An article by Alexander Degwitz M., Chairman Investment Committee, GEM International Services

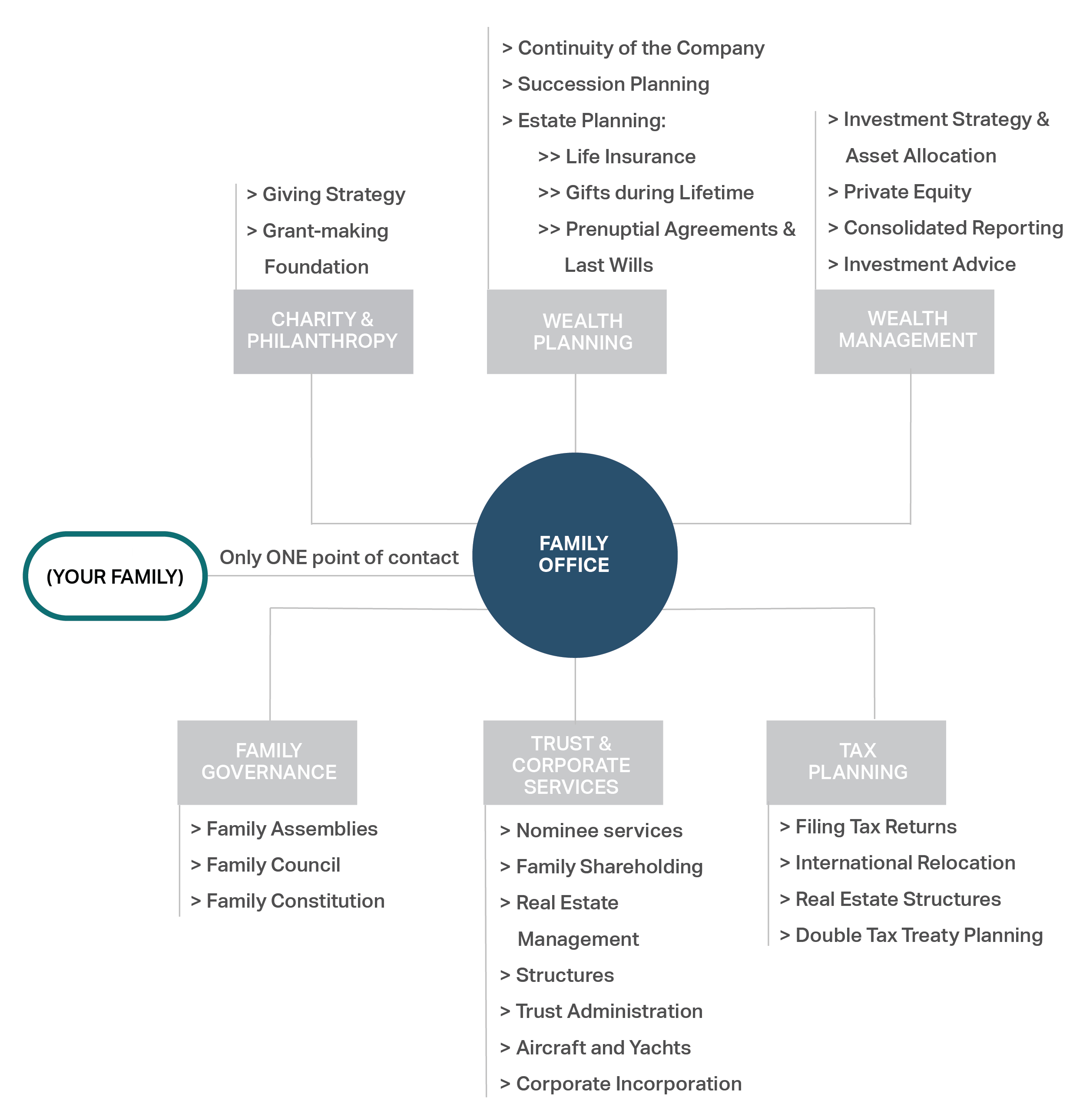

In 1911 my great-grandfather, Samuel Dario Maldonado bought a large tract of land in the wetlands of southern Venezuela to conserve its incredible biodiversity and to create a business that he could give to his children. From there after decades of dedicated hard work by three generations of many committed and hardworking family members we grew significantly, diversified into agro-industry, financial services and real estate. In 1998 when a leftist, radical coronel was elected to be president, we came to the strangely surprising realisation that our family group did not exist outside of our home country. Under the pressure of threatening rhetoric in an outright hostile environment towards the private sector, our family members chose to migrate, seeking a destination where there is both economical and political stability, a more promising future for our descendants to develop their full potential. For many years, as our land was taken away and we saw the size of our ongoing concerns diminished our small Family Office (FO) itself, increasingly became the family business. Due to this unique condition, it evolved into a type of organisation that unlike most, takes care of the emotional or “soft issues” of the business and its beneficiaries. Over time, I have learned that an FO is not a precise term, but rather a broad concept that refers to an organisation devoted to fulfilling the needs of high net worth families. Diverse as they are, each FO is a world of its own, and there is no right or wrong approach nor is there a single solution that works for everyone, as each serves the specific needs of its family (Single-family Office) or various families (Multi-family Office) (See Graph for possible FO functions).

In conventional practice, family offices focus their attention on asset management for a simple reason: that is where the money is. As a consequence, an FO’s duties that may have great impact on the success of the business and transcending role as an instrument to foment family unity is often undermined. Since there is more than enough published works about the family office as the asset manager, my focus will be to introduce the FO’s potential to fill a role that is more impactful to the success of the family business itself.

The Unconventional Roles of the Family Office

All individuals are intrinsically different. The closest we come to an egalitarian community is the family unit which can somewhat compensate differences amongst its members, motivated by bonds of affection. It is my belief that families in business should aspire to create systems whereby resources for basic needs and a decent lifestyle are attainable by members who are willing to make the effort to work within the norms and assume