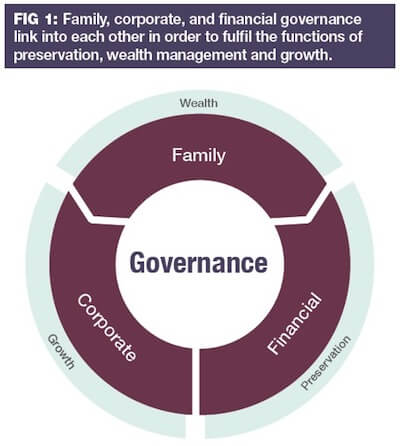

A comprehensive system of financial governance is an essential tool for family businesses to efficiently manage their wealth. It can be seen as one of the binding elements between the family governance and the corporate governance, and includes measures both for private and corporate wealth. Considering the multi-layered construction that such a system requires, it is not surprising that establishing efficient financial governance in a family business is no easy task. Grégoire Imfeld, Senior Relationship Manager, Pictet Family Office Services and Allard Lugard, Regional Head Middle East for Pictet Wealth Management explain how financial governance can assist the family in managing its wealth and what are the particularities to be considered for family firms in the Middle East.

Exceptional levels of wealth in family firms often become extremely difficult to manage in a way that satisfies all family members equally. For wealthy families, it is therefore paramount to achieve financial objectives and to create an appropriate structure.Financial affairs and commercial affairs represent two of the most important components making up the wealth of families. Whilst in most cases wealth creation originates from commercial assets, wealth preservation is generally granted through the management of financial assets. Both types of assets behave differently though, and have their own characteristics. As a result, they should have different governance structures.

In the family governance concept however, family councils and/or boards must be created, covering both aspects of corporate governance and financial governance. The former is often well put into practice, whilst the latter less so. In that regard, advisers often hear the following kind of observations: “My financial affairs are unattended. I have too many bankers and I have no time to assess nor answer the many investment solicitations I receive. I cannot evaluate the true quality of my financial performance”. Such words are too often heard from busy and successful entrepreneurs, still heavily involved in their business.

This illustrates that successful family businesses that create large amounts of cash find themselves confronted with the task of wealth management, but with limited time and sometime interest, to dedicate to it.

The elaboration of a successful financial governance structure assumes that the family governance structure is established and sound. Developing a family strategy that defines values and objectives associated to a family business plan is important. It provides the prerequisite information for the creation of an investment policy, which should translate the family’s objectives into financial objectives. Family objectives depend on where the family stands in the wealth cycle, on whether it is creating or preserving its wealth (Figure 1 below). One key advantage a wealthy family has is that its financial objectives can be set over several generations. That way, financial turmoil and periods of increased market volatility can be better endured. This unique characteristic shapes choices of asset classes.

The financial “>governance setup allows the creation of formal guidelines, which will guide the investment committee. The investment committee is set up to oversee the family’s financial governance and is a crucial organ of the financial governance system. Furthermore, it offers the opportunity to truly understand the family’s culture and dynamics while providing time also for interaction amongst family members. More importantly it should also unite the family with regards to financial expectations and consequently should result in the most appropriate, long lasting tailored solution.

Families generally have more than one asset managern> or private banker. The role of the investment committee varies from an institutional approach to a private banking approach. The former rests on a delegation principal, which consequently requires a strong investment committee, whilst the latter offers more flexibility and customisation, with a more controlling responsibility.

With an investment policy created and agreed upon, the implementation can begin, from the RFP (request for proposals) to beauty contests, right through to the elaboration of reporting tools. Once the investments have started under the guidance of a carefully crafted financial governance system, the monitoring of the various managers in terms of risk and investment guidelines, supervision and market reviews become the investment committees’ core activity. A fine-tuned financial governance system should manage a ly”>family’s financial portfolio efficiently and in a transparent manner.

As the wealth cycle evolves, the importance of and the dependence on financial wealth increases. Creating an adequate financial governance early on is paramount to the success of both meeting financial objectives and insuring a smooth transition to the next generation. It prepares the young family members for their futurepan> and increasing responsibilities in the world of financial asset management. Additionally, it provides a truly, long term fiduciary relationship