Photo by Philipp Birmes from Pexels

In the second part of this series of articles we focused on preferred jurisdictions for family offices, this time we look at the actual services provided by single-family offices (“SFOs”) and multi-family offices (“MFOs”).

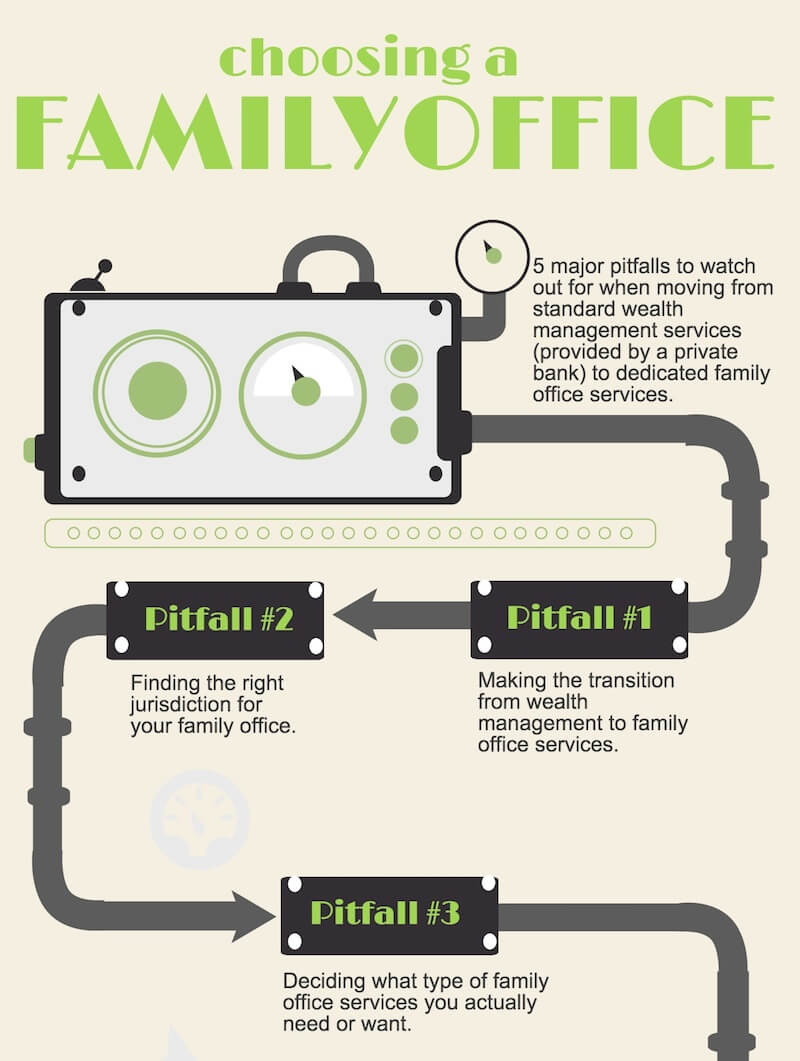

What type of family office services do you actually need or want?

At face value, it seems very easy: identify the services you want and need as a family, and choose the appropriate family office. But in practice this isn’t quite so simple. Analysing the actual needs of the family from a family office is a process that takes time and should be taken very seriously.

Every wealth owner arrives at this juncture with a unique set of circumstances; the family may possess wealth as a result of selling the family business, or the family business might be experiencing robust growth and remain the core of the family’s wealth. The wealth may be in the hands of only one person (such as the founder/patriarch), or multiple generations might need support with a broad range of services. Once the family’s background is identified, it must be appropriately matched with the goal of its family office: is the primary goal wealth-preservation, wealth-creation, or philanthropy? Depending on the outcome of this analysis, various core services can be identified while discarding the unnecessary ones.

There is an almost unlimited assortment of services that can be provided by family offices. Among others, they include:

- Investment management

- Asset allocation

- Risk management

- Book-keeping

- Tax assistance

- Wealth planning

- Family governance

- Lifestyle management

- Philanthropy

- Relocation support

To see a complete overview of all the different types of services that family offices offer, click here.

But which of these servicesspan> or the concept of a family office, but primarily because they are dissatisfied with the level of services they receive from their existing advisors or wealth managers.

This automatically means that an MFO is not necessarily the answer for them. In many cases, a change of provider, a small adjustment to the existing set-up, or the addition of an external service to the set-up could benefit the family the most, especially when there is not a lot of wealth involved. It is therefore important to thoroughly analyse the actual needs of the family before any decisive move is made.

Once the wish list of >services is decided on, the next challenge is finding the right persons to provide them. In the case of an SFO this means finding the right CEO and staff willing to take the job and having the right connections to provide and coordinate the services. Where an MFO is opted for, the challenge will be to find the provider that fits the ly”>family’s background and wishes. In the next part of this series of articles we therefore discuss the challenges in selecting the right MFO provider and learn ‘Which provider provides what?’</p>

Jan van Bueren & Thomas Ming are Co-Founders of FOSS Family Office Services Switzerland & Senior Wealth Planners in Zurich at Union Bancaire Privée, UBP SA.

For more information go to: www.switzerland-family-office.com