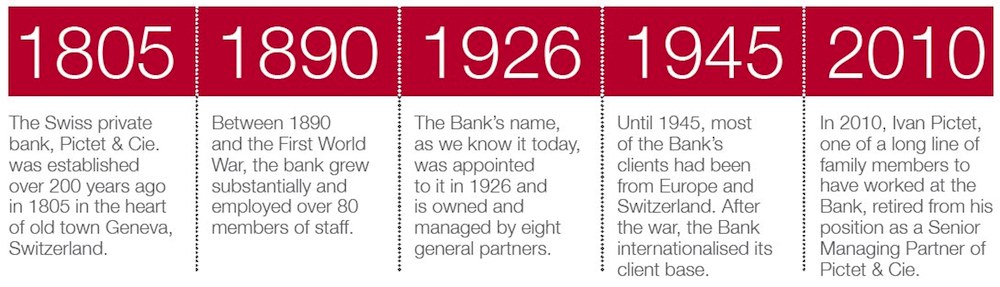

Swiss private bank, Pictet & Cie was established over 200 years ago in 1805 in the heart of Geneva’s old town. Today, it is one of the largest private banks in Switzerland and one of Europe’s leading independent asset management specialists. Pictet & Cie, the name by which the Bank is known today, was chosen in 1926. The bank is owned and managed by eight general partners. Due to its clear governance structure, the Bank can by no means call itself a ‘family-owned’ business. On closer inspection, however, Pictet & Cie has, from its inception, had all the traits of a family business.

When it was founded in the beginning of the 19th century, the Bank was named Banque de Candolle Mallet & Cie after its two young managing parters and founders, Jacob-Michel-Francois de Candolle and Jacques-Henry Mallet. The Bank’s initial vision was “to trade in goods and articles of all types, collect annuities and undertake speculation in commodities.” Soon, however, it started to focus on assisting clients in their financial and commercial affairs, as well as on wealth management. To this day, these activities form the core of the Bank’s business.

Even though Pictet & Cie does not consider itself to be a family-owned business, a brief look at its history soon reveals that family members have followed in each other’s footsteps into the world of finance, thus fostering quite an extraordinary sense of loyalty and shared vision of the Bank’s future. Indeed the Bank’s story, past and present, is linked to the achievements of a few distinguished individuals who often, but not exclusively, share the same name:

After it was founded in 1805, the first Pictet family member to enter the business was Edouard Pictet, the nephew of founder Jacob-Michel-François de Candolle’s wife. His career with the Bank lasted more than 37 years until 1878. By then, the Bank had been changed to Edouard Pictet & Cie Between 1890 and the First World War, the bank grew substantially and employed over 80 members of staff. The Partner at that time was Ernest Pictet, who was succeeded by his second son Guillaume following his sudden death in 1909. Guillaume Pictet was a traveller at heart and added much value by setting up the Bank’s network in the United States and Latin America. He was in turn succeeded by his eldest son, Aymon Pictet, who later entered the world of politics.

In 1926, the Bank was given its current name: Pictet & Cie Aymon was succeeded at the Bank by his cousin, Albert Pictet, in 1928 against the backdrop of the market turmoil, which followed the First World War and in the midst of the Great Depression. Pierre Lombard, who had been appointed a Partner one year previously, shared the task of addressing the disastrous consequences of years of recession and another World War, which shook Europe to its core. It was also during this dramatic period that Alexandre van Berchem was made Partner. He has since gone down in the Bank’s history as the man who symbolised the transition to the post-War boom. He was the first member of the Bank to promote the its international presence and to set up offices abroad. Until 1945, most of Pictet & Cie’s clients had been from Europe and Switzerland. After the war, the Bank increasingly started to offer its services to clients from all over the world. A significant upturn followed, bringing with it many years of growth and prosperity. Much as it had been in the late 19th century and to the advantage of the banking sector, during the Cold War Geneva became a diplomatic and financial centre. Pictet & Cie grew substantially between 1980 and 2005 and the number of staff it employs has increased from 300 to over 2000 employees. In 2010, Ivan Pictet, one of a long line of family members to have worked at the Bank, retired from his position as a Senior Managing Partner of Pictet & Cie and was succeeded by Jacques de Saussure, who has been with the Bank since 1980.

Pictet & Cie. stands for over 200 years of family and industry history. To this day, the Bank’s headquarters are in Geneva but it has expanded its global presence to include offices in Barcelona, Basel, Dubai, Florence, Frankfurt, Hong Kong, Lausanne, London, Luxembourg, Madrid, Milan, Montreal, Nassau, Paris, Rome, Singapore, Turin, Tokyo and Zurich. Staying true to its values and core business activities, Pictet & Cie negotiated its way through two centuries of economic and political changes, and shows every sign of continuing to do so, always steering a steady course.

