A Conversation with Philip Aminoff, Chairman of Helvar Merca, Finland

For some family owned businesses, success means having the family name become iconic in the industry. If the company grows large enough, the name no longer is the sole domain of the family but also belongs to the company. The reputation of one becomes inextricably linked to the other.

However, there are also instances where families have run extremely successful business for more than a century and yet, the family lives in relative anonymity. One such family; the Aminoff’s based out of Finland.

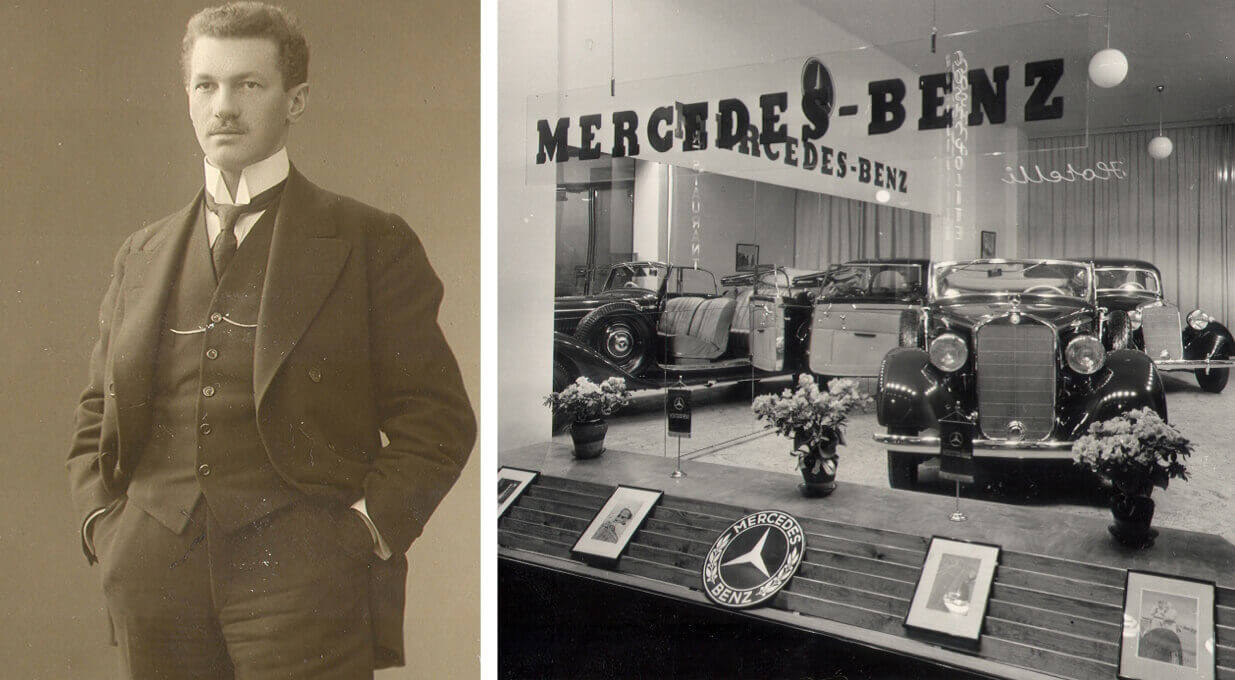

The Aminoff family business dates back to 1901 when Mercantile, an importer of industrial products, was founded by Charles Elmgren in Tampere, Finland. While it was still part of the Russian Empire, Finland was a popular destination for trading and exporting companies due to its access to the Russian market.

Today the company consists of eight ‘cousin companies’, all of which are owned by the Aminoff family, yet none of them bear the family name. These companies constitute one of the top ten revenue generating privately held corporate entities in Finland. Along with Mercantile, they include Helvar (set up in Finland in 1921 today focuses on controls for technical and architectural lighting), Electrosonic (established in the UK in 1964 providing high-end audio-visual solutions for the entertainment and corporate market), Fastems (established in Finland during the 1980’s focused on factory automation for the engineering industry), as well as Veho (since 1939 the distributor of Mercedes-Benz in Finland), MTC Flextek (an importer of machine tools and industrial robots in Finland and Lithuania), and Parator and Luna Holding (real property holdings).

