In the last two years stock markets have witnessed a historic downturn, and many investors have subsequently, and quite naturally, become rather shy when it came to trusting listed companies. Private companies started to turn away from IPOs as source of external financing and all in all confidence in capital markets was shaken. More recently, the lost trust seems to be returning as some companies seem to reconsider IPO’s a tool for growth and investors are showing signs of slowly recovering from the post-crisis trauma.

In our IPO storyboard, we have picked 5 world-renowned family businesses and entrepreneurs that have gone through the process of becoming publicly listed companies or that have withdrawn from the possibility for various reasons. All of the cases demonstrate different aspects of the IPO process and showcase different reasons for either going public or trying to avoid certain implications of the IPO. The companies have each had their particular experiences, both positive and negative. In some cases, trouble began only after the business was listed, for example when attempts were made by close competitors to take over the business by an excessive acquisition of shares. Other families were dissuaded from their initial plan to go public by extreme market conditions in the very last moment. Another example is an IPO, which was the consequence of a family conflict that demanded the raising of capital in order to split up the fortune. And in many other cases companies have simply taken the route of listing on the stock markets as a straightforward means to expand their facilities and add new factories to their existing operations.

Whatever the reason to go public, what we can see from these five stories is that when going public, companies should be ready, continuously vigilant and – expect the unexpected.

Hermès

In 1837, a man called Thierry Hermès founded a high fashion house in Paris, France. Ever since Hermès Internatioal S.A. has become one of the most renowned brand names in the world. During its sixth generation of family ownership, the company went public in 1993 at a share price of 5 Euros whereby the family retained 78% ownership. Hermès has since enjoyed an annual growth rate in net profit of 14.7%.

In a recent twist, Hermès name appeared in the press due to its recent clash with Moët Hennessy Louis Vuitton SA (LVMH) over an alleged attempt to a takeover. In reality LVMH started an aggressive buy of Hermès stocks and in 2010 came to own 17.1% of listed Hermès shares. This did nothing to improve relations with the Hermès family, which felt its six generations old legacy in need of protection against the increasing control of LVMH. 70 members of the Hermès family gathered to formulate a plan. The idea produced outlined the creation of a holding company whereby the bulk of family members’ shares would be put into a single entity amounting to just over 50% of Hermès. If this plan were implemented then all options for a takeover by LVMH or indeed anyone else would be stopped. This would, however, not only protect the ownership but also expose the family to the criticism of other single shareholders that bought the shares under the impression that there would be no single larger entity retaining a majority share. Hermès is pushing the Autorité des Marchés Financiers, the stock market regulators in France, into investigating how it could come to this sudden and alleged hidden takeover attempt by LVMH.

Hyatt Hotels Corporation

Hyatt Hotels Corporation

The Hyatt Hotels Corporation is a world-renowned hotel chain owned by the Chicago-based Pritzker family. It was over 50 years ago in 1957 that the Hyatt Hotels & Resorts started out with their first small motor hotel at the Los Angeles International Airport. Today, the corporation includes over 365 hotels and resorts in over 45 countries.

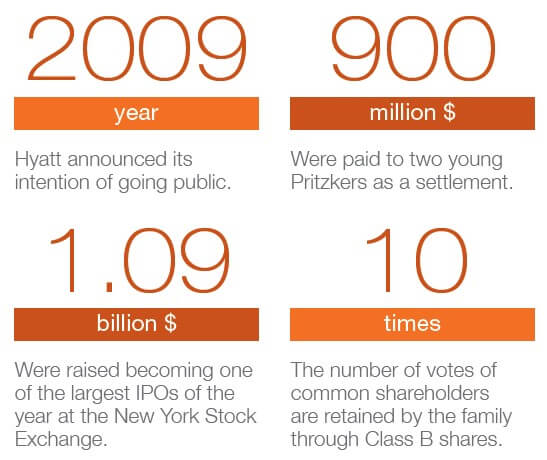

It was a surprise to some when, in 2009, Hyatt announced its intention of going public. It was not a good year for the hotel industry globally, however, Hyatt stood apart from its competitors by maintaining a uniquely low debt level and so took the plunge. And successfully so; in the first day, the Hyatt Hotels Corporation raised $1.09billion, becoming one of the largest IPOs of the year at the New York Stock Exchange.

