By Prof. Lorraine Uhlaner, Professor Entrepreneurship & Family Business, EDHEC Family Business Centre

In many family businesses – especially small or first generation companies – the lines often blur between the roles of family, ownership and management. But as the number of owners increases, especially when some of those owners are no longer actively managing the firm, it becomes increasingly important to understand the responsibilities of ownership as distinct from management. This understanding becomes all the more defining as a family firm advances to second and later generations, especially when the number of non-managing or passive owners, those not involved in day-to-day affairs, begins to multiply.

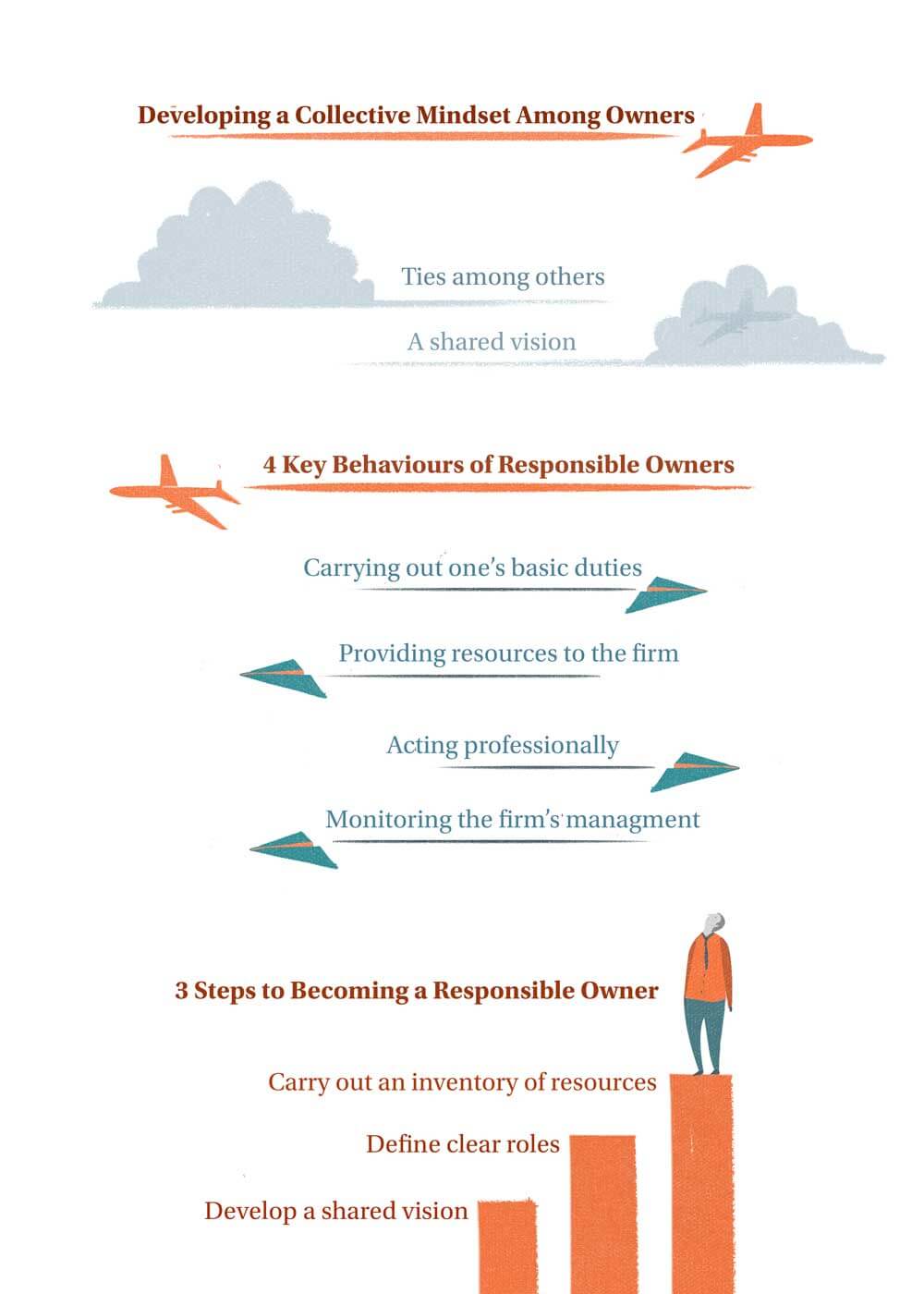

Our research confirms that responsible ownership is clearly linked with a firm’s success, from better mobilisation of owner resources for the firm’s benefit, to innovation and financial performance. In this article we explain the collective mindset needed to be an effective owning group, the four key behaviours of responsible owners and three steps that can lead to better owner groups.

[ms-protect-content id=”4069, 4129″]

Developing a collective mindset among owners

The success of a family business depends, first of all, on the bond between its owners toward each other as well as a shared vision of the firm’s future. These two aspects work together to create a strong collective mindset of the family business owners.

1. Ties among owners

Ties among owners refer to the quality of relationships among the owners – how much they trust one another, cooperate and share a positive team spirit. One senses this positive energy among family members in superior-performing family firms. Conflicts are resolved without tearing apart family relationships.

