Family ownership has long been credited with creating advantages for businesses. The practice is correlated to a higher rate of innovation and financial performance. Dr. Haslindar Ibrahim, Senior Lecturer at the School of Management, University Sains Malaysia and Afizar Amir, consultant at LS Cemerlang Enterprise in Malaysia, compare the performance of family-owned companies to that of non-family companies. Their findings include a collection of statistics that indicate a clear tendency of better performance in family as opposed to non-family firms.

The contribution of family businesses to the marketplace cannot be denied. Most countries reap the influence of family-owned businesses, as their success plays a significant role in economic development. In East Asia, figures show that family firms demonstrate a high level of performance in Taiwan, Hong Kong, Singapore and China. Family names like Ayala (Philippines), Li Ka-Shing (Hong Kong) and Kyuk Ho Shin (South Korea) are well-known for the successful companies they have established.

In Malaysia, Robert Kuok, ‘The Sugar King’ of Kerry Group, Lim Kok Thay of the Genting Group, and Lee Shin Cheng of IOI Group are among the families dominating the burgeoning ASEAN nation’s business landscape. According to the Malaysian Business Magazine of February 2012, the top 40 richest Malaysians include five prominent family businesses. The YTL Group, represented by founder Yeoh Tiong Lay and his five sons, has accumulated a net worth of RM7.01 billion. Another company listed, IOI Corporation Bhd., is run by a father and his two sons. IOI boasts a combined wealth of RM14.89 billion. A mother and son team head up The Genting Group, and command an empire worth RM14.17 billion. The Batu Kawan and Sapura Group are each represented by teams comprised of two brothers.

Based on Figure 1, the top 40 richest Malaysian businesses for each year are defined by their personal wealth. The figure is based on an individual’s reported personal stakes in listed companies and private holdings. The cross holdings and indirect stakes in subsidiaries are omitted to avoid over calculating one’s wealth. Personal debt is considered only if it has been reported in the annual statements. The year 2011 witnessed the highest financial disparity between family and non-family firms.

Similarly, Figure 2 details the number of families with wealth in the millions, an amount which exceeded the number of non-family millionaire businesses for the last 5 years.

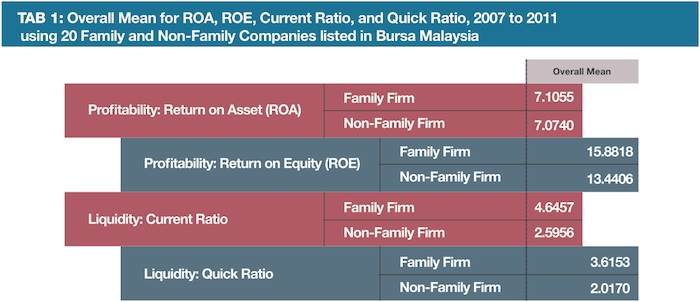

We have also collected the preliminary data represented by the family and non-family companies listed at Bursa Malaysia (formerly known as the Kuala Lumpur Stock Exchange). These numbers allow for better evaluation of company performance by measuring their profitability and liquidity ratios.

Table 1 (below) presents the detailed statistics of 20 selected listed firms of family (10) and non-family (10) ownership from different industries. The mean of all the samples in the data present a ratio of Return on Assets (ROA) as 7.11% for family firms, and 7.07% for non-family firms for the period of study. This shows further that family firms are more profitable than non-family firms.

Family firms outperform non-family firms with a greater ratio of Return on Equity (ROE) with family firms averaging 15.88% and non-family firms 13.44%. The mean of the current ratio for family firms is 4.65 compared to non-family businesses 2.6. These figures show that family firms possess considerably more liquidity on average than non-family firms. Lastly, the quick ratio mean for family firms is 3.62 while non-family firms fall behind at 2.02. This strongly indicates the notion that family firms possess a better ability to meet their obligations without a need to sell off inventory.

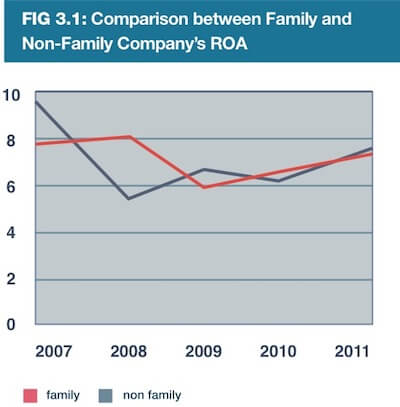

Figure 3.1 depicts the profitability performance measured by ROA between family and non-family firms between 2007 and 2011. The numbers indicate that despite the slump enabled by the economic crisis, family firms managed to sustain their overall performance.These figures point further to a trend of family business dominance, while additionally spotlighting their resilience even in turbulent economic periods.

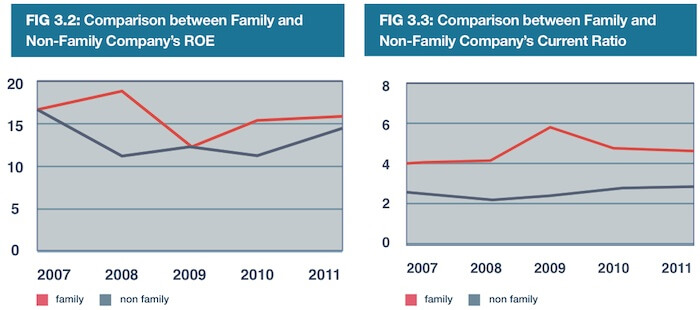

Figure 3.2 details the second profitablity performance measure as expressed via ROE statistics. The results exhibit that the mean value of ROE for family firms is higher than that of non-family firms for the entire period studied. Additionally, the study finds that family firms exhibit greater valuation than non-family firms with a significant gap between the two groups.

Figure 3.3 depicts the mean values of current ratio for family and non-family businesses for the period of 2007 to 2011. As detailed, family firms exhibit positive trends concerning liquidity. The stats strongly imply that family firms possess the necessary spread sheets to better guarantee capital collection as compared to non-family firms during the period studied. Family firms have significantly better current ratios.

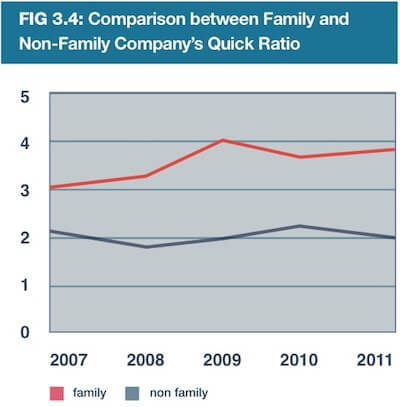

The last graph, Figure 3.4, presents the mean value of quick ratio for both family and non-family firms during the same period. Upon analysis it is clear that family firms possess certain dominance as related to short-term financial security.

These findings clearly reveal that family firms significantly outperform non-family firms across a range of measurables. From year to year, the survival of family businesses has provided continuous contribution towards economic sustainability in Malaysia. Even during periods of global economic uncertainity, family businesses leverage strong ties and demonstrate altruistic methods in order preserve strong output from generation to generation. The evidence from family business practices in Malaysia could lead as an example for family ownership as a sustainable business model to improve prosperity and economic development the world over.

Tharawat Magazine, Issue 16, 2012