Interview with Maja Baumann, Board Member, Vontobel, Switzerland

We do not naturally associate banking with entrepreneurship. Yet it was the entrepreneurial spirit of Jakob Vontobel, founder of illustrious Swiss private bank Vontobel, that set the foundation of his family’s legacy for generations to come when he took on a brokerage firm in the 1930s. Throughout recessions, wars, and boom times, the Vontobel family has stood by its values and found opportunities in the unexpected changes of history.

Today, the Vontobel bank has over 1500 employees and its activities span well across the world. The entrepreneurial drive remains preserved as the fourth generation of the Vontobel family, its employees and other shareholders navigate the legacy through uncertain times and towards its centennial.

Tharawat Magazine spoke to Maja Baumann, fourth generation family member and board member at Vontobel, about legacy, entrepreneurship, and the values that drive both.

How did your family business grow into one of Switzerland’s most renowned private banks?

My great-grandfather, Jakob Vontobel, was a real entrepreneur. He took over a stock exchange brokerage in the 1930s and so began his own brokerage business right around the time of the Great Depression.

Obviously, two generations working side by side had its challenges but the business grew and their entrepreneurial instincts continued to see returns.

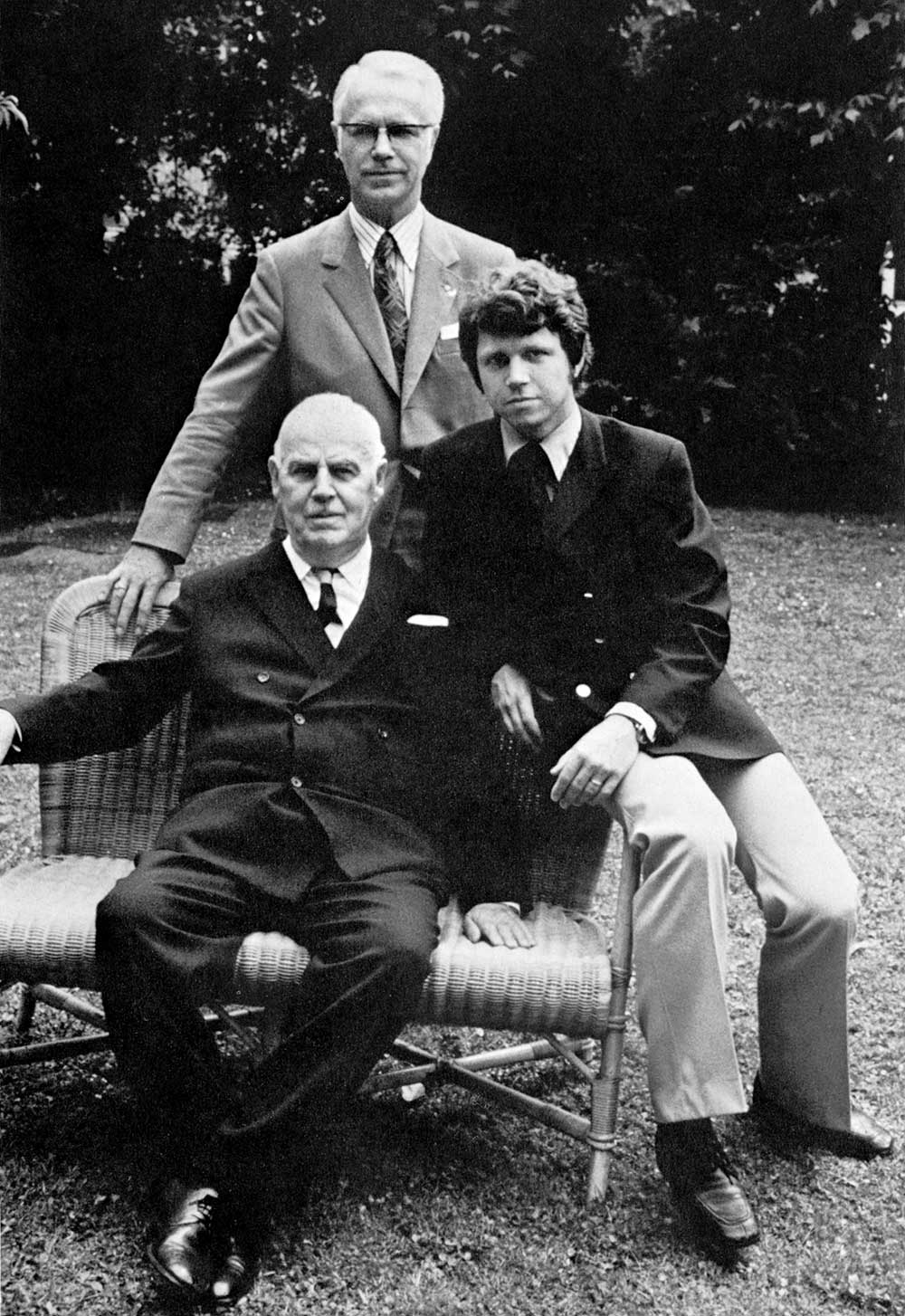

When it was my grandfather Hans Vontobel’s turn to join his father’s business, it was in the midst of the Second World War. Obviously, two generations working side by side had its challenges but the business grew and their entrepreneurial instincts continued to see returns.

