The knowledge community based around family business management has evolved greatly over the past 30 years. Scholars have attempted to find answers to the ever-changing needs of family businesses and trends have come and gone. In the following article, Prof. Alberto Gimeno, Associate Professor at ESADE Business School, and Director of the Family Business Lab, explains how the understanding of family businesses in Spain has evolved in recent decades, and why the best-practice focus has to keep shifting in order to properly adapt to global realities.

Family business management in Spain

In Spain, the family business management field has rapidly evolved over the past three decades. Family businesses started to be regarded as something more than just informal business organisations in the early 1980s.

At that time, business schools around the world started creating courses to tackle this emerging field and in the early 1990s the Spanish Family Business Association (Instituto de la Empresa Familiar) was established alongside similar initiatives throughout both the country and the world. The confluence of both phenomena created an entire educational ecosystem around family businesses. Today, there are almost fifty family business chairs throughout a number of Spanish universities and almost all consulting companies devote special attention to servicing family businesses.

[ms-protect-content id=”4069, 4129″]

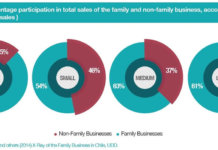

Before this surge in interest, the social image of family businesses in Spain was quite conventional. They were seen as nepotistic, not particularly professional in terms of management and of a low competitive nature. In short, the family business was deemed an underdeveloped business organisation.

In accordance with mainstream management theory, the more competent family businesses would evolve naturally and eventually open their ownership to the market. The corporate control provided by the market, as opposed to family control, was touted as a guarantee of the competence and potential of these “high level” companies.

The fact that some successful Spanish companies like Inditex (Zara), Mango or Puig (Nina Ricchi, Paco Rabanne) intentionally labelled themselves as family businesses created a paradox in the business community. It was a sign that family businesses were not necessarily the underdeveloped organisations which they were thought to be, but instead were able to grow internationally and within various industries.

The family protocol

As a result, the business world sharpened a focus, which was drawn squarely on family business management. The most evident approach was identifying the main problems that arise in family businesses: succession and conflicts. The instrument identified to deal with these problems was what is now commonly known as the “family protocol”. The protocol was an interesting blend of the old tradition of writing a family constitution, which emerged from the 19th century Japanese merchant houses, and the Latin tradition of dealing with problems by establishing explicit rules.

The results were largely successful, though mainly in terms of quickly diffusing satisfactory family business management practices throughout the community. It was a relatively easy approach for family businesses to incorporate regulations and formalise their relationships. Families were guided towards solving family business problems by establishing clearly defined rules such as “work outside the family business before entering”, “no in-law has the right to purchase/own any shares” or “shareholders can exit by selling their shares internally at a previously defined price”. These conventional ground rules were widely adopted.

Family protocols also influenced the rise of consultants who could help produce these guidelines for family businesses. Law firms, management consulting companies and independent consultants easily acquired the competencies needed to create family protocols. An additional incentive was to prepare ownership succession, subsequently minimising inheritance taxes.

Succession

While protocol was largely addressed, succession continued to be a tricky topic for family businesses and planning was presented as the solution. Succession planning was seen as both the right and responsibility of the elder generation, or the leading family member of the elder generation. The elder was expected to make the right choice in selecting the next leader and had to prepare a training and development plan for the successor.

This approach was based on the implicit assumption that the new leader had to be an exact substitute of his predecessor, but reality often indicated that this was not the case. The new leader could never be identical to his or her predecessor because each person crossed differing paths to reach the driver’s seat whilst possessing a unique profile of competencies. Smooth succession was usually the result of a very long period of coexistence during which both leaders shared power.

Governance

Succession woes became not only a hindrance to a family business’ day-to-day planning but also establishing a conversation between the current and future generations concerning their respective roles, their decisions, and accountability which occurred as a result. To quell the stalemate, corporate and family governance emerged as an important aspect in family business management. Identifying the proper decision making bodies, family councils, board of directors and executive committees were now tasks that lay at the centre of discussions aimed at bettering family businesses.

Leadership development and governance had a common requirement in order to prosper: the capacity to create an agreement and establish a consensus. This created a premium on communication within a family business. Leadership was not only needed within the business but also for the family order of things. Each generation was composed of individuals with equal voting rights, which were required for finding solutions and accepting limitations whilst fostering the ability to recognise one another’s interests, virtues and limitations. The relationship between governance and communication beget a mutually beneficial cohesion, which gave the family businesses that employed each a better working order.

Decision-making

Governance also meant changes in decision-making. This shift quite often pushed a family business to evolve from being an entity driven by a solo-decision maker into one charged by group decision-making. Those successful soon championed group leadership over the previous reign of solo command.

The problem was not who made decisions, but how decisions were made. It needed to be determined to what extent standalone analysis was necessary or if expert intuition had to be outsourced. Before family businesses started planning ahead, succession once meant the depletion of key resources (e.g. knowledge, skills, networks) caused by the retirement of the previous generation. This brought the need to make family businesses less dependent on specific persons and enacted the implementation of incorporating non-family CEOs alongside a desire for family members to maintain control without remaining in management positions.

Professionalisation emerged in the agenda as an important tool for addressing these issues. Plenty of mistakes were made until it became clear that professionalisation was also a process that included varying levels of execution, which had to be addressed appropriately.

Entrepreneurial Spirit

The distinctive nature of management is that the equilibrium is always unstable. Long-term success results from maintaining proper rules, an adequate governance structure, succession preparation, developing a consensus via cohesion within the family and creating professionalised management structures. All of these components must also apply continued innovation. In the modern era business models and competitive advantages expire faster, whilst new opportunities emerge at a quicker rate as well.

Sustaining an entrepreneurial spirit and behaviour conducive to this in the family business is now a necessity. Family businesses have to be able to transform themselves by incorporating new products, penetrating markets, as well as implementing processes and technologies. This is possible when the family is oriented to value creation, when the family finds pleasure in incorporating “the new”. This does not mean not devoting attention to preserve value, but when preservation is the main family driver, businesses lose their capacity for transformation.

The family business experience over the last 30 years in Spain shows that family business management is not simply trying to find the Midas touch. Instead, successful family business management bears organisational dimensions related to the combination of hard and soft elements and the right processes, but also possesses a personal dimension related to awareness, intelligence and generosity.

Tharawat Magazine, Issue 22, 2014

[/ms-protect-content]