A study conducted over a three-year period by the Thomas Schmidheiny Centre for Family Enterprise at the Indian School of Business (ISB) revealed that more than 50 percent of firms were non-compliant with the Corporate Social Responsibility (CSR) law, spending less than the mandated amount. However, a greater proportion of family firms met their CSR obligations compared to non-family firms.

Family Businesses vs Non-Family Businesses

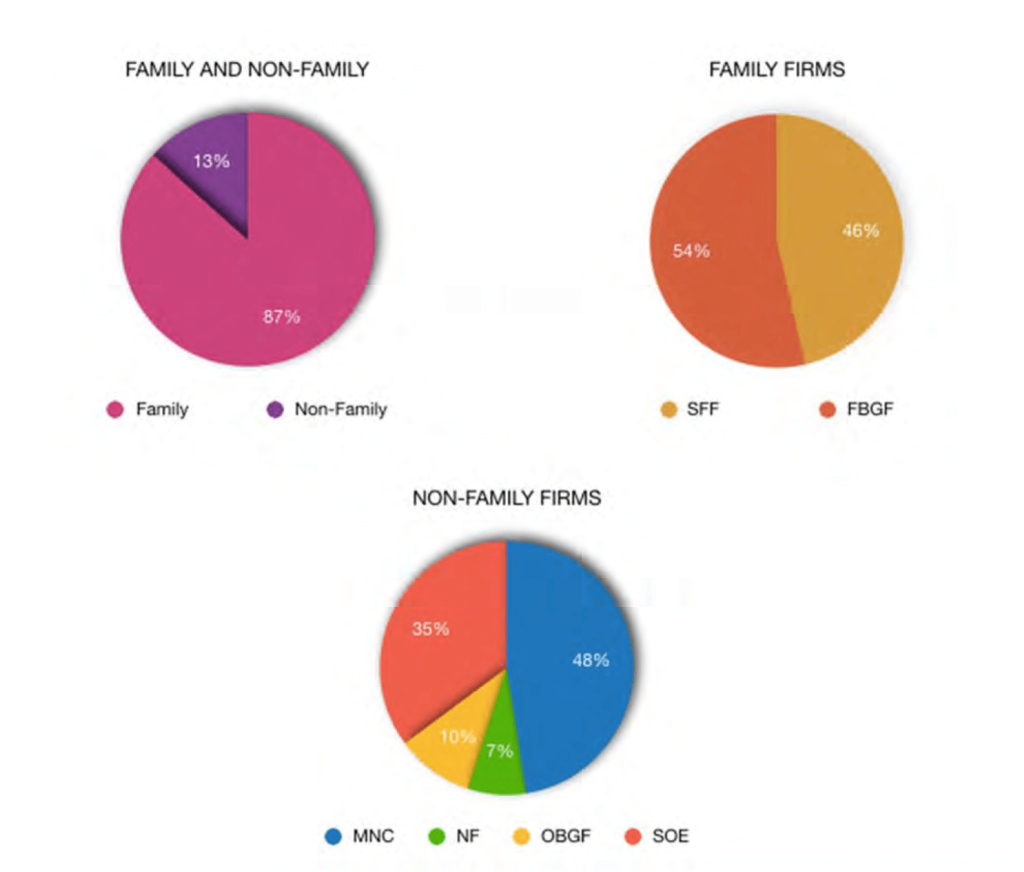

Figure 1. Distribution of firms in the sample.

Family businesses create lasting organisations, contribute to the community and leave a positive legacy behind. Compared to their non-family counterparts, family firms strive to institutionalize long-lived values that reflect in the engagement in social welfare activities across generations.

Authored by Syed Eraj Hassan, Dr. Nupur Pavan Bang and Professor Kavil Ramachandran (ISB) and Professor Raveendra Chittoor (University of Victoria, Canada), the study chronicles the CSR spend behavior of different categories of firms, based on ownership structures and using data from the Government National CSR Data Portal. The final sample for the study consisted of 1,210 firms and 16,470 project-level observations.

The CSR law established mandatory disclosures of social spends. This uniform regulatory landscape provided a unique opportunity to study the characteristic differences between family and non-family firms in the CSR spend behaviors across a large set of representative companies.

