Photo by ajay bhargav GUDURU from Pexels

Intra-Arab investment is still scarce and its growth is relatively slow compared to overall regional FDI growth. Yet, by taking a closer look, we see that intra-Arab investment is happening and has produced numerous success stories. Abdulla M. Al Zamil, CEO, Zamil Industrial Investment Company, Saudi Arabia, tells the story of how Saudi-based Zamil Steel built a plant in Egypt and within a decade turned it into one of its most competitive operations.

“When I am in full control of my car, I know I am not going fast enough” Mario Andretti, Nascar race driver.

Generally on going abroad

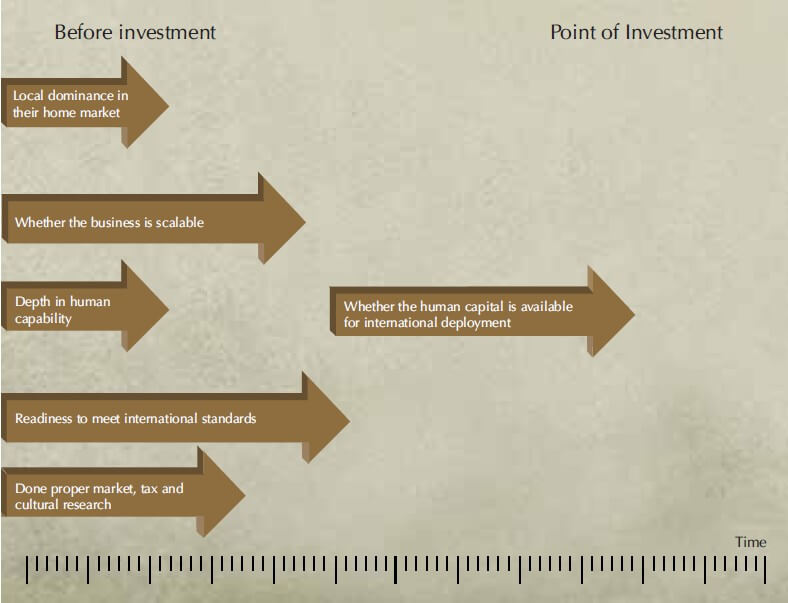

Investing abroad is an enticing thought for businesses that have reached a certain size in their home markets. Often the idea is to internationalise an existing activity of the company, or an entirely new opportunity is seen in a foreign market and an investment is made. The decision to go across borders does not only require great knowledge of the new market; it first and foremost demands a close scrutiny of the company’s position in the home market, as well as its situation. There are several dominant factors that will influence any business’ decision to go abroad (see graph below).

The importance of these determinants may vary from business to business and may also depend on the geographical proximity of the new market. Yet, however well prepared a business is for foreign investment, the actual implementation and the post-investment time can still hold many surprises that require flexibility and strategy adaptation.

About us

Our Saudi based Zamil Industrial Investment Company “Zamil Industrial” employs more than 10’000 people in 55 countries. One of its main operations is Zamil Steel Industries, which was founded in 1977. Today, Zamil Steel is a global leader in the manufacture of pre-engineered steel buildings and the Middle East’s premier supplier of structural steel products and process equipment, transmission and telecommunications towers, open web steel joists, and roof and floor steel decks.

Zamil Steel manufactures over 500’000 tons of fabricated steel per annum of low and high rise steel buildings and the structures for diverse industrial, commercial, agriculture, aviation, entertainment and military applications and support of infrastructure and development projects. Our products are sold in more than 90 countries through and international network of sales and representative offices, certified builders, agents and distributors.

Zamil Steel’s main factories are based in Dammam, Saudi Arabia. Additional facilities are located in Egypt, Vietnam, India and Ras Al Khaima (UAE). More than 600 engineers are employed in its engineering departments in Saudi Arabia, Egypt, Vietnam and India.

These are the facts, as they can be seen today. However, it is only little over a decade ago that we were still largely based in Saudi Arabia and had only just started FDI into Egypt and Vietnam.