responsibilities. I have witnessed families where there are members suffering disadvantages while others are thriving, and have concluded that they are more likely to fall apart than those where such disparities are minimized. To help mitigate such differences, our family has created an education fund which has been endowed and is managed by our family office. It guarantees access to higher education for all the blood-descendants of the family. Our fund has already paid for seven MBAs and three bachelors with four more on their way, while five cousins (including myself) had the opportunity to graduate from last year’s Family Business EMBA program at Kennesaw State University. Additionally, this fund can invest in outings or events that create conditions for the family to share, learn together, and strengthen family bonds. An example of this is a subsidy to encourage participation in the yearly Family Business Network Summit, which provides education in a fun and nurturing context. Such experiences educate our members and increase their awareness by demonstrating that the business can be more stimulating and rewarding when more family is involved and motivated.

Our FO coordinates all legal affairs of the estate and also aims to participate more in facilitating legal and tax advice to family members. Centralizing these efforts is common given the communitarian nature of most family estates, and when we assist our individual members, we make sure they get it right. A mistake by any individual in his tax planning or legal affairs can affect the greater whole, therefore centrally coordinating such efforts through an FO makes sense. Of course, asset management and insurance policy advice are apparent areas where an FO can prove to be virtuous. There may be great win-win opportunities implementing economies of scale by centralising functions under the FO as combined assets are more significant and critical mass provides access to more investment opportunities; resources and expenses can be shared, and one can achieve more negotiation power with any third-party providers including lawyers, accountants, consultants, etc.

An Impartial Third Party

When an FO is consolidated, it can serve an additional purpose by being an objective element that facilitates better relationships amongst family members. The family office can take on duties that have the propensity to create rifts amongst the family or with other important stakeholders in the enterprise. When delivered by a hired professional a message is more likely to be well expressed and received because it does not come with an emotional load. FOs are often capable vehicles for “fostering family harmony by creating better communication among relatives… I like that we provide an outlet for our clients where they don’t have to be the bad guy,” according to Brian Luster, co-founder of Abernathy”.