In 2010, you were appointed to the Senior Managing Partner position in Pictet & Cie.. Can you tell us more about the path that led you to join this centures-old bank?

To do so, I’ll need to tell you something about my own family history. Ours is a very old Geneva family and one that it is best known for the many scientists it has produced over the years. Geneva has always been a place that favours exchanges between representatives of the worlds of science, the arts and business. My own father was the first member of the de Saussure family to be a banker, and he became a partner of Pictet in 1960. As you can imagine, this was a decisive factor in my own decisions. Moreover, my grandfather on my mother’s side had a private bank in a small town in the mountains, which had in turn been founded by his father. And added to all of that, I now live in our family house, which was built three centuries ago by an ancestor who was a banker as well. That was the time when France was the great power and the bankers in Geneva were its financiers. This meant that the 18th century was a great one for Geneva; the city was at the height of its power because of the prosperity of its economy, which was composed essentially of the watchmaking and banking sectors. At the same time, Geneva also played a key role in the arts and sciences. Much like in my own family, there was always a strong mutual relationship between the two professional orientations, because if there was a trader or banker in a family, that meant other members could dedicate themselves more freely to the arts and sciences. I think it is important to strike that balance within a family and to have not only business people but also others who contribute to society in a different way.

My own personal development was naturally influenced by this rich historical background and by my own family history. I studied science because I thought it was the most interesting way to look at the world and also because the scientists in the family were a lot more famous than any bankers had ever become. You know, bankers are often entirely forgotten after one or two generations, whereas artists and scientists are more often remembered! I therefore studied science at the Federal Institute of Technology and Engineering.

After a while, the other side of me came to the fore, the financial side, if you will; and I decided that the best way to connect the two things was to study business but in a scientific setting; I went to MIT. This was just a fantastic experience because the professors were outstanding. They were brilliant and fascinating people. Having this unusual background is useful in my work at the bank, first and foremost because it is a differentiating factor. In business you always try to differentiate yourself.

What was your first position when you started with the bank?

For many years I worked as a portfolio manager in the asset management department. Maybe here my scientific background was more important, because IT has become a key tool in banking today, and the way markets and trade are run and analysed is highly technical and scientific.

If I could do something differently then it would be to spend more years working for other organisations outside the family business. After my graduation I worked in a small research and consulting firm in New York for about two years, after which I was offered a job at Goldman Sachs. However, I thought that it was maybe time to go back into the family firm. Today, we urge the younger generation to develop outside of the firm as much as possible. Staying outside until the age of 33 or 35 is perfect, because the more you learn outside, the more experience you can bring to the family firm when you come back to it later.

The Pictet leadership model is one of great interest and repute. What particularly characterises it and why do you believe that this is the recipe for the future?

What makes us different is that, since the beginning, we have combined ownership and management in the same hands. The advantage of having this combination of management and ownership is that we reduce conflicts and diverging interests; the usual conflicts that you may have between owners and managers and the conflicts that you have between employees and managers are avoided because the interests are all aligned. We see our employees daily and we develop long-term relationships with them and also with our clients. The clients’ interests have to come first, but we see many other organisations where there is a lack of connection between the owners, the management and the clients. Thanks to the system we have in place, we have managed to avoid this situation.

As the owners and at the same time the executive team, we have introduced an operational convention whereby we meet every morning. Being both owners and managers accelerates the decision-making process. Rather than having to pass information up and down the hierarchy, our employees share their thoughts and questions with us directly and we can react quickly. We are responsible, we are accountable, we know what we are doing, we know what risks we want to take, and when we want to take them! We have nobody else to report to.

It is a great model although one that places a lot of weight on individuals. It does confer privileges on the partners but above all duties and responsibilities. Moreover, even though the partners buy into the firm at book value, they also retire at book value, which many executives would not want to do. Non-family members may become partners as well, which would probably be one of the main aspects that differentiates us from most family businesses. However, we believe that in the services industry, the human being is the essential element.

You just mentioned the partners’ daily meetings. Can you take us behind the scenes and tell us what the core purpose of these gatherings is?

It ensures the flow of information between the partners. Every time something happens or a special situation arises, it is important that you are aware of the key decisions to be taken – particularly so in our case where we share unlimited liability for the bank’s balance sheets. For one thing, you want to make sure that nobody works in isolation and does things that he should not do or feels that he cannot talk to someone else about it. It also has another interesting side effect, namely the promotion of a smooth inter-generational transmission of the firm. For 25 years I have seen senior partners take decisions day after day, which helped me in assuming my current position. We have two younger partners who were elected following Ivan Pictet’s retirement last year and who now attend these meetings and can see the decisions being taken day after day. So when managers have a problem in their specific field of competence, they can discuss it every day. This helps to create a commonality of views, a corporate culture and a vision for the firm.

