Interview with Rodolfo De Benedetti, Chairman, CIR Group, Italy

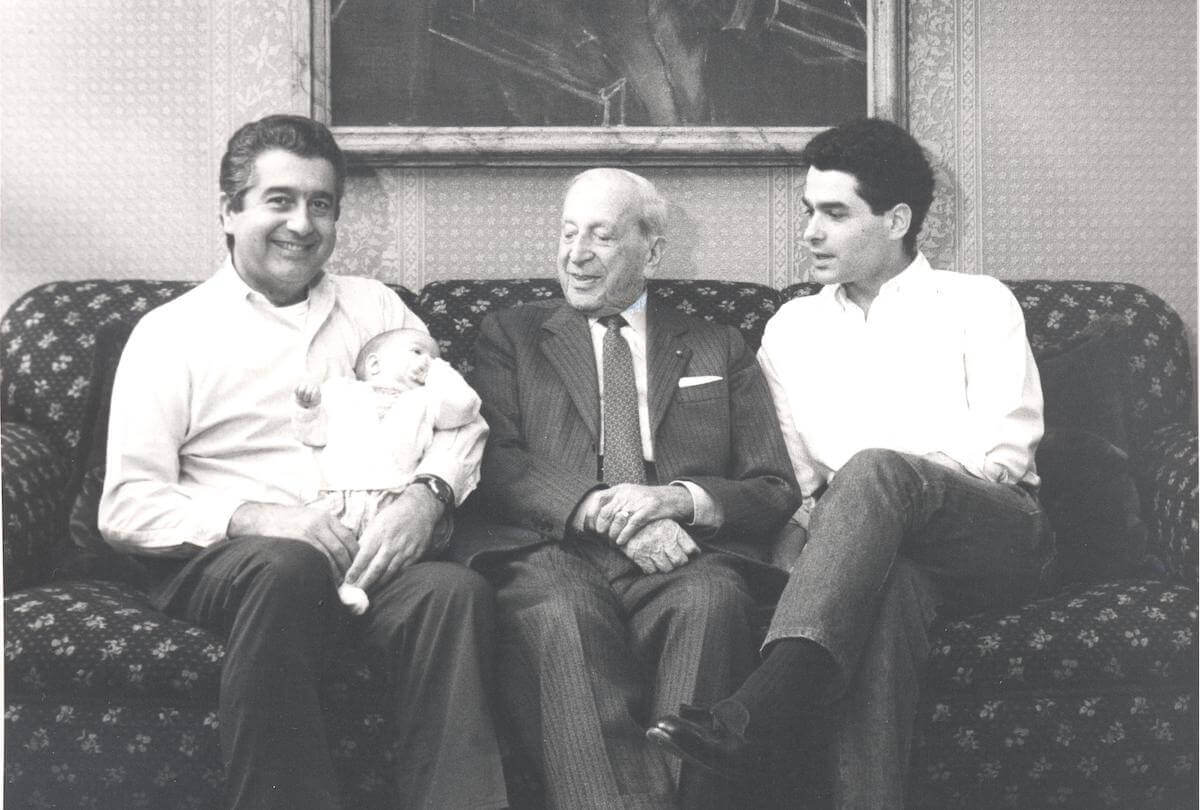

Rodolfo De Benedetti was a mere 30 years old when he became the CEO of Compagnie Industriali Riunite (CIR) Group, a business established by his father, Italian business tycoon, Carlo De Benedetti who founded the company in the mid-1970’s. He made his name for taking over the typewriter company Olivetti in 1978 and transforming it into a computer and telecommunication company. From there he and his son Rodolfo built the CIR group into what it is today; one of Italy’s most important consortiums with companies in the media, automotive, and healthcare sectors. Its media holdings all fall under their publishing company GEDI which oversees daily newspapers such as La Repubblica and La Stampa as well as national radio stations and weekly newspapers.

The CIR subsidiary SOGEFI is one of the world’s most prominent auto-parts supplier focussing on the sectors of filtration, air and cooling, and suspension. In 2016, SOGEFI reported revenue of more than 1.6 billion euros. The family business is also a major player in the Italian healthcare sector through KOS which operates nursing homes and rehabilitation centres.

Not only did Rodolfo De Benedetti need to steer the company through difficult economic times but he had to do so while trying to establish his own way of doing things. Leadership can take many forms, and De Benedetti’s leadership skills were shaped and honed by the unique challenges that faced him. Not the least of these was ensuring the company thrives through the disruptions of technological disruptions.

Tharawat Magazine had the opportunity to sit down with Rodolfo De Benedetti to discuss leadership in the 21st century as well as the challenges and opportunities when faced with a great legacy.

Let’s start with the story of your family business. Your father’s entrepreneurial journey began in 1976. Tell us more about his journey and how CIR came to be.

When I’m asked to tell the family business story, I always hesitate as to whether we are in the second or third generation because I think the entrepreneurship genes come from my grandfather who founded his family business before the war. It was a company that manufactures thermostats used in the oil, power and automotive industries. My father started his career working in my grandfather’s business, and he developed it quite rapidly when he took over. In the 1970s he was to become the CEO of Fiat, but his company was a supplier. So he sold the company to avoid a conflict of interest. But he did not stay long in that new position, and so a few years later, he started again by founding the CIR Group. But if it had not been for all that, we would still have been running my grandfather’s business, so I believe we are in fact in the third generation.

