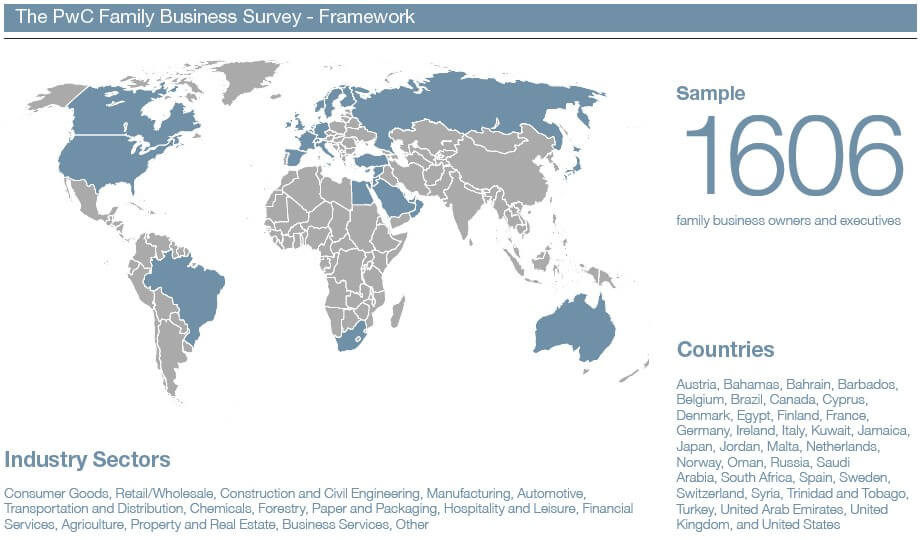

Many things have changed in the last couple of years; however, the fact that family businesses are predominant in numbers as well as economic impact has remained a constant in economies around the world. PricewaterhouseCoopers (PwC) has undertaken its second global family business survey, entitled ‘Kin in the game’. With a total of over 1600 respondents from family businesses in 35 countries, this is one of the largest research projects in 2010 dedicated to family-owned companies. Undoubtedly, this year’s highlights lie in the marked differences they show compared to the previous survey in 2007. Indeed, a great many changes in priorities and business behaviour can be detected and the survey documents well that the world has just witnessed a global crisis that has changed the way we think and that will not be forgotten any time soon.

What catches the eye most in the 2010 PwC Family Business Survey are the differences it displays when compared to the first survey in 2007: All in all there is no doubt that the global economic crisis has left its mark, if not in performance, then at least in the way family businesses view the future.

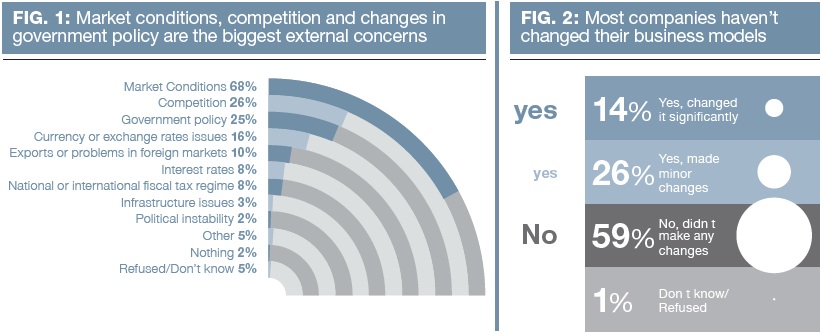

While in 2007 the major concern of global family businesses was the increasing competition in their sectors, this year’s focus lies in the fluctuating market conditions. As a result of the financial crisis this is not surprising as such, however, the numbers show real fear; 64% are concerned with market conditions, more than double the percentage worried about government policies and competition (See Figure 1).

One would think that recent events would have made executives and business owners prioritise strategy reviews. Ironically, the shock and residual fear does not seem to run deep enough as to provide executives with a sense of urgency and push them to make changes, nor do most of them intend to undertake anything of the sort in the near future. Only 14% have made significant modifications to their business models over the past 12 months. (See Figures 2 and 3).

This, however, is not a fact that can be generalised: According to the survey, family firms in emerging economies have been more prone to change and adaptation than the ones in mature economies.

While the mood is anxious and flexibility as well as speed of adaptation varies, most respondents feel rather confident of being able to exploit new opportunities and to capitalise on them. Thus, again, especially in the emerging markets, there has been significant growth in most companies in spite of 68% confirming that they have seen a decisive decline in demand.

