Family firms would not survive across multiple generations without the ability and willingness to innovate and adapt to changing circumstances. In fact, countless revolutionary inventions that have changed the course of industries and history have come from family firms. The notion of disruptive innovation deserves a closer look in the family business context. Exploring this challenging topic, Professor Alfredo De Massis, Professor of Entrepreneurship and Family Business and Director of the Centre for Family Business at Lancaster University, shares his insights and observations on why family businesses provide the ideal environment for disruptive innovation – provided the timing is right.

Disruptive innovation

Disruptive innovation is an innovation that enables a company to create a completely new market and value network – it fully disrupts an existing system or industry. One example is Ryanair, the airline company that brought low cost flights model to the travel market by creating an entirely new standard. For any firm it is important to be engaged in disruptive innovation as it is mandatory for its long-term survival in a dynamic and rapidly changing environment. Family firms, however, need to have an eye on timing and monitor proactiveness to ensure that the innovation process has a positive outcome and does not lead to complications.

[ms-protect-content id=”4069, 4129″]

Finding the right timing

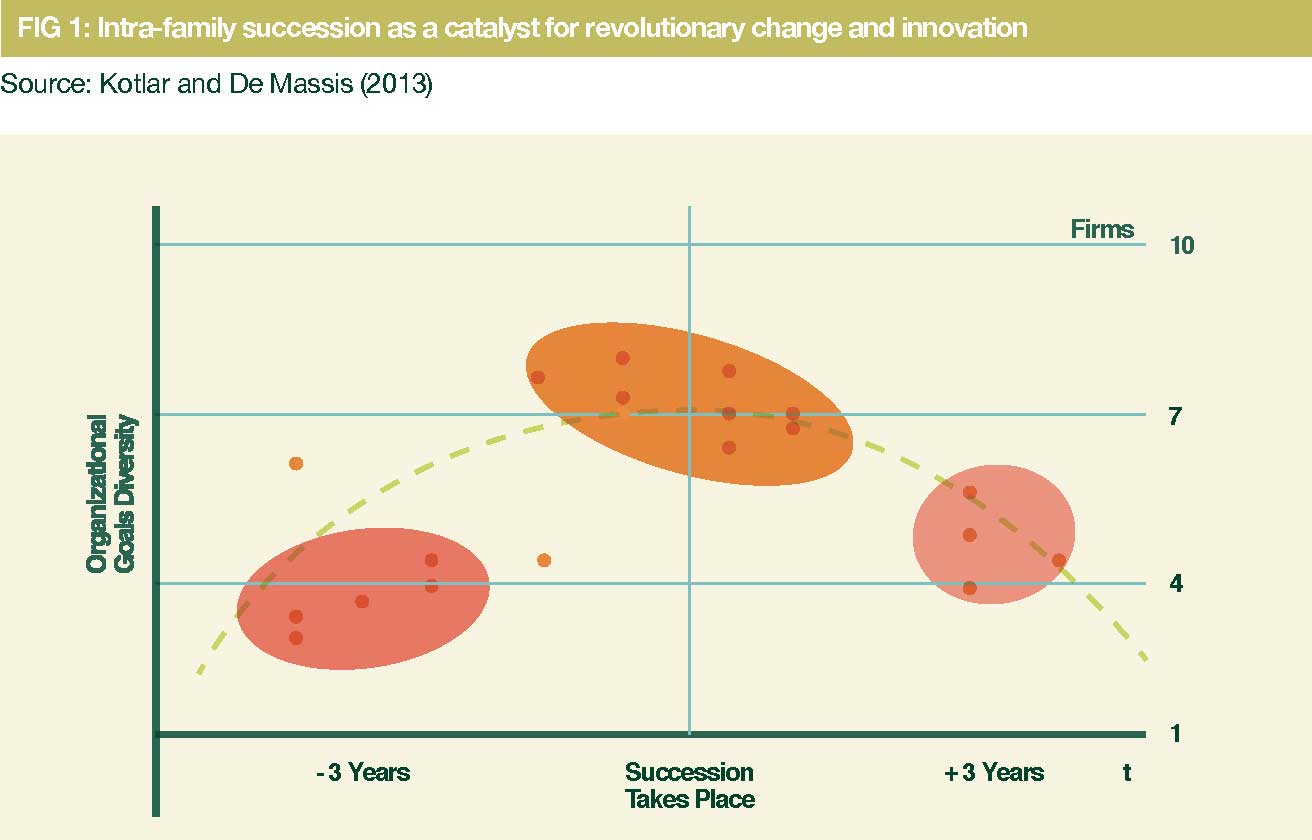

For disruptive innovation to be successful in the family firm, it has to happen at the right time and the moment of succession from one generation to the next, although usually an anxious time for the family firm, provides a unique opportunity. Research has shown that goal diversity, which describes the distribution of goals among the organisational members in a family business, is maximised