Did you always know you were going to join the family business or did that calling come later?

Actually, it came later. I attended a boarding school in Switzerland and then attended university in Geneva. I thought it was good to start somewhere else and learn something before going into the family business so I worked in the financial services industry as a wealth management banker at LODH in Geneva. I worked there for just over a year before I went to the United States. I was at Lehman Brothers in New York, and I would have loved to have stayed there because I had a great experience and I was learning a lot. But that’s when I got the call from my father.

Were you being summoned back to the family business?

Exactly. This was the late 80s, and I was relatively junior, I was less than 30 years old at the time. But I had some professional experience and so it was at that point that I really became more closely involved with the business and could see what my father was doing to develop it. I joined the business at a delicate juncture; it was just after the 1987 stock market crash so, after years of very rapid growth, we were faced with a severe downturn. Our business went through a tough period for a few years, but I will say I was lucky. It’s much more useful and you learn so much more when you go through a tough period right at the beginning. You don’t have the illusion that things are easy because they are not easy. So that’s kind of how it began and how it was for the first five or six years.

At what point did you take over as CEO and what were the circumstances that brought that about?

My predecessor was somebody who had been working with my father, and he decided to quit, so my father asked me to take over the CEO position. I thought that was a bit too early. I thought I was too young and I felt that the weight of responsibility was too big, so I resisted a lot. However, we had a very savvy chairman at the time, and when we asked him for his opinion, he turned to me and said, ‘You don’t get to choose your timing and being too young is something that resolves itself over time.’ And with that, I became CEO of the business.

What was the consequence of taking that on so young? What were some of the leadership lessons that you learned?

It was formative and useful, and I learned a lot. But it was emotionally challenging, and I felt the weight of the responsibility. You learn but it weighs on you.

But I learned something that I believe it is essential in business: Resilience. Resilience not only for the business, but also resilience in your psychological approach to problems. Running a company is going to mean facing difficulties and challenges and crisis, and it’s not always going to be a downhill slope. Learning to deal with that is an integral part of being an entrepreneur.

The CIR group is in a lot of exciting industries including media, automotive and healthcare, three industries that are being disrupted along the whole value chain. What kind of leadership skills are required to take a group like that into the Next Economy?

I think one the most important things is to be flexible; to be able to adapt to a rapidly changing environment. When I look at the last 30 years since I started working, the pace of change has only accelerated. And I don’t think that’s going to stop; I think it’s going to increase. It was brought about by two things: technology and globalisation. Those two factors will continue to change very established and long-lasting business models.

If you run any business, you have to be a bit paranoid about who is out there and how they’re working towards disrupting your business. It’s a much more complicated set of challenges than people faced just 20 years ago. To survive in this business environment, I think you have to do two things which are to manage the day-to-day and make sure you are efficient in how you run the business. But at the same time, you need to have a more long-term view and embrace the opportunities associated with change and see how to exploit that or how to defend yourself against that. That’s difficult.

It’s no secret family businesses are known to take a long-term perspective on everything. Is the family business model suitable for the 21st-century?

No, I don’t think family businesses are ill-suited to meet that kind of challenges. Family business or no family business, if you want to grow, you have to be open to change. You have to discuss things that may, up until now, have been seen as taboo. I think at times family businesses can be too attached to tradition and what has maybe worked in the past. It’s easy to believe that just because you’ve come a long way, it’s going to last for a long time into the future. But often, it doesn’t work that way.

But I’ve seen family-owned businesses who had the same product or process for many generations show they are capable of adapting. This might mean ending activities, in a core business. I think the values and the experience and the approach that family businesses have can be instrumental, even in a fast-changing environment. You could argue it’s more important because, in a rapidly changing environment, the key is being entrepreneurially minded around change. And if you have been part of a family business, you know that you have that in your DNA.

[ms-protect-content id=”4069,4129″]

What are some of the macro trends that you are most excited about? And what macro trends do you think will pose a challenge going forward?

I think, by and large, the world is doing well. There is growth; there’s no inflation. There is a very benign monetary policy globally, and interest rates are low. So if you’re running a business and you need capital, it is easy to find. I think this is probably a good time to be an entrepreneur.

I think technology has been pervasive and you have to embrace it; you cannot fight it. It is as much of an opportunity as it is a risk, so you have to be aware of it. The barrier to entry has been lowered dramatically. This means that you will have more and more people who will try to become entrepreneurs. This could be both and opportunity and a risk.

From your perspective, what is the greatest wish for your company’s future?

I would say we hope to be able to navigate the increasingly rapid pace of change. Take a look at the auto industry. Technology has revolutionised this industry which has been around for 100 years and it has disrupted the business model. People use Uber or they have ride-share companies. Tesla’s market cap is bigger than most of the traditional carmakers today. Those companies have been around for more than 100 years and produce 10 million cars a year compared to a few thousand so that tells you how that could also be a great opportunity. So my wish is to understand and be able to adapt to those changes and protect the businesses from the risks while still exploiting the opportunities.

[/ms-protect-content]