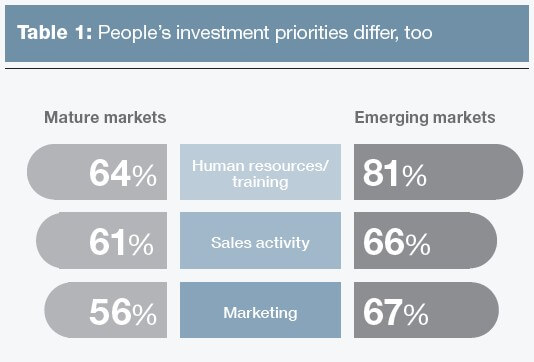

With regards to the future investment priorities of family firm executives and owners, we find yet another marked difference between mature and emerging markets (See Table 1).

Family firms in emerging markets clearly prioritise HR and training investment. This could in part be explained by the extensive growth these economies have gone through recently. There is more work than people who have the skills to deal with it. This has intensified the search for skilled people as well as increased the need to improve present company performance through employee training in emerging economies. Clearly, these family businesses recognise the need to build knowledge inside and outside their companies.

Succession…

The most persistent problem and, at the same time, the most frequent reason for family business failure was and remains the succession process. Yet, in spite of that well established fact, over half of the firms surveyed still have not set up proper succession planning.

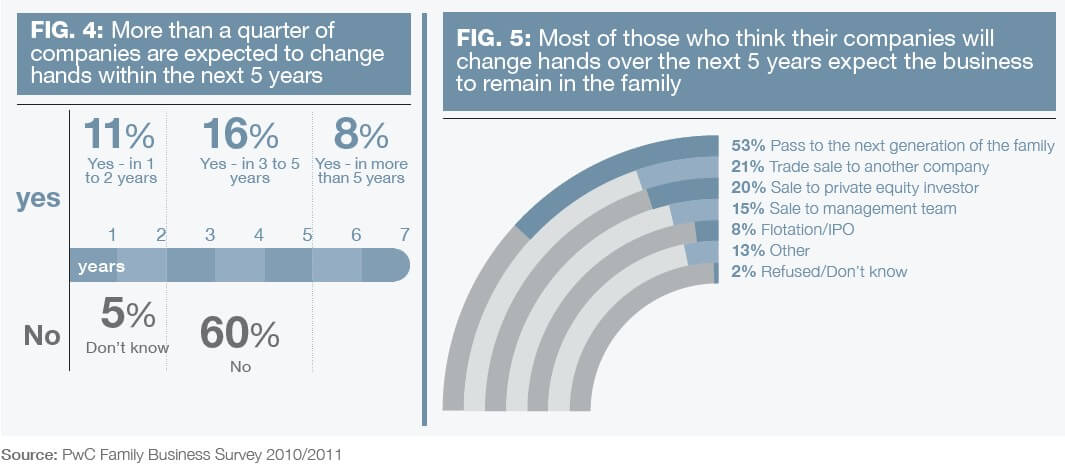

The cautionary tale is not told without grounds: succession is imminent with 27% and 36% of family businesses in mature and emerging markets respectively being passed on to the next generation in the next five years alone. Over half of them anticipate the business to remain in family ownership (See Figures 4 and 5).

In general, the survey shows that the older the family business, the more likely it is that family ownership across several generations is expected.

Globally, family firms face a challenge indeed if any sudden changes of ownership occurred since 65% do not have procedures in place, which enable them to purchase shares of incapacitated or deceased shareholders. Additionally, 50% would not be able to buy out family members should they wish to exit the business.

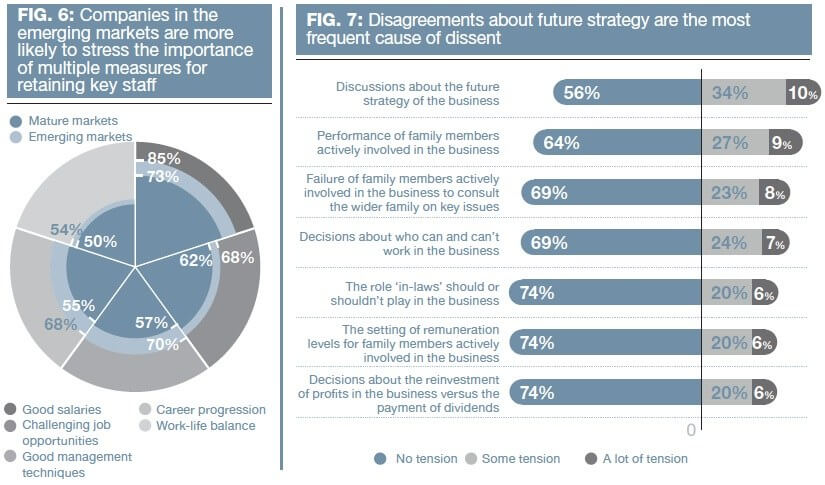

The challenge of succession is not only underlined by the lack of systems in place but also by the gap between this and the next generation’s expectations when it comes to work-life balance. The next generation puts a clear emphasis on free time. How to attract and retain staff is generally dependent on determinants such as salaries, work-life balance, job opportunities, leadership/management techniques, and career progression (See Figure 6).