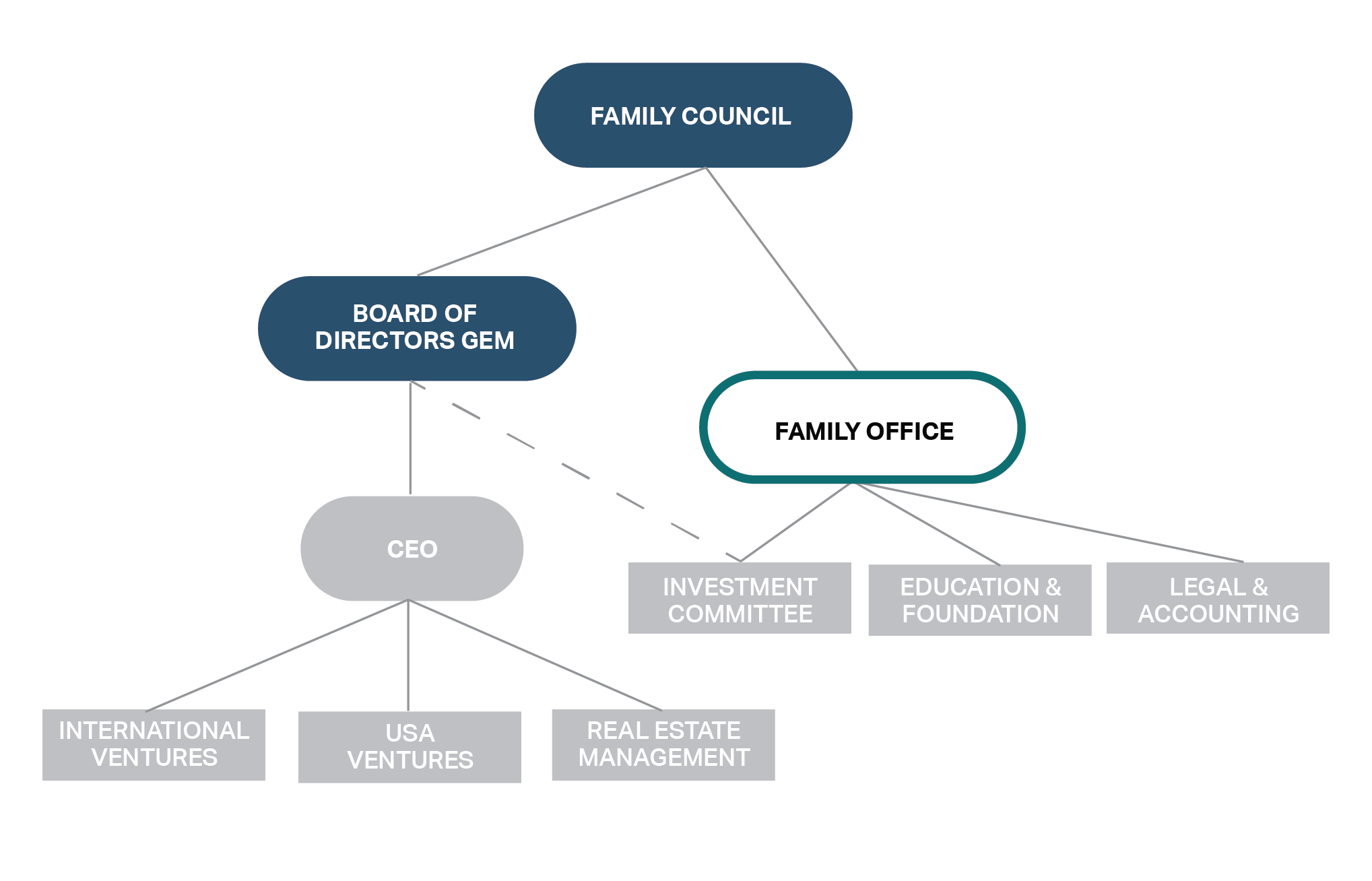

As a member of the third generation in our family business, I had an active role persuading my grandfather, so he would consent at age 87, to deliver his succession plan. Against all odds, we survived two generational transitions simultaneously which brought us from founding patriarch to cousin consortium without going through sibling partnership. We attribute our success partly to the conscious decision of procuring impartial and institutionalised relationship between the ownership and our management team. When there is a patriarch or even a few leaders, communication can be simple. When there is a multitude of cousins, the FO, as the executive body of a Family Council (FC), can play a pivotal role as the “controlled” formal channel for communication between the FC and its members. Additionally, the FO role can be fundamental in shielding the business from the often-thorny relationship amongst family members that inevitably permeates into day-to-day management. To contain this threat, which may result in undue influence, cross-communication, and other impediments, we have taken the radical decision to limit family member participation to the Board of Directors role, where a balanced relationship between merit and representation has been found. To be clear, family members cannot hold a management role in our family business, as we understand the importance of focusing family energy at the strategic level and have seen first-hand how easily conflict amongst owners evolves and how effectively that can destroy value.

Responsible Ownership Through the Family Office

Ownership participation in our family business takes place primarily through our Family Council (FC), our ultimate governing body, which has held formal meetings eleven times a year since 1997 (See Graph). Our in-house council is the secretary of the FC and of our Board of Directors, as well as a key executive of our FO. Hence these bodies, are very closely intertwined and interdependent.

Though the FC defines the strategy and provides general direction, the FO is responsible for facilitating our processes to generate a clear message packaged in family values and ‘clean’ of emotional baggage. The FO can lead the way by projecting what the family aspires its business to be and it can present the will of the owners in a manner that is conveyed and understood by the members of the Board of Directors. According to Professor George Manners, ownership has to reach a fundamental agreement in terms of:

- Payout – How much is expected in dividends

- Growth – What is the expectation for long-term growth of the business

- Risk tolerance – What is the maximum acceptable leverage to be assumed by the companies

- Best Earning Power – What is the expected return on assets (EBIT/Total Assets).