What I have seen throughout our history is that whenever our family saw an opportunity for the business, a possibility to offer a service to its clients, we would find a proper way to do it. By the 1970s, my uncle had joined the business, which meant there were three generations working alongside each other in the bank. We went public in the 1980s and the expansion that followed was significant. In the 1980s, we also started to grow internationally and today we employ over 1500 people.

I never met my great-grandfather, but my grandfather lived to the age of 99 and only passed away this year. We talked a lot about the recent times and its challenges, but even more about the future and new opportunities. It is clear that entrepreneurship, critical thinking and a long-term orientation has always been part of our family’s values.

How did you become involved in the family business?

I remember that we sometimes visited the bank, even as children – to say hello to my grandfather or my uncle or to see the big vault. Those are memories that we will never forget. Of course, family conversations always included bits and pieces of banking topics. I think I attended my first shareholders’ meeting while I was still in my teens.

After the end of my studies, I began by working for one of our foundations pro bono. It was very satisfying working with charities. It’s good to understand at a young age that there are many people who need support and to see how fortunate you are. Giving back to society is important to us.

We also have a family holding company where our shares are bundled and I joined its board of directors at the age of 30. However, I wanted my own career and so I pursued a law career and worked for major law firms in Zurich, Geneva and New York. I was involved in many mergers and acquisitions and advised on corporate governance. I’m very happy to have gotten this broader view.

However, I was drawn back to the family business. My grandfather was getting older and as fourth generation members of the family, we started to work on the family governance. We also set up a structured exchange with the company on topics that are within the shareholders’ competences. By doing so, you get involved in these topics more deeply and become part of the exchange with the board of directors of the company.

In the end, it is not surprising that I did. Vontobel is engraved in my heart, in my brain; it’s just part of me.

My decision to join the board of directors of Vontobel was a process. Because I wanted to be able to do a good job and dedicate time and attention to this, I had to make the right adjustments in my life first. My grandfather had already repeatedly asked me to join. In the end, it is not surprising that I did. Vontobel is engraved in my heart, in my brain; it’s just part of me. I wanted to belong to it. So I went through the formal application process to the board and joined this April.

Were you nervous before your first board meeting?

That was a great feeling. I am very happy to be able to give added-value to this company and its people.

I had a lot of respect for this new experience. I prepared myself and read everything carefully, and went to the first meeting with the idea that I would just listen. But then also legal and regulatory matters and topics related to our family values came up and I realised that I had a lot to contribute from my experience as a lawyer and board member in the family holding company. That was a great feeling. I am very happy to be able to give added-value to this company and its people.

When did your family establish the holding company that bundles your shares?

That was in 2001. Having the family holding company also pushed us later to write our family charter, which regulates the “soft law” aspects of the family’s relationships. It’s about how we deal with each other; what processes we have in place for family events and education. When we drew up the family charter, we discussed our values, which was an essential process for the fourth generation to go through, that is my sister, my cousins and me.

Most of us from the fourth generation have worked in the bank at some point. This has been very helpful to get to know it better. In the charter, we discussed this topic and we decided that family members will be encouraged to join the company for a while, at an early stage, to familiarise themselves with it. However, they will also be encouraged to pursue their own career. A longer career within the bank has to be based on competence.

[ms-protect-content id=”4069, 4129″]

How do you maintain family cohesion when you aren’t working together day to day?

Some family members will always be more involved than others, but everyone has to feel a part of it.

It is very important to keep the dialogue going within the family. You have to work at it. We do this by organising regular family events and education. You have to inform family members as much as you can about what is happening to the business, and you have to be frank in your communication, so everyone stays aligned. Some family members will always be more involved than others, but everyone has to feel a part of it.

My grandfather died in his hundredth year. He was a key ingredient for our cohesion. We were all very lucky to learn from him. He used to decide what happened at our family events. Now, after his passing, we take more of a team approach. It is nice that the whole responsibility doesn‘t weigh on just one person’s shoulder anymore, but it’s still not easy: there is quite a lot of coordination involved in taking everyone’s opinion into account.

How do you remain an entrepreneurial family in an industry such as banking?

The financial industry is a highly regulated environment and risks are calculated. I think this really suits us as a family. We have high ethical standards and we believe in compliance and rules and risk control. Where we remain entrepreneurial, however, is in understanding where new opportunities lie for us and for our clients. We look at whether there is an opportunity for us to grow bigger and to become better and, of course, we check if it is a strategic fit for us.

We really focus on the future and are keen to see where technology will take us. My cousin, Björn, who joined the board at the same time as I did, has a lot of experience in digitalisation through his own company. This proves the point that we need diversity in the company and that diversity doesn’t just relate to gender but it’s also about other aspects, such as age or nationality. This helps us to stay alert and to remain relevant in a quickly changing world.

The bank was established in 1924. What is the secret to surviving all of the turbulent times, especially in finance?

In every crisis, we have asked ourselves the same questions: What is going to change? What can we do? Where do we see an opportunity? There are always opportunities in times of turmoil. To be able to take advantage of change, we always make sure that we have a capital cushion that allows us to think before we act. It gives us time to reflect. When my grandfather was around, he brought relativity to every crisis. Whenever we would get worried, he would smile and assure us that everything would be fine. He could certainly do so, having frequently witnessed financial turmoil in his life! I guess that is the advantage when you are in it for the long-run; when your name is over the door when you are here to stay.

Tharawat Magazine, Issue 31, 2016

[/ms-protect-content]