The context

Egypt was and still is an important strategic entry point for us and we were not the first ones to pursue such expansion; others such as Khrafi from Kuwait had already successfully established themselves by the time we considered the Egyptian market. However, we did it with the aim in mind of paving the way for other foreign investors.

Towards the late nineties, Egypt was solidifying its foreign investment laws and regulations; the forward path the country was taking was clear and very committal. However, we knew that if we waited for the laws to be implemented we would lose the chance of becoming market leaders and exploiting our competitive advantages.

Ideally, a company setting up operations in another country will take time to consider the factors mentioned before and assess the risks and advantages. However, when we decided to go to Vietnam and Egypt, it was mostly timing that was of the essence. Vietnam had not yet joined ASEAN and the Arab open market was not yet instated. We knew of these developments ahead and decided to establish ourselves in anticipation. We planned the operations in Egypt in such a way that we would be ready to serve the local and surrounding markets when the time came. We saw an opportunity and were ready to take the risk it meant. In 1999, we started operations in Cairo, 6th of October City. Starting in an Arab country, as Arab investors, did not mean that the implementation was any easier. It did, however, encompass certain advantages.

Our competitive edge

We had timing on our side, yet we would not have taken this risk without being strongly aware of our strong competitive advantages:

Firstly, Saudi has a large number of Egyptian expats, therefore our brand was already quite well known to many, which we strongly felt when we entered the market.

Secondly, we saw the opportunity of being the first ones to bring the concept of Pre Engineered Buildings into Egypt. This was ideal, as we did not create direct competition for local factories but brought in innovation and know-how.

Another advantage certainly lay in expanding into a country that shared our language and to a large part our culture.

Why we did it

Arab cross boarder investment for us was not an act of charity. On the contrary, we had numerous strong reasons for considering Intra-Arab expansion:

1. Egypt had and still has a wealth of capable work force and engineers that have the will and the ambition to lead and to develop themselves. Tapping into such a rich pool of human capital was of the essence for our investment and supported our decision to do it in the first place.</p>

2. It was also a possibility to create opportunities and jobs mainly for Egyptians and other Arab nationals, hence promoting one of the ultimate goals of a free Arab market; the creation of employment.

3. Egypt’s geographical location was another crucial factor in our decision. It is of the greatest important strategically as it connects Africa and Europe and therefore represents an important trade axis.

4. The decision to place a plant in Egypt was part of our geographical expansion strategy as a whole group. It was one of our first investments outside Saudi Arabia and was to be the tester for all future foreign investment projects.

The difficulties

We faced many obstacles throughout the years since the project’s inception in 1999. Twice we had to increase the capital to cover our losses, which were due to bureaucratic and legislative difficulties at that time. We knew the risks of setting up while legislations and reforms were not yet set in stone and while FDI rates were still growing more slowly in Egypt compared to the rest of the Arab world. Yet, the advantages of being ready with infrastructure and work force when the environment became more investor friendly, compensated for a slow start.

One decade later our Egypt operation is the most competitive and amongst the best contributors to the group.

The winning attitude

Investing abroad is always a risk. The simple fact of the physical distance between the head quarters of a company and its operations in other markets makes it a decision that requires primarily the right people and as well as a deep market knowledge. The exposure of the company’s brand to possible failure in a foreign market is not a decision that can be taken lightly, especially for family-run companies that are regionally reputable. At some point however, it comes to the stage where the bigger picture counts; geographical expansion ultimately becomes part of any company’s strategy if its operations and activities cover international needs and demands.

Creating FDI flows between countries holds many benefits. This is not only the case for the individual participants, but for nations as a whole; the economic channels and dependencies created have a stabilising effect on inter-country relations.

It is about striking a balance between what you gain and what you give back. Creating employment for the local population of the country in which you invest must be a strategic goal in order to consider cross-border investment successful and sustainable. We have experienced that it is the long-term view that permits to benefit from intra-Arab FDI. The benefits may not have been reaped as quickly as if we had invested elsewhere, however, through showing a commitment not only to our investment but also to the Egyptian community, they are now lasting and sustainable.

Today, Zamil Industrial exports to over 90 markets, whereby over 30% of its revenues come from outside Saudi Arabia.