in the imminence of intra family succession. During a time of leadership stability, the goals of everyone in the family firm are usually aligned and stabilised, and it is harder to change the strategic directions. In the moment of succession, however, there is a high diversity of different individual goals, which means that the status quo can become unstable and organisational members express their goals more fervently. (Figure 1)

The joining of a younger generation usually brings new ideas quite naturally and this often leads to a clash with the older generation’s goals to varying extents. But goals do not only diverge between generations but across all stakeholders involved with the family business like non-family executives, employees, clients and suppliers. Thus, during the succession process, the width of the range of goals actively pursued by members of a family business is maximised. This means that there are multiple and competing claims and some parties express different aspirations regarding how to use firm resources in the future. Family firms might feel the urge to smooth over such a phase, which is potentially rife with conflict, but this tension and divergence can actually be used to come up with disruptively new ways of doing business. Rather than seeing succession as a problem the family business could see it as an opportunity for change – a chance for disruptive innovation. In sum, the imminence of an intra-family succession appears to momentarily disrupt goal diversity in the family business. Thus, in the imminence of succession the organisational goals previously stabilised are unfrozen as the existing leadership and structure are likely to be reconsidered, and succession acts as a catalyst of revolutionary change and offers an ideal opportunity for conducting disruptive innovation in the family business.