Defining these necessary parameters will require significant debate, as there are always fundamental differences in needs amongst beneficiaries. The distribution paid to family translates into cohesion and investment translates into growth of the companies. An adequate balance must be struck between these two as they are mutually dependent while they compete for the same limited resource: profit. Finding such a balance is necessary for long-term planning and for providing direction, this inevitable debate is guaranteed to be lively. The FO can help beneficiaries by orienting discussions and bringing in advisors if needed so that a clear mandate can be produced, parameters established and delivered to the board so that management can be empowered to create results accordingly.

[ms-protect-content id=”4069,4129″]

It is commonly understood that asset allocation of liquid portfolios is a central job for an FO. What is more unusual yet highly beneficial, is to evaluate 100% of the assets the family collectively owns in a single matrix, an initiative we are currently undergoing thanks to the guidance of our director/advisor Joe Astrachan. The most important information we can produce is a clear understanding of the real risks our estate may be exposed to. In our case, for instance, having significant risk exposure to the energy-dependent country of Venezuela means that it would be advisable not to buy stock in oil companies, energy-related financial instruments, or emerging markets altogether for that matter. Additionally, each asset class can be evaluated in quantifiable terms to be in line with the four criteria referenced above, which the owners must provide to management. In a perfect world, we would include everything belonging to the family estate; stocks and bonds, ongoing concerns, brands, buildings, land, cars, artwork, boats, planes, and more, regardless of their “legacy asset” status. This type of discussion amongst family members can bring out emotional elements and attachments that can be very uncomfortable to address. As such, this presents a magnificent opportunity for the FO to shine by bringing in objectivity and a “get the job done” approach. The family business would be left with a single list of all identifiable assets, starting with the most liquid to the least, with a clear and quantifiable view of exposure to all relevant risks, making it a powerful dashboard for managing the estate.

I share our FO experience not pretending to be an authority on the subject or to define every expectation for your FO, but rather with the hope that it may be inspiring and perhaps spark creative curiosity in expanding the frontiers that such support can bring to the family and its business, which in our case are:

- Serving as the FC executive body and liaison amongst family members and management

- Managing our educational fund and the relationship with its beneficiaries

- Providing beneficiaries with the basic managerial tools and platform they need to be successful and responsible owners.

Do not doubt that a great FO will have the competency to handle emotional thorns that arise and often reappear over the long life cycles of families and can help them engage constructively with their business by institutionalising systems and communication to allow for sustained growth over generations.

[/ms-protect-content]