The Banca March was established in 1926 on the Balearic island of Palma de Mallorca by Juan March and his family. The March family quickly expanded across the neighbouring islands and has since become one of the leading banks in Europe. After nearly one century of existence Banca March is still entirely family-owned. Apart from the Balearic Islands, it has branches in the Canary Islands, Madrid, Barcelona, Zaragoza, Valencia, Alicante, Malaga, Cadiz, Luxembourg and London. The March family has always been known to invest into other family businesses. Recently, the family-owned bank has taken this strategy a step further by creating a family business fund. Tharawat magazine explores what makes a family business invest in family businesses.

About Banca March

The Banca March Group includes a variety of activities such as banking, investment and pension fund management, handled by March Gestión, as well as insurance activities. Through its listed holding company, Corporacion Financiera Alba, the March group also owns long-term stakes in Spanish firms. In recent European banking stress tests the Marches came out on top, which in the public eye is to a great deal attributed to the bank being owned by a family with conservative values and business ethics. Banca March has been ranked the first bank in Europe for two years in a row by the World Bank and is one of the largest Spanish financial groups with one of the highest solvency ratios in Europe (Core Capital of 26%). The bank is now in the hands of the four brothers and sisters of the third March family generation: Carlos, Juan, Gloria and Eleonor March. With the fourth generation slowly taking their place on the company’s board the family seems to be gearing up for another century of family ownership.

Banca March is probably the only family-owned Bank in Spain and today employs over 1400 people. The March family is also known for its philanthropy; it established the Fundación Juan March patrimonial and operative institution dedicated to fostering culture and the arts in 1955. Through the Fundacion, the March family also supports research in its Centre for Advance Studies and sponsors the Banca March Chair of Family Business at the University of the Balearic Islands.

The Family that Invests in Families

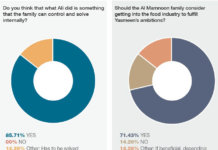

The March family has always considered family businesses a viable investment opportunity. This strategy has led to considerable success and the bank holds family businesses in most of its private investment portfolios. Taking their committment to family-owned firms a step further, Banca March established a unique portfolio that only invests in family businesses. But why are family businesses a good investment? According to José Luis Jiménez, CEO of March Gestión, family businesses are more profitable than non-family business in the long-run partly because they are more conservative: “Anytime you talk to a family member, they are talking about the next generation and what they want to leave them. They are not only talking about short-term results.”

Fact is that more than 15% of the companies listed in S&P 500 and Stoxx 600 are family businesses. Moreover, historically, family businesses have outperformed non-family businesses and also have a better earning predictability. The Banca March’s family business fund is a vote of confidence that the intrinsic values of family businesses heighten their odds of survival even during economic crises.

How Families Qualify

For a family firm to qualify as an investment opportunity in the eyes of the Banca March, 25% of the company at least must be in the hands of one single family. Ideally, a senior family business member is active in the executive committee or the board of directors. The March family feels that a family member involved at top level is an advantage because they know their business better than anyone else.

Most family businesses on the long run perform much better than non-family business. The Banca March has experienced this first hand by investing in them for the last 30 years and carrying out specific research on this topic. The research appointed by Banca March aims to explain why family businesses perform better than non-family business. A first conclusion is that family businesses grow and create employment despite the crisis and that they seem to go for low leverage and controlled risk in investment.

Banca March did not only start the fund because of its own convictions with regards to family businesses but did it in response to investors asking for such opportunities. Many family offices for instance seem to prefer to invest in family-owned companies because they are aligned with their clients’ values and philosophies. Through its fund the March family has invested in all types of family companies: The core criteria is the quality of the business model not the origins of the business or even its sectors or market capitalization, as confirms José Luis Jiménez. The fund selects the right businesses through its investment committee; a body constituted by the bank’s most distinguished professionals who undertake an analysis of the economic environment, as well as the investment strategy with regard to the family businesses.

Considering the Stage of the Company

Whether a family business is a good investment opportunity or not is largely determined by what stage it is at. If the company is at a transition stage it can be riskier to invest as not all family businesses have been successful in handing over the organisation to the next generation. However, Banca March has found that companies that have reached the third and fourth generation mostly show the greatest potential as they tend to have strong protocols and structures in place. The March family knows from its own decades of family history which faced them with many economic and political changes, how crucial such structures are and how they increase the odds of survival for family businesses.

Through its family business fund, the March family does not only think of the next generation of the family but applies that thinking to the next generation of investors as well. The family has its own wealth fund and continues to invest, along with its clients, into family businesses. Certainly, seeing a century-old family business such as the Banca March investing and believing in family businesses, cannot fail but be credible and, hopefully, encourage others to do the same.

Tharawat Magazine, Issue 15, 2012