Innovation through proactiveness

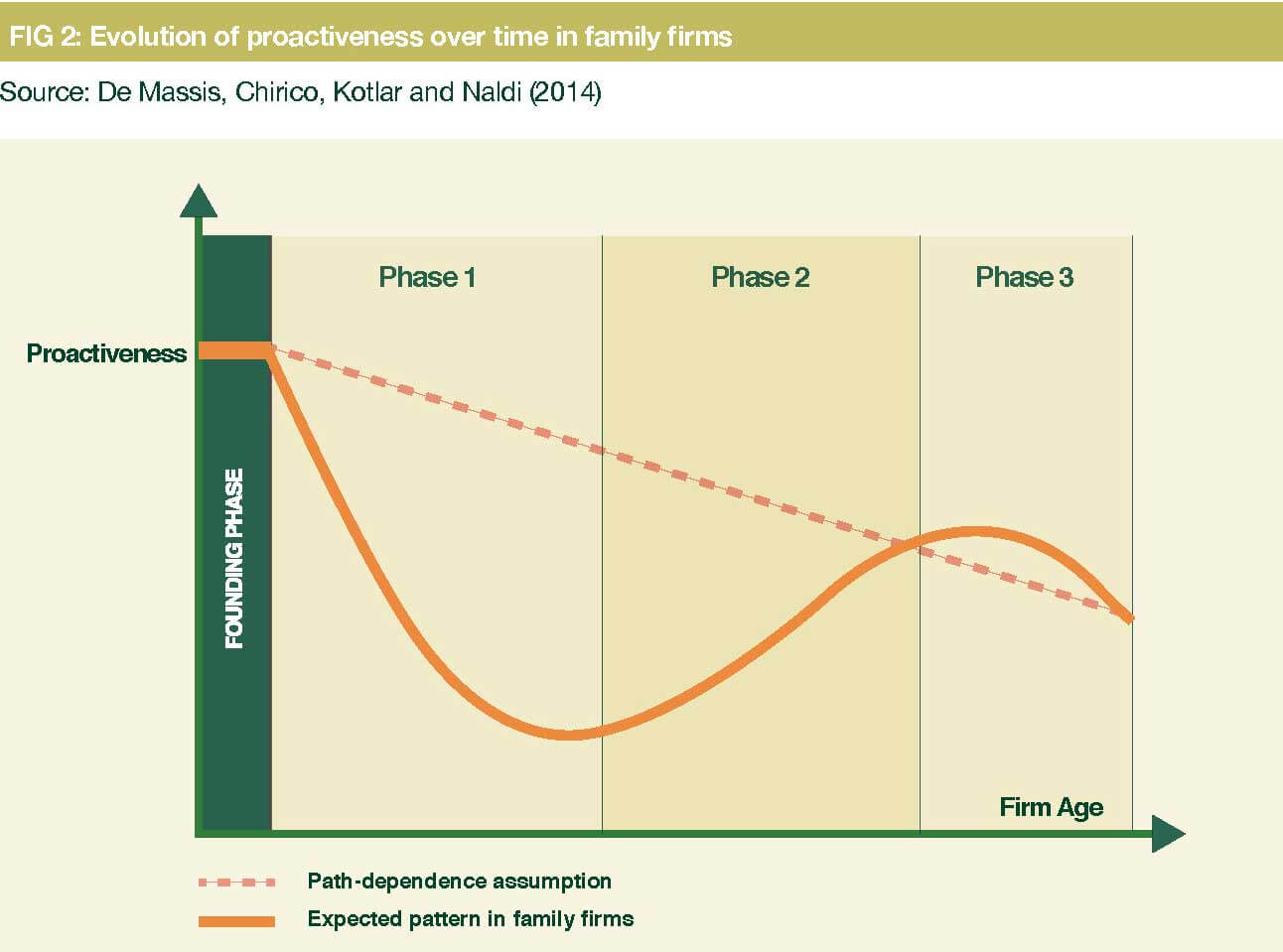

If the family wants to realign its goals towards a new direction it requires proactiveness, which here refers to the firms’ efforts to seize new opportunities, anticipate future market demands, and actively shape the external environment. The older a company gets the higher is its dependency on the past. People get set in their routines as a result of path dependency. In family firms, however, studies show that there are different phases and degrees of proactiveness (Figure 2).

The proactiveness curve of the family firm over time draws a horizontal “S” symbolising the different phases they go through. They are defined by the fact that dynamics change as the family and the business systems evolve over time. For instance, during the founding phase of the firm, the family business is very proactive. After this entrepreneurial stage follows an inevitable decline as everything and everyone starts falling into place and routines. As the family business ages, family members and other stakeholders join and goals start diverging. When there is a point of maximum divergence of goals the family attempts to naturally realign its goals through increased proactiveness, which usually results in an increase in innovation. In a nutshell, owing to family dynamics in terms of goal diversity, trust, altruism and interpersonal relationships in the family business, that add to the natural evolution of businesses, the proactive behaviour of family firms is much more complex. Specifically, the interplay between evolutions in family dynamics and the business is expected to result in an alternating pattern in the family members’ propensity to engage their firms in innovation through proactiveness.

Facing obstacles

We can see that the family firm is by its nature a favourable environment for disruptive innovation. However, there are also factors that may inhibit the family from engaging in innovation and which can generally be explained through adversity to the threats it may present:

1. Disruptive innovation requires opening up the family firm to external knowledge, for example in the areas of financing and technology. We know that family firms can be family-centred in their economic and their non-economic thinking and that goals like keeping the family reputation safe are paramount. Especially such non-economic goals might cause a family to shy away from opening the business to external partners, new technologies, and other measures necessary to engage in disruptive innovation.