Moreover, we do not need to get outside consultation for our strategy: indeed, we build it gradually every day, in small steps. It is an ongoing process that we are engaged in. Finally, one more advantage of this system is that as the senior partner, one does not experience the loneliness that such a position often entails – as in the case of CEOs – or feel the rivalry from others that can ensue from different structures.

Do you think that this is also helping you to adapt quicker to a required change?

Yes, absolutely. Decision-making goes through a careful process, though. I remember having to correct presentations in our meetings over and over again until everyone was satisfied.In the end the final decision is almost always better than the initial proposal because it has gone through that process. We believe very much in our culture of teamwork. This is what we practise at the head of the firm: a lot of teamwork, a lot of team decisions and full endorsement of the decisions made.

Considering how many family members are working within the firm can you still consider Pictet & Cie. a family business?

The way the partners are elected is purely by cooptation. Only existing partners have voting rights, not the families. This helps us avoid nepotism. For instance, we have a rule that if one of the new potential candidates for election happens to be a close relative of one of the existing partners, then that partner has to withdraw from both the discussions and the voting. Interestingly, we still prefer to have people with a strong family tie to the firm working with us. This is for a number of reasons: There is, of course, the financial side.

However, most important to us is the fact that this is a wonderful firm and, because of that, we want to see it in the hands of someone close to us. Pictet’s combination of long-term tradition and vision is its backbone, and when you have someone whose uncle or grandfather worked in the firm and whose name has been there for several generations, it gives a sense of accountability for what is inherited. This is particularly the case for people who bear the name of the company. Our clients very much like to see this as it reinforces their sense of belonging and identification with the company. I also believe that this is important for employees. This identification with families, tribes, and communities must be deeply rooted in the DNA of human beings.

Back in the 40’s Francois de Candolle and Guillaume Pictet witnessed a financial crisis that led them to take cautious actions regarding the services offered by the bank. Today, again, we are confronted with a post-crisis world. How does Pictet position itself in this new economic context?

We have to remember that most of the banks in Geneva were founded somewhere between 1798 and 1815. This was because all the previous banks had collapsed with the breakdown of the French assignat currency (originally conceived as bonds, they developed into a paper currency, the excessive printing of which led to hyperinflation) in 1796. I believe that the crisis we have witnessed now is not only a sovereign crisis in the usual sense of the word but also an adjustment to a new economic paradigm. We are seeing the shift of power away from the US and Europe to Asia and also countries like Brazil. We have not seen the end of It because it is happening as part a major structural secular change in the world. As far as Pictet is concerned, it is true that we do constantly adapt our business model to the changing climate; however, it should be emphasised that the core of what we do has always remained the same. The nature of our clients has changed enormously, not only over the span of 200 years but even within my own lifetime. For instance, when I started, asset management (for institutions) was just at an embryonic stage, whereas today it makes up half of our business. So although we have changed and expanded, our core business and our principles have remained the same. In that sense, we are well prepared for the future.

The usefulness of what we do can be seen in good allocation of assets and wise investment of our clients’ wealth so as to provide them with security, be it for their pensions or enabling them to pass their wealth on to their children. If I look at certain countries, the misallocation of capital is striking, and it is frustrating to see the amount of senseless spending that has been going on. From Pictet’s perspective, one improvement that could be made would be to suggest to some of the governments currently in power that they shift their allocation of resources towards a better use. This could bring considerable economic advantage. In the end, however, the allocation of resources is just one element; we firmly believe that only education can ultimately bring wealth and prosperity to a country.

Pictet has set up successful operations in Asia and the Middle East. How do you feel your global footprint is going to evolve in the future?

I have to mention here that having our base in Switzerland is certainly a very valuable asset for us, not just because of the country’s political stability but also its financial governance. At the same time, we also operate on a global scale and invest all over the world, including the Middle East. It is marvellous that we can offer our services here in particular, as many of the successful entrepreneurs in the region are our clients, and it is amazing to see the potential and creativity that they demonstrate. We should not forget that the Arab world led the rest of the world in the Middle Ages and was the link between Europe and India. Indeed, it still has a central role today. When you look at the energy of this emerging young Arab generation, you can see that there is a lot of hope and potential.

Worldwide, we see that family firms play a strong part in the development of good governance and responsible behaviour; when you have your name associated with a company, you are committed to its continuity and you need to see to your children enjoying a good life. That is the most important thing. The Arab world is particularly strong in this regard, because family ties are very strong and this is definitely something we can learn from.

Tharawat Magazine, Issue 10, 2011