments who are pre-disposed or politically aligned to one shareholder more than another. If a board does not have sufficient numbers of independent non-executives the business can be crippled by in-fighting and a lack of pragmatism in decision making.

Directors Responsibilities

Directors must always remember that their responsibility is first and foremost to the company. They must act within their powers, promote the success of the company, exercise independent judgment, avoid conflicts of interest and use reasonable care and skill (See Figure 2 below). Whilst these are the general legal duties falling on directors, there will always be further specific ones dependent on the local laws of a jurisdiction. For example, some territories have particular health and safety laws, duties to employees and insolvency provisions. It is impossible for a director to know all of these and so the need for professional advisors and legal counsel to the board is apparent and an important appointment to get right. It is for the company to enforce a directors duties, although in some instances shareholders can bring action on the company’s behalf.

Board Control

No individual or group should be able to dominate a board’s decision taking if independent governance is to be properly effected. If a patriarch or senior family member is concerned that they do not have sufficient control, this can be provided for using a casting vote, veto powers, or authority to intervene.

Employing Family Members

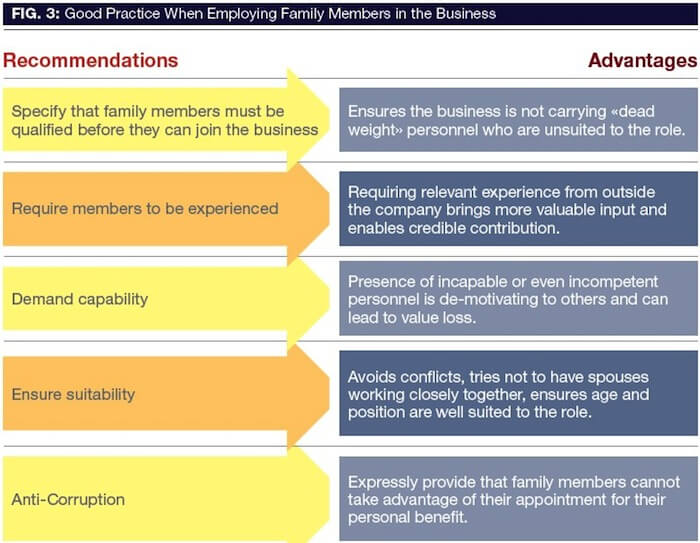

It is good practice for directors to implement a policy providing for how family members may be employed in the business, including at a board level. Such guidelines can help avoid awkward or embarrassing situations which shareholders or management find difficult to deal with or which may cause tension, drain resources and even provoke disputes. Recommended provisions include those described in Figure 3.

Duration of duties

In terms of duration, a director’s duties to the company start from the moment of appointment but they will cease upon resignation or retirement. Notwithstanding that, some responsibilities will be held applicable even after resignation (such as a duty of confidence) and just because a director is no longer appointed when a liability is discovered does not mean that they will not be liable for acts done during their term.

Fulfilling responsibilities

Directors often worry about how they fulfill their duty to act in the best interests of the company. However, provided they always act with good faith and in consideration of all the issues, they will often be compliant. Special insurance, called directors and officers insurance, can be effected to cover the directors performance liability. In the absence of misconduct and negligence this would usually be sufficient to cover all acts done in good faith. Board minutes can also provide a vital documented trail evidencing that the board has considered all the issues and reached the best decision. Appointing a company secretary and maintaining full and accurate company records is therefore not just good practice, it can be the vital proof that a director has adequately fulfilled their responsibilities.

Avoiding conflict

Directors should always avoid being in a position where they may be conflicted between their duties to the company and their personal (or third party) interests. Such interests should therefore be declared (including in particular issues regarding that director’s own service contract, loans to directors, property transactions involving directors or persons connected to them and so on). Some directors may hold board positions in more than one company and perhaps even in companies that are rivals or competitors. Such directors should ensure they remember that their obligation is to the company and they are bound by confidentiality and fiduciary responsibilities. Enforcement is not straightforward but in circumstances where an appointment with two absolute rivals is simply unsustainable, then the director would likely have to step down from one board rather than act as a member of both.

The by-laws or articles of the company will usually provide for the practices and procedures by which directors are appointed, attend meetings, vote and gain access to information and so on. It is important that directors understand all of their rights and powers so that they can fulfill their responsibilities fully and in the knowledge of what they can do to challenge and direct the rest of the board when their judgment demands it.

Maintaining Good Practice

Directors should always be mindful that there can be a liability on them personally as well as to the company if they fail to fulfill their duties or execute their responsibilities with the care and skill expected of them. However, having adequate practices and procedures in place, keeping abreast of developments in law and corporate governance (such as with the new Bribery Act introduced in the United Kingdom) and taking expert advice can ensure not only compliance but also enable directors to effectively steer the progress of a family business, building on the driving force of blood ties and generating valuable growth and success.

Tharawat Magazine, Issue 12, 2011