What is equally remarkable as this growing network of companies is the way the family has been able to harmoniously manage them over the years. Through a process of open communication and ‘pruning’, the Aminoff family have enjoyed both success in the boardroom and peace in the family – no small feat for an operation this large and complex. The Aminoff cousin companies with 1.5 bn euro turnover and over 3400 employees have retained a strong spirit of entrepreneurship and continue to display a truly 21st century approach to innovation and change.

Phillip Aminoff member of the fourth family generation is today the only family member who holds an executive role, as chairman of Helvar Merca. Tharawat Magazine had the opportunity to sit down with Aminoff to discuss how he came to take his position and why he believes in a silent but strong future for his family and business.

Can you tell us about your experience before you got involved in the company.

I studied finance in business school and continued with postgraduate studies. But the more I worked with econometric modelling the more bored I became. I wanted to do a real job, I wanted to see practical results of what I was doing. So I became a salesman driving across the country trying to convince people to buy plastic raw materials which are probably the least exciting things on the planet, or so I thought initially.

What were some of the important early lessons you took from that experience?

I realised that when you’re talking with customers about what they want to achieve, you can help them reach their goals. And when that happens, they want to meet with you again and again. In many ways, that was one of the more defining moments in my early career. I met with somebody who wanted a good quality polystyrene for drinking glasses for Finnair, our national airline. I worked very closely with a supplier to find just the right raw material and when it was produced, it became a huge hit. I remember flying together with the customer to Paris to meet with the supplier because he was very happy with the results. We raised a toast of gin and tonic in the glass that we designed together. That experience convinced me that I want to be where you can create new things. Ever since, my main job has always been in businesses where we do things that have not been done before.

Looking at your business track record, it becomes apparent how that has played out in your career throughout the years.

Precisely, in my second job I joined a very respected company in medical diagnostics. This was a business that combined optics, biochemistry and electronics because they made blood glucose monitors for the home. So again, here I was working on something that was truly benefitting not only the company owners but humanity as well. The quality of life for diabetics improved massively when they got access to good diagnostics which, in turn, leads to good medication. So ever since, whether it’s been audio/visual products or lighting control or whatever it is, I always focus on what the organisation can bring to the customer in such a way that the customer is able to achieve something he or she wants to achieve.

After getting this valuable experience outside the family business, what was it that called you into it specifically?

Within two years of joining the diagnostics company and becoming department head there, I had gotten a call that this English company that my family had bought (Electrosonic) was in dire straits. When I flew to Finland to meet with my family, my wife told me in a cryptic way ‘You know, if you come back from lunch and tell me that we may need to move to London just so you know, it’s OK with me.’ Then I went to lunch and they told me that there is a fundamental problem with this company and they needed somebody to fix it. They said “So what do you think? It would mean that you would need to move to the UK.” So I went back home to my wife and I said ‘We’ll probably need to move to London’ and she said ‘Well, I already told you I’m OK with it,’ So off we went.

What was the situation when you first arrived?

The company was in very big trouble. Helvar had acquired it with high expectations in 1990, but immediately afterwards the economy was in the midst of a serious recession. At the same time, we had invested massively in new lighting control technology and new custom-built facilities and the suit simply got too big for the company that was shrinking. But I was not unfamiliar with the looming issues. When I did my MBA at INSEAD in 1990, I wrote a paper together with some colleagues where we studied the nature of the take-over and how it should be implemented to avoid some key pitfalls. We made a presentation to everybody involved to say ‘This could work out really, really well but there are some issues here that may go horribly wrong. And everybody said ‘OK we understand,’ and then changes were made without attention to the pitfalls that had been identified.

Can you talk about your approach and how you decided what needed to be done to take the company where you felt it needed to go?