The authors also analyzed not only the amount but also the nature of spends and the implementation modes chosen by family and non-family businesses. Family firms were further classified into family business group firms and standalone family firms, while the non-family firms were divided into State-owned enterprises, multinational subsidiaries, other business group affiliated firms and standalone non-family firms.

The key findings of the report are provided below.

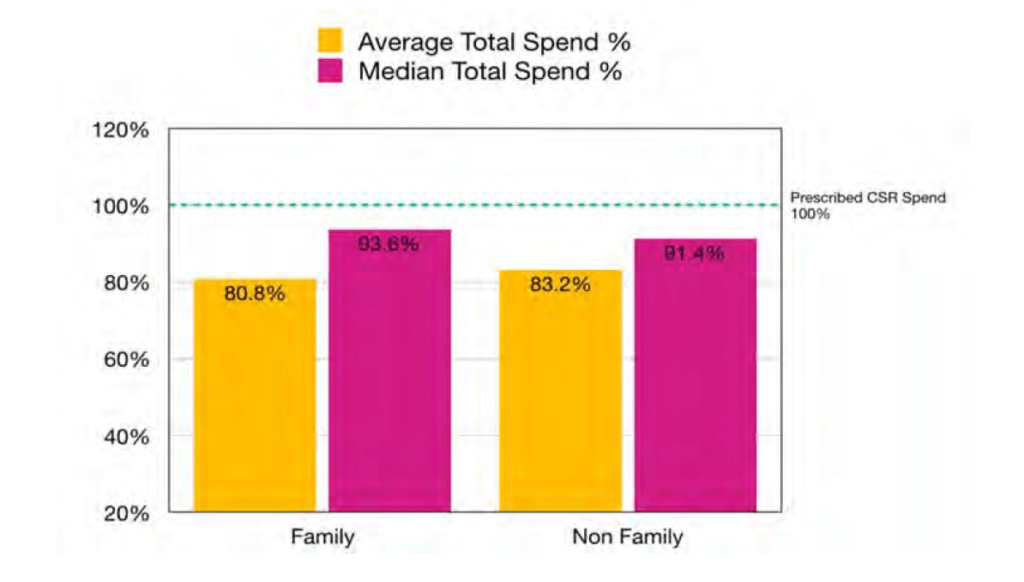

Overall, Family Firms Outperform Non-Family Firms

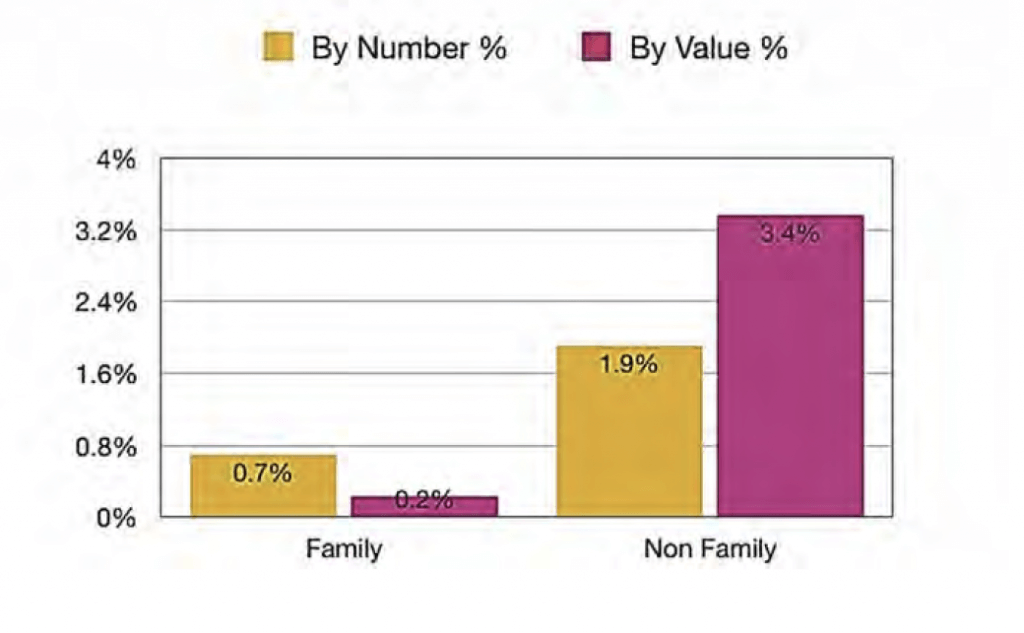

Figure 2. Split by Government flagship programme funds.