2. A shared vision

A second essential aspect of the collective mindset is a shared vision among owners. To be an effective owning- group, owners must continuously align their values and vision to maintain a shared perspective of where they want the company to go. It becomes harder to forge ahead when owners have divergent goals. Research has shown that a shared vision among owners (regardless of their roles as manager) is crucial to ensuring the continuous mobilisation of company resources, as well as better financial performance of the family firm.

Four Key Behaviours of Responsible Owners

For business owners to truly contribute to the growth of their companies, they must not only think but also act responsibly. Owners who view their role as more than collection of dividends or the exertion of voting rights can be of great benefit to the firm. According to our research, there are four ways responsible owners can act, that have varying positive effects on firm performance:

1. Carrying out one’s basic duties

Of course, an owner that is more familiar with the firm is more likely to act in a way, which is helpful in the long term. Attending shareholder meetings, reading quarterly and annual reports are ways in which owners can make sure they are well informed about the direction of the firm. Although not directly impacting financial performance, such actions build a foundation for a more knowledgeable group of owners.

2. Providing resources to the firm

There are many ways a responsible owner can serve as a resource. Of course, one aspect is keeping one’s investment in the firm as long as needed, a notion we referred to in the family business literature as ‘patient capital’. But finances aside, especially younger, smaller, or rapidly expanding firms can benefit from the contacts and network of its owners, as well as helping the firm to identify new entrepreneurial opportunities for the firm. Owners from firms with a collective mindset (especially those with a shared vision), are more apt to mobilise such resources for the firm’s benefit and in turn, to stimulate innovation.

3. Monitoring the firm’s management – or not

Although the role of supervising and monitoring management may seem to fall naturally to its owners naturally, the need for such monitoring may vary widely across firms. Whether an owner is monitoring or ‘meddling’ – i.e. interfering with the activities of management – depends in part on his or her designated role. Those serving on a board of directors may be appointed to oversee the work of management in broad lines. But overzealous monitoring can turn into micromanaging and have a contrary effect to what is desired. In one study of larger, older family firms, too much monitoring actually seemed to harm the firm’s financial performance. Thus handling the supervisor role is very much a matter of measure.

4. Acting professionally

Some of the most important aspects of responsible ownership require knowing what ‘not to do’ – for instance, not interfering with the company’s hierarchy or breaking rules of the shareholder’s agreement. Responsible owners must clearly understand their obligations and act out their roles according to the rules of the firm. Some family businesses also develop a code of conduct to clarify further what owners should and should not do, with respect to the firm.

Studies and data show that the adoption of these behaviours benefits company performance. Acting professionally and providing resources to the firm (especially by mobilising one’s network of contacts) have been found to have an especially positive effect on firm financials.

Three Steps to Becoming a Responsible Owner

How can family business owners make sure they are up to the mark? There are three steps to keep in mind, to enhance responsible ownership:

1. Develop a shared vision

Vision is a strong and powerful variable. If the relationship amongst family owners is already built on a foundation of trust and team spirit, the owning group can use its power by building a more unified vision for the firm’s future. Face to face gatherings of family, (including present owners but also the next generation), can make sure that owners do not become strangers as the firm advances to a cousin consortium in later generations. Annual shareholder meetings, family reunions, ‘vision-building’ workshops, social events, and websites have all been used to keep family business owners informed and more unified.

2. Define Clear Roles

To be responsible is to understand one’s duties. It is paramount that family business owners are clear when it comes to their own roles, as it sets an example and helps put the right structures in place. Part of the owners’ role is to explain their duties to the next generation, which can significantly impact the continuity of a family business. Developing a code of conduct or family business constitution can help many family groups to clarify the do’s and don’ts of behaviour as current and future shareholders.

3. Carry out an Inventory of resources

What does a good owner bring to the table? A family member is not automatically entitled to ownership. Rather, it is an identity each member has to assume, with all its advantages and drawbacks. It is important that owners create an inventory of what they can offer their business, which also helps identify them as resources to the firm.

It is tempting to claim that responsible owners automatically make more socially responsible companies. Although such a statement is probably too strong, many firms do build stronger ties and sense of shared purpose, in part around socially-oriented goals that help the community. Such activities in turn, have brought many family owning groups closer together and to a stronger identification with the business. And because responsible ownership is linked with better firm performance, such firms are in a better position to allocate some of those profits toward charitable causes.

Selected references:

Berent-Braun, M.M. & Uhlaner, L.M. (2012). Family governance practices and teambuilding: Paradox of the enterprising family. Small Business Economics Journal, 38(1), 103-119.

Berent-Braun, M.M. & Uhlaner, L.M. (2012). Responsible ownership behaviors and financial performance in family owned businesses. Journal of Small Business and Enterprise Development, 19(1), 20-38.

Uhlaner, L.M., Matser, I., Berent-Braun, & M.M Flören, R.H. (forthcoming). Linking Bonding and Bridging Ownership Social Capital in Private Firms: Moderating Effects of Ownership-Management Overlap and Family Firm Identity, Family Business Review. Published online before print February 1, 2015, doi: 10.1177/0894486515568974.

Tharawat Magazine, Issue 26, 2015

[/ms-protect-content]