What I tried to do first, which proved to be very, very difficult was to reconcile the original strategic intent of the acquisition (building a leader in lighting controls) with the reality of Electrosonic’s situation. There were many complicated parts to the problem. One was too much had been invested in the lighting control business and too little investment had been made into the audio-visual business. Another problem was that Electrosonic’s fully owned manufacturing subsidiary had a crazy incentive structure. In-house transfer pricing rules made it more profitable for it to manufacture for third parties rather than for Helvar or Electrosonic. So the factory paid much more attention to the needs of outside customers rather than to Electrosonic and Helvar. So it was really about trying to identify and support the bits of Electrosonic that had good commercial potential and rescuing those bits. The lighting business was merged into Helvar, the contract manufacturing subsidiary was closed and the audio-visual business was made independent and has grown well to its current position as a world leader in high end audio-visual solutions.

As the 1990s turned into the 2000’s we saw many innovations that caused major business disruptions. How were you able to remain agile enough to adapt during this time?

It was very fortunate that I started with Electrosonic because the electronics required for video control got more and more complex and this meant that we were unable to produce our next generation of control electronics without a massive investment. Because we didn’t have the money, we had to outsource it and we found a very good partner. We realised this turned out to be the best course of action and we continued the process of outsourcing the more demanding electronics. I’m very happy with how it turned out because this made us able to focus our spend on product and concept development rather than on production machinery. Today Helvar manufacturers maybe 5% of all of its products. Electrosonic has been even more radical. It has moved up the food-chain into systems design and engineering and produces no products at all.

You are the only family member in an executive position at this moment in time. Can you tell us a little bit about how your unique ownership structure works?

We’ve tried to create an ownership structure where most owners own at least 10% of the share capital. When you hold enough of the share capital of a company you feel responsible, and when it gets diluted you feel less so. In our family, there has been some pruning in the ownership structure in every generation. In the 4th generation, we realised that we needed to continue this actively. This was done in such a way that some family members exchanged shares between companies, others sold their shares and again others made no changes in their ownership. In the end, we now have strong enough groupings of family owners that really feel responsible. As a result, the current cousin consortium consists of only seven main shareholders at this point. We pay a lot of attention to the boards as well; in of our operating companies the boards always have a majority of non-family members and also an external chairman.

Everyone in the family is on board with this pruning process?

The important thing to keep in mind is all of these transactions have been voluntary, no one has ever been forced to do anything. We’ve used redemptions of shares and sales of share and exchanges of shares; I have exchanged shares with my uncle to become the biggest owner in one of the companies while he became the biggest owner in another. This also helps us stay involved in only those businesses that we care about.

We did a strategic review of our businesses in 2001 and realised that we did not really have an ownership strategy. Some of our companies lacked a competitive advantage or growth prospects, or both. We also realised that we lacked commitment to one of our companies. We had been able to buy the business very cheaply so we did. But actually the managing director was not really interested, no board member was interested, no family member was interested. Only by talking about this openly did this become apparent, and then we sold the company. Since then we have been trying to do fewer things better.

Can you tell us about how you’ve been pushed over the years to be more entrepreneurial and stay entrepreneurial even with a conglomerate of 3400 employees?

I think the most important thing is that our businesses are based on trust, that we want our customers to feel it was worthwhile dealing with us and that they are comfortable that they will get all the support they need throughout the lifecycle of the system or product that they have bought. This goes back to what I learned in my early days as a salesman. We have to deliver something that customers cannot easily get as reliably from anywhere else. We need to ask them what they need to be successful and this then becomes what drives business development. And if you always make sure that you know your customers, you will evolve with your customers. It’s the minute that you start thinking that your real ability is to produce a widget of size so-and-so and that’s all you are good at that you will lose the game. We tried to make sure that we deliver what customers really want.

What do you think is going to keep you successful in the years to come?

I think it will be important to keep pruning the family tree so that the owners continue to feel responsibility for the business. Another thing is to think of the business as an ecosystem where the only way to survive is if the other parts of the ecosystem want you to be around. We have to design the company in such a way that everybody else wants us to be around. We have to move forward with a servant-leadership mindset whereby we want to be the best but are always serving our stakeholders.