Again there is a clear distinction between the priorities set by family businesses in emerging and mature markets.

Succession cannot be successfully managed only through proper planning but has to be communicated in an adequate manner. The way a family deals with communication and possible conflict becomes central.

Conflict Management…

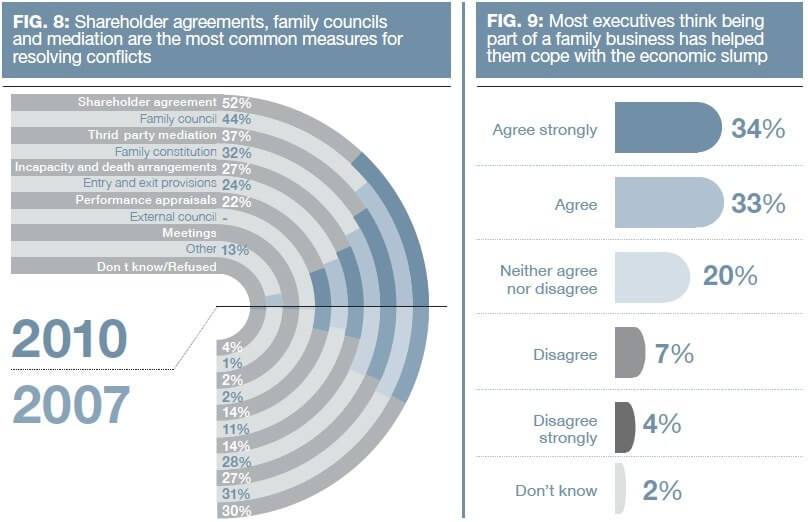

It is not surprising that conflict has arisen from the tensions experienced over the last couple of years. Indeed, the PwC family business survey states that 50% of its respondents have argued about the firm’s future and 40% about the performance of family members. These conflicts might be fuelled by the fact that over 60% still hire family members without training. This number has increased from 43% in the 2007 survey (See Figure 7).

In 2007, respondents had voted family councils to be their preferred tool to deal with conflict. This year’s answers paint a different picture: shareholder agreements are now preferred as a method to avoid and resolve conflicts. Yet, the crucial point remains that less than 33% of all family businesses have proper conflict resolution procedures in place. It goes without saying that this can represent a serious risk for family firms (See Figure 8).

Other options such as third-party mediation is still scarcely used and if yes, mostly in mature markets. Emerging economies still hold on to other tools. The hesitation of bringing in third-party mediation must originate in family businesses’ innate protective instincts when it comes to their conflicts and disagreements. Reputation awareness in family businesses is strong and that may explain why tools such as family councils and shareholder agreements are preferred.

Regulations and Corporate Social Responsibility…

The quality of regulatory environments has shifted to become a top priority with family businesses as opposed to it being a rather secondary consideration in 2007. This change, like many others, can be attributed to recent events, as for many the financial crisis was a direct result of regulatory deficiencies.

Another remarkable shift shows in 50% of family businesses globally wanting to form closer ties with academia for further product development whereas only 37% are actively looking for greater access to capital markets.

Corporate Social Responsibility (CSR) has become a worldwide trend and is also well received by family businesses: over 75% of all respondents have confirmed the positive impact of CSR on their companies. 48% have made changes to accommodate CSR and 49% intend to do so in the near future.

CSR seems to have been recognised by family businesses as a means towards strong reputation building and a way to distinguish themselves as well as to increase efficiency and establish new products and services.

Finally…

While the economic downturn has certainly left its traces and the differences between mature and emerging markets are at times considerable, one thing has remained the same: respondents consider their companies resilient and they attribute it to the very fact of being family businesses.

Family businesses constitute the very foundation of Middle East economies and are considered to be relatively young,” says Amin Nasser, the partner who leads the Family Business Advisory Services for the Middle East at PwC, the leading professional services firm.

“Most of the families in this region are managed by members of the first and second generation.” he continued. Although it is evident that families with proper succession planning and good governance structures are more viable and vibrant than others, a significant number of family businesses still rely on traditional word-of-mouth arrangements between family members rather than formal written agreements. The families in the Middle East have not yet fully adopted the modern global corporate culture. In particular, there seems to be a reluctance to give up boardroom control or to comply with the strict requirements of transparency and corporate governance.

Generally, family businesses in the Middle East are less vulnerable to economic downturn since most of them have, over a period of time, built considerable reserves and been conservative in their business strategies. However, Middle East financial institutions have recently been demanding increased transparency and more formalised ownership and management structures in respect of family businesses. Consequently, we are likely to see a decrease in name lending by the financial institutions.

Tharawat Magazine, Issue 9, 2011