South Korea is among the finest examples of the impact a nation’s family-run businesses can have on the economy. By helping bring about an unparalleled transformation of the South Korean economy between the 1960s and 1990s through collaboration with the government, it is often stated that business families in the country were key to transforming a once poverty plagued nation dependent on international aid into one of the wealthiest in the world.

Chaebol translates as “business association” and is the Korean word used for large and diversified conglomerates, which as a rule are family-owned. It is the chaebols of South Korea that have spearheaded economic transformation and continue to lead its economy today. The following article discusses the rise of the chaebol, the lessons learned from economic crises, and the paramount importance of implementing corporate governance and SME support for the South Korean economy.

[ms-protect-content id=”4069, 4129″]

The “Miracle of the Han River”

After 30 years of Japanese colonisation and the devastating Korean War which followed, South Korea was an impoverished country drawing considerable foreign subsidies by the 1960s. The following thirty years reversed the nation’s devastation however, due to what is commonly referred to as the “Miracle of the Han River”. President Park Chung Hee (1961 – 1979) decided that to turn around the economy the most powerful, family-owned chaebols (privately-owned and diversified conglomerates) would need to be harnessed to influence great change in conjunction with government initiatives. The model was based on the Japanese Zaibatsu system which helped create economic development through prominent conglomerates up until the end of World War II. Access to financing coupled with export promotion and import subsidisation allowed the chaebols to develop South Korea from a primarily agrarian economy into a highly industrialised global power.

As a result of a vast range of cooperation between the government and the chaebols, Korea witnessed on average 10% growth of GDP annually between 1962 and 1994. With chaebols leading the charge, exports were heavily relied upon during this period and remain the cornerstone of the Korean economy. By 1997 the 30 leading family businesses accounted for over half of South Korea’s total assets, debts, sales and net profit.

This sky rocketing growth was altered significantly by the 1997 Asian financial crisis. Chaebols by that time were in debt for up to 500% of their value due to the liberalisation of short-term capital flow. Accelerated by exchange rate appreciation, a series of bankruptcies followed the financial crisis signifying the demise of 11 out of the 30 largest chaebols. In 1997, South Korea was forced to secure a $58 billion bailout from the IMF. The aid came with a number of conditions which included extensive reforms such as foreign exchange liberalisation and macroeconomic adjustments in the form of fiscal and monetary tightening, creating a different landscape for the chaebols.

Recovery was imminent and by 2000 the economy regained a steady growth rate. This fast turnaround was enabled by the restructuring of the chaebol system, which henceforth reduced corporate debt, increased transparency, concentrated on core businesses and emphasised greater organisational accountability. The combination of mergers, acquisitions and restructuring allowed family businesses to emerge triumphantly from the calamitous conditions, which surrounded the crisis. As a result the chaebol debt ratio was reduced to 118% on average by 2005.

The 2008 global economic crisis met a seasoned South Korean economy, prepared with stimulus packages and budgetary support, allowing for the continuous growth of its chaebols.

The Giants of Korea

Among the most notable chaebols are recognised brands such as Hyundai, LG, SK and Samsung. Today, these family- owned conglomerates are known around the world and their contribution to the South Korean economy accounts for almost half of total assets.

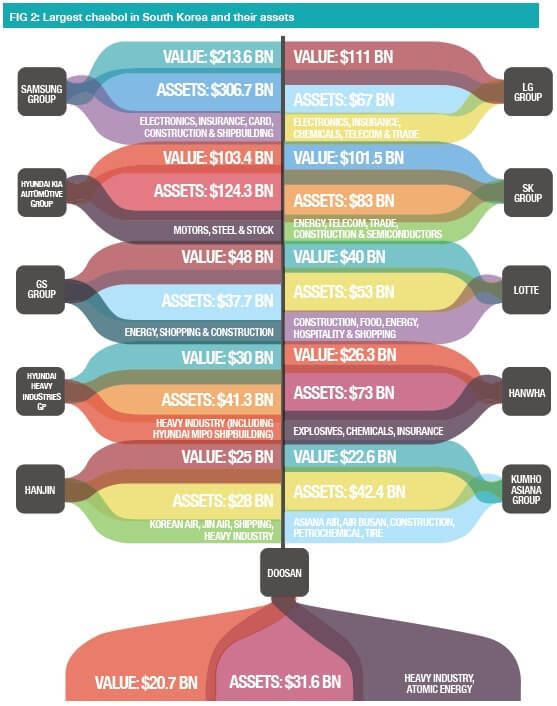

Market leader Samsung is famously forging ahead to offer the world its best mobile computing options whilst Hyundai diversifies the largely tech and construction offerings of Korea’s chaebols with its well-honed global reputation for quality automobiles. Figure 2 details South Korea’s top chaebols.

The draw backs of the chaebol system

Despite promising economic performance in the past and the lessons learned from previous failure, there remains a general call for chaebols to more fervently embrace corporate governance in order to shield the South Korean economy from future risks. Due to widespread governmental support the chaebol system has faced accusations of tax evasion, managerial hubris, corruption, a lack of reporting transparency as well as fears of chaebols monopolising key industries. This range of doubt coupled with the inherent challenges of family-ownership has emphasised the importance of adopting rigorous corporate governance systems. While the current focus of the South Korean government has shifted to SMEs, chaebols will continue to play a vital role for the growth of the economy and their continuous development will be of paramount importance.

The future of the Chaebol

Family business efficiency will continue to be a determining factor for the future of Korean society. The coupling of family ownership, diversification, and government backing has proven to be a successful recipe for South Korea in its fast ascent in recent decades. The business families responsible for key chaebols have dedicated their efforts to bolstering the Korean economy while also growing their family businesses and as a result the reputations of their family names. If the adoption of corporate governance within chaebols is enforced and SMEs are supported in equal measure to avoid concentration, South Korea appears well equipped to enter the next phase of its growth, in turn playing an important role in the global economy.

Tharawat Magazine, Issue 22, 2014

[/ms-protect-content]