A recent study of 800 companies in Latin America by Exaudi Family Business Consulting shows that family businesses are at the helm of private sector growth in the region. To manage their wealth and safeguard their legacies many families in are turning towards family office structures. We asked Guillermo Salazar, founder of Exaudi Family Business Consulting if Latin American family businesses should embrace the concept of the family office and what are the challenges involved.

About the study

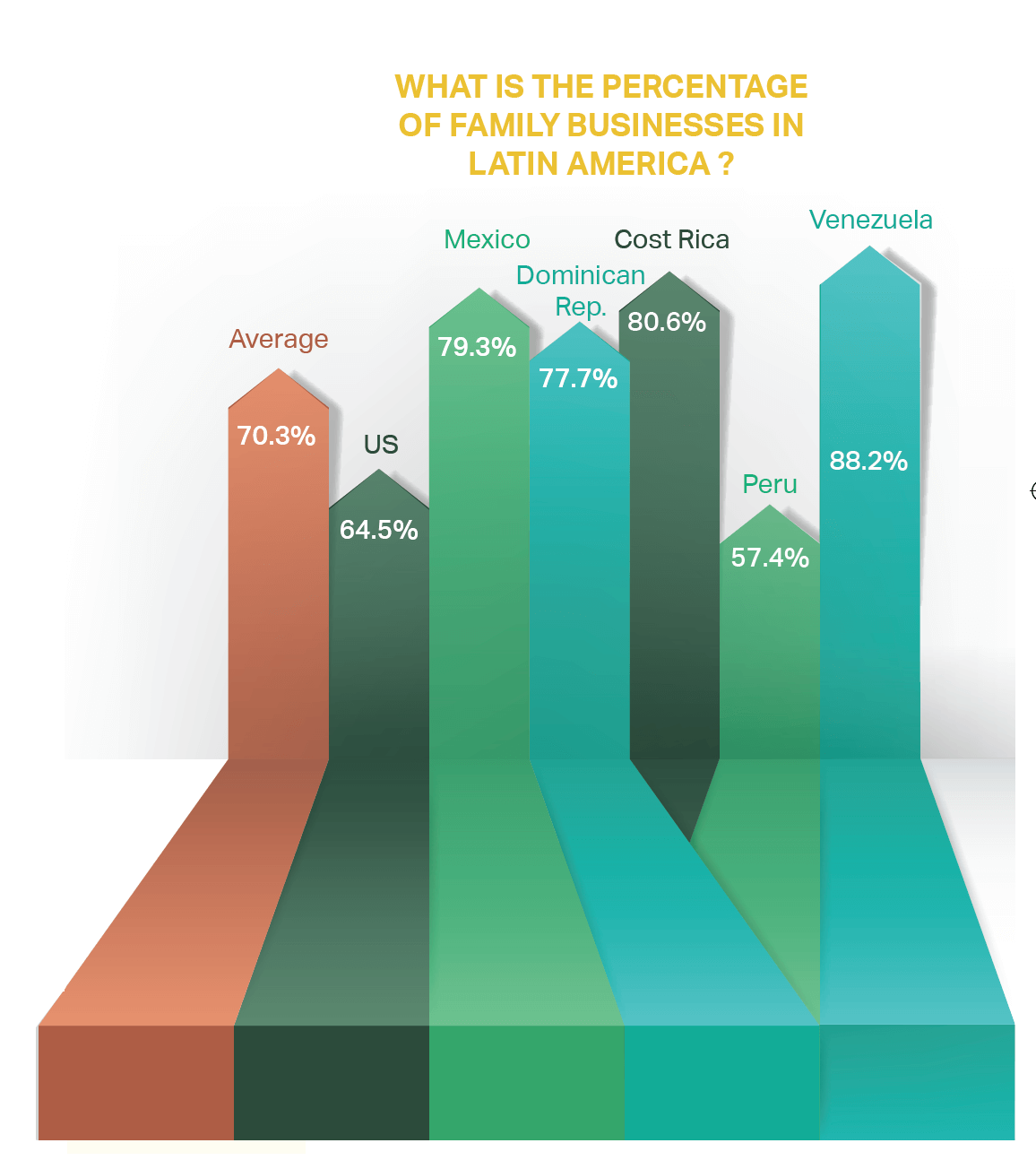

There is a notable lack of research into family businesses in Latin America. Our advice is based largely on best practice information from the United States and Europe. For this study, we asked 800 companies in Mexico, Dominican Republic, Costa Rica, Peru, and Venezuela how they defined themselves. Pretty much as expected, around 70% of respondents defined their business as family-owned; this is indicative the economy at large and it tells us that this sector merits further investigation.