2. Disruptive innovation usually requires considerable financial investment often over many years. Many family firms are reluctant to take financial capital from outsiders as they make decisions parsimoniously based on pursuing family-centred goals and preserving and growing the family wealth. This limits their responsiveness toward potentially disruptive opportunities. Taking a chance by investing in something that might threaten the pursuance of family-centred goals or put at risk the family wealth is not something undertaken lightly by any generation.

3. But even when families are willing to invest in innovation, they might have disadvantages in accessing financial resources, such as debt or outside equity financing. The inability to access external financing is a serious inhibitor to the family’s ability to innovate.

Using advantages

Despite the mentioned obstacles, family firms have a great basis to be strong innovators for the following reasons:

1. The long-term orientation of the family firm is a positive enabler for disruptive innovation. Making a difference does not happen overnight and the family firm constitutes a favourable environment for such thinking as it naturally plans in the long run and is oriented towards development beyond one generation. This long- term orientation of family firms may evidently increase their propensity to respond to changes in technologies with disruptive products that take years or even decades to produce tangible returns.

2. Family tradition is also a strong advantage for disruptive innovation. Family firms in comparison to other organisations are strongly rooted in the past and have accumulated a big stock of knowledge, competencies, values, norms, beliefs and habits pertaining to their history over their existence. Family history pervades business practices, producing and reinforcing shared values, norms and beliefs over time, and creating a close link between the present and the past. Looking back can be a great source of inspiration and knowledge for developing disruptive innovation. History and tradition of the family firm is a unique asset that can be leveraged on by analysing the past and linking it to the future in a meaningful way.

3. Family businesses already have a natural point of disruption: the moments of succession. As outlined above, those phases may sometimes be challenging to handle, but carry great opportunities for the future of the business.

The innovation paradox

Overall the characteristics of family firms seem favourable to engage in disruptive innovation and obstacles surmountable, so why do we not see more of it around? An explanation could be attempted by taking a closer look at the following paradox described by third-generation member of Pellini Caffé, Nicolò Pellini: “It is really frustrating to be recognised for our ability to handle complex innovation projects and realising that our organisational environment reduces disposition to change.”

This leads us to determine that family firms face a paradox when it comes to innovation: In spite of the highly favourable environment they create, family firms seem less willing to innovate. Usually the lack of willingness can be traced back to the above- mentioned obstacles that are strongly linked to perceived threats to the pursuance of family-centred goals. The paradox lies in this high innovation-ability coupled with a lower innovation-willingness. In order to enforce innovation in the family business, family members must have a vision, realise the rationale behind change and their willingness must be stimulated. Sometimes this means convincing family members to engage in innovation, the realisation of which they might not witness within their lifetime and that is a hard argument to make.

Clearly, standard best practices suggested in innovation management handbooks do not apply to family businesses and innovation, and it is important to understand how the distinctive characteristics of the family business have an impact on the management of innovation. Family firms should avoid using traditional best practices for innovation if they want to leverage on their distinctive resources and characteristics. Each family firm will have to find its own path to innovation. Some will go the way of less formalisation and others need firm structures to do so. It is wise to bear in mind, however, that innovative thinking can be suffocated when the degree of formalised decision-making is too high in the family firm. Many decisions in family firms are taken informally, which can be a marked strategic advantage. Essential to any and all approaches is to find the right moment, read the signs of the market, empower the people in charge of the innovation projects and to find a champion in the family. The champion might not necessarily be the person who has the know-how but rather the one who has the political clue and diplomacy to make the change happen. Given those circumstances, family firms are more than equipped to make significant contributions to their industries and economies.

Tharawat Magazine, Issue 24, 2014

[/ms-protect-content]