After the IPO, the Pritzker family still retained control of the company through family members holding special Class B shares that entitle them to 10 times the number of votes of common shareholders.

Damas

The goldsmith and jewellers craft has run in the Abdullah family for a long time, with Mohammed Tawfique Abdullah’s already designing and crafting gold pieces to Syrian retailers in the early 1900s.

The Damas jewellery and watch retailer was, however, established as a brand name in the late 1970s by Mr Taher Abdullah and his three sons, Tawfique, Tamjid and Tawhid.

Today, the group –based in Dubai, UAE- operates in 14 countries with around 424 stores. Its network of retail outlets is spread across the Middle East, South Asia, Europe and North Africa.

In 2008, aiming to fund expansion plans, the Damas group went public and raised $270.6 million (Dh993.94 million). It gave the company a value of $968.6 million (Dh3.56 billion). In spite of the successful IPO and in an unfortunate twist, however, things went the other way: two of the Abdullah brothers allegedly withdrew personal funds from Damas without disclosing the reasons to the board. It is estimated that as much as AED365 million ($99.4m) plus the value of approximately two tonnes of gold are owed. The scandal pushed DFSA (Dubai Financial Services Authority) to ban the Abdullah Brothers from the board of any DIFC (Dubai International Financial Center) company for the next 10 years and fined them a total of $3m. The lack of compliance to the corporate governance rules by the brothers caused great turmoil. The Damas group had to work hard to regain the confidence of its shareholders and is still doing so today.

[ms-protect-content id=”4069,4129″]

Axiom Telecom

Axiom Telecom is a handset retailer, distributor and a strategic partner of telecom service provider in the UAE and in Saudi Arabia. In addition, it has partnerships with telecommunication companies in India and South Africa. Axiom Telecom was founded in 1997 by Faisal Al Bannai whose family currently holds a 53 percent stake in the company. Al Bannai Enterprises itself is a family owned group of companies founded in 1960 in Dubai.

In 2010 it was announced that Axiom Telecom was planning to raise $382 million in the United Arab Emirates’ first initial stock offering since 2008. Axiom Telecom has over 600 stores across the Gulf, India, and the UK, and makes for a most convincing success story that was very well received by investors all around the world. The shares were supposed to be offered solely to institutional investors and not to retail investors. Dubai Holding – a conglomerate owned by Dubai’s ruler – is a 40 percent stake holder in the company and was also hoping to raise as much as $110 million from this IPO.

While there was a huge demand from high quality international investors in Europe and the US in the offer, Axiom Telecom canceled the company’s IPO and listing on Nasdaq Dubai in December 2010. The difficult decision came as a result to the company’s concerns about market conditions and liquidity. In the meantime, the company still believes in the suitability of Axiom as a listed company and they will be re-evaluating their options in the future.

Sateri Holdings Ltd

Sateri Holdings Ltd

In Asia, especially China, the number of IPOs has been rather high during 2010, much in contrast to a rather careful atmosphere in the rest of the world. This story, however, deals with an Indonesian entrepreneur that made it to the top out of unlikely circumstances and seems to have set the premise for a long-lasting business model.

Dropping out of school to support his family, Sukanto Tanoto started his career at the age of 17. Today, he is one of Indonesia’s richest people with an estimated fortune of $1.9billion. The company built by Sukanto is none other than Sateri Holdings Ltd., which in its core business grows eucalyptus tress and produces specialty cellulose in Brazil, operates a cellulosic fibre mill in Jiangxi province, China and provides materials for textile and non-woven customers (cellulose is an organic compound from green plants, which is used as a biodegradable raw material for products like textiles, cosmetics and cigarette filters). Today, Sukanto has renamed his conglomerated to RGE (Royal Golden Eagle) and the group has over $10billion in assets.

It is claimed that the company will use money raised at the IPO for the expansion of Sateri’s facilities in Bahia, Brazil and a new viscose staple fibre factory will be built in China in the Fujian province.

Tharawat Magazine, Issue 19, 2013

[/ms-protect-content]

Hyatt Hotels Corporation

Hyatt Hotels Corporation

Sateri Holdings Ltd

Sateri Holdings Ltd