Few family offices in Latin America

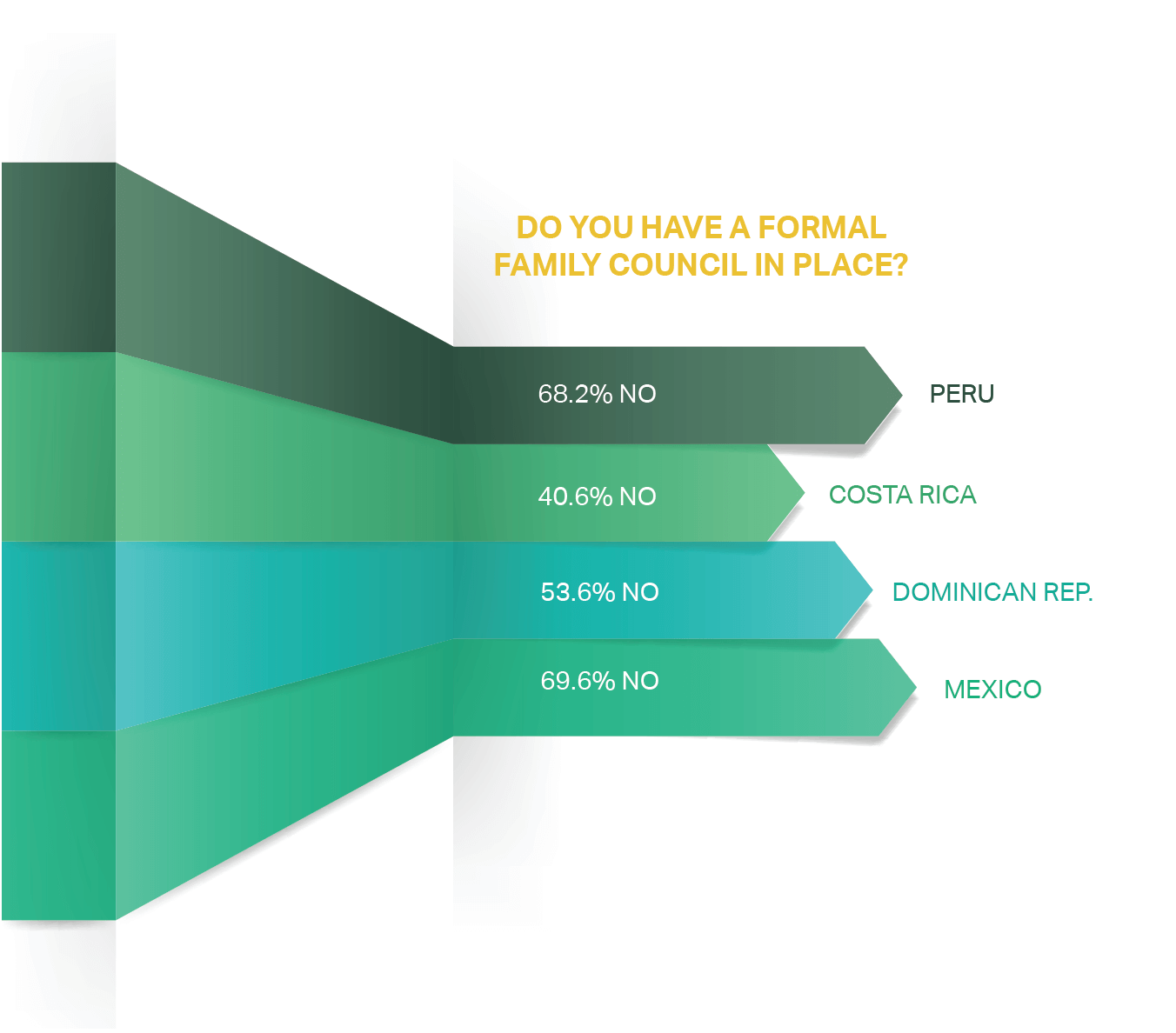

Family offices are still very few and far between in Latin America. To assess the extent to which families are ready to consider family offices as a wealth management solution, we looked at how far along they are with basic structures such as family councils, succession planning, and family protocols. Family offices tend to be based on at least one of the above structures as a premise for wealth management.