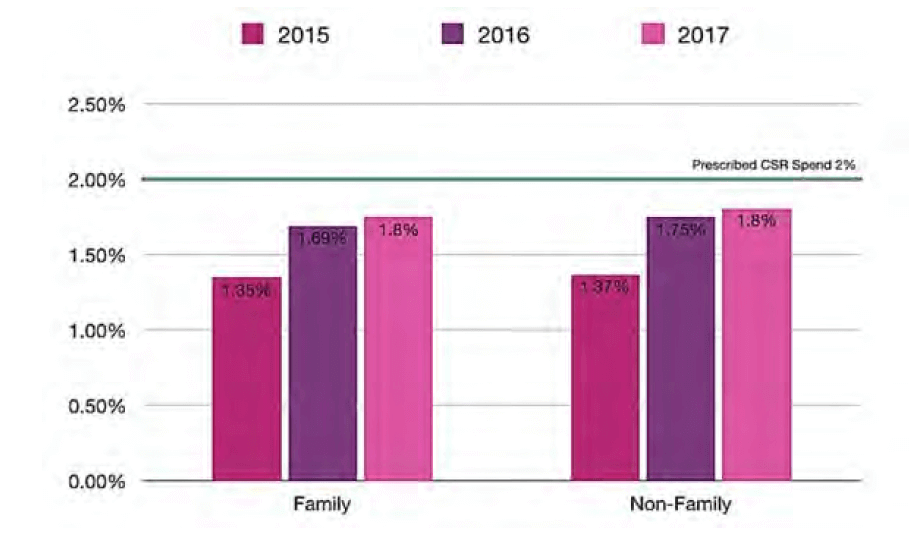

The proportion of family firms that met or exceeded the prescribed limit was 50 percent. The corresponding figure was only 45.1 percent for non-family firms. Family firms are more driven by non-economic utilities and therefore more likely to contribute to social welfare activities. According to the study, family business group firms outperformed standalone family firms. These findings point to the advantages that business group affiliated firms have due to central institutional mechanisms, such as company-owned foundations used to find avenues for social investments.

Family Firms Need Stronger Governance

Company-owned foundations are often run by members of the promoting family firm, who may take decisions that are not in the best interests of the other shareholders. This scenario raises the question of whether the family might benefit to the detriment of other company stakeholders. It is vital that families professionalize their efforts and implement transparency and monitoring mechanisms to lend greater credibility to their social initiatives.

State-Owned Enterprises Lead CSR Push

Figure 3. CSR spending by average net profit.

State-owned enterprises have been largely driving the CSR spends in India, keeping with their social welfare mandate. Despite forming only 4.7 percent of the study sample, they contributed 31.7 percent of the total CSR spending, compared to 46.4 percent of family business group firms contributing 42.7 percent. It is fundamental that the Government does not exhibit a double standard with respect to CSR at the expenses of other retail shareholders. The Government had clarified in a circular that CSR was not intended to fund gaps in government schemes. However, recent press reports show this may not be the case.

Multinational Subsidiaries’ Quest for Localisation

Multinational subsidiaries show a propensity to entrench themselves in the Indian ecosystem, bringing with them a social consciousness driven by western ideals. Establishing trust in the local context remains crucial to their long-term success. These companies , therefore, need to consider the aspirations of their employees, local communities and the Government while formulating CSR strategies.

Widely-Held Firms Restrain CSR Spend

Figure 4. CSR spend by prescribed expenditure across three years.

Other business group affiliated firms and standalone non-family firms have been restrained in their spending, indicating that continuity in long-term vision and institutional values may be an issue in such companies. Professional managers may not have the will to proactively drive social welfare activities. The short-term horizons of non-promoter shareholders in these companies could be driving the priorities towards economic returns to the detriment of long-term social investments.

As Dr. Nupur Pavan Bang concludes in the report, “Firms would do well to understand that a well-defined CSR strategy has several advantages in the long term. It leads to strategic competitive advantages and, as a result, creates long-term value for shareholders. Without enlightened promoters aided by independent directors and a complementary policy framework, universal adoption of well-meaning and highly spirited CSR pursuits will continue to remain a distant dream.”

To read the full report, please click here.