Over 59% of respondents said they do not have a family council in place and many of those that do have a family council feel that it is not yet working. Succession planning and family protocols have not made significant in-roads: over two-thirds (68%) of family firms said they had none of these systems in place.

Protect wealth from economic instability

Fifty years ago only a handful of countries in the region had democratic systems of government; the rest were military powers and dictatorships. Private wealth was not always safe and risk was hard to diversify.

Over the past years thanks to changes in the political environment (among other social and economical factors), we have seen wealth (including private wealth) increase in several countries, including Mexico, Brazil, Venezuela, Colombia, and Argentina. But businesses in the region still have a lot to learn when it comes to managing and protecting that newfound wealth.

Real estate is the usual option for diversification allowing families to reinvest their profits back into their business. In such cases, an embedded family office (an officer within the company) may be best – to help the family organize its private matters. It’s worth noting that families with this kind of structure in place rarely call it a family office.

[ms-protect-content id=”4069,4129″]

Family constitution

For most families, the first step is to create a family constitution. This regulates the relationship between the family and the business. In our research, we found that the average family business in Latin America is around 33 years old and over 60% of them are still in first generation hands. This means that we’re coming up to a transition period where the founding generation will soon be handing over to the second generation and deciding how to transition wealth downwards.

Raising awareness

We believe more family businesses should consider the benefits of family office structures. We’d like to see more research into the subject of family offices as a way to raise awareness of what is an important step in professionalising their business. Two things would help. Firstly: let’s have more examples of what a family office is and the different forms it can take. Over the next few years we’d like to keep track of the different family offices that emerge and create cases of what is possible to inform and inspire others.

Secondly, let’s show business founders how to use the family office to get the next generation into the family business. It’s becoming increasingly difficult to attract younger family members when external offers are often more enticing. A family office can help recruit sons, daughters, nephews and nieces who want to contribute to the family’s legacy but not necessarily work for the core business.

Not everyone needs a family office

Our research highlights how different-sized family businesses have different goals and visions for the future. In some cases, you cannot justify making them more complex and a family office might not be the right solution for some. Families should start simply and add services as they go along, such as philanthropy or education management. It’s counter-productive to suggest families add things they really don’t need.

Family businesses in Latin America are at a crossroads

It’s getting harder to retain young talent and we’re all still in rather volatile economic context. The global professional opportunities that next generation members have are now affecting the succession of leaders in local family business. But putting structures in place that increase transparency, manage wealth and decouple private and corporate governance can only contribute to securing the future for these businesses.

Equally valuable is the way family offices can help channel communication between generations and manage expectations. We would say for businesses in this region, it’s definitely worth exploring the possible options and formats for family offices.

By Guillermo Salazar, Founder, Exaudi Family Business Consulting

Research Results © Copyright 2015 by Exaudi Family Business Consulting, the Hispanic Chamber of E-Commerce, the Centro para Empresas Familiares de la Universidad de Monterrey, the Cámara Nacional de Comercio de Monterrey (Canaco), Perú Top Publications, the Universidad Católica Tecnológica del Cibao (UCATECI), Business and Commercial Law VC Stern & Asociados, MayIdeas (Mayra Ruiz & Asociados), the Cámara Costarricense de Empresas Familiares (CACEF), the Tecnológico de Costa Rica, the Universidad Latinoamericana de Ciencia y Tecnología (ULACIT), FedeCÁMARAS Costa Rica, the Universidad Metropolitana and the Facultad de Ciencias Económicas y Sociales (FACES) de la Universidad de Carabobo.

Tharawat Magazine, Issue 30, 2016